- In recent weeks, Science Applications International Corporation (SAIC) and its partners have announced several major developments, including a multi-year AI-at-the-edge alliance with Google Public Sector and significant U.S. government contract awards, such as a US$202 million Navy training deal and a key Air Force intelligence modernization contract.

- These initiatives not only strengthen SAIC’s position in the defense and federal technology sectors, but also highlight the company’s increasing focus on advanced technology integration and mission-critical solutions for national security clients.

- We'll examine how the new alliance with Google Public Sector and recent government contracts could influence SAIC's future earnings outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Science Applications International Investment Narrative Recap

To be an SAIC shareholder, you have to believe that the company's proven track record in securing federal contracts and pushing advanced technology solutions will outweigh near-term risks tied to changing government procurement priorities and contract structures. The recent string of contract wins, including military AI integration and Navy training deals, could support revenue visibility, but ongoing uncertainty around government budgeting and efficiency efforts is still the most important short-term catalyst, with procurement delays remaining a key risk. At this stage, the overall impact of the latest announcements appears directionally positive but not materially transformative for these core issues.

The newly announced AI at the Edge alliance with Google Public Sector stands out for its alignment with the shift toward mission-critical digital transformation, underscoring a relevant catalyst for margin improvement and differentiating SAIC’s capabilities as government clients increasingly demand secure, scalable, and innovation-driven tech solutions. This partnership can strengthen contract win rates in emerging high-growth areas, which remains a top focus for investors watching catalysts.

Yet, in contrast to the momentum from contract awards, there’s still the real risk that...

Read the full narrative on Science Applications International (it's free!)

Science Applications International is projected to reach $8.1 billion in revenue and $394.1 million in earnings by 2028. This outlook assumes annual revenue growth of 2.5% and a $41.1 million increase in earnings from the current level of $353.0 million.

Uncover how Science Applications International's forecasts yield a $118.67 fair value, in line with its current price.

Exploring Other Perspectives

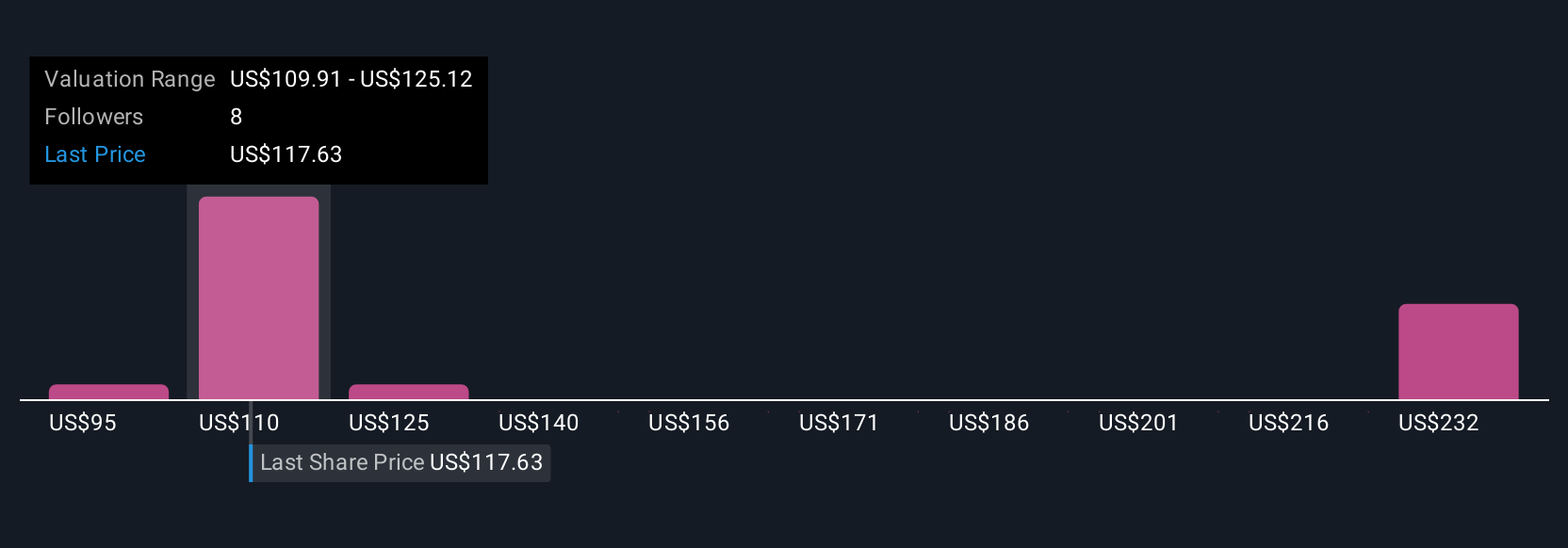

Four members of the Simply Wall St Community estimate SAIC’s fair value anywhere from US$94.71 to US$252.60, showing how widely opinions can vary. Many see margin improvement through advanced technology integration as a key catalyst, giving you a reason to weigh several perspectives on the stock’s future.

Explore 4 other fair value estimates on Science Applications International - why the stock might be worth 19% less than the current price!

Build Your Own Science Applications International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Science Applications International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Science Applications International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Science Applications International's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com