- In the past week, IPG Photonics Corporation completed a share buyback program totaling 3,600,367 shares for US$279.93 million and reported second-quarter 2025 earnings, highlighting year-over-year declines in both revenue and net income.

- Alongside these updates, new leadership appointments were announced to strengthen human resources, global laser systems, and component management, signaling a renewed focus on advancing growth, innovation, and operational capability across the company.

- We'll now examine how IPG's buyback completion and executive appointments influence its long-term investment narrative and growth outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

IPG Photonics Investment Narrative Recap

A shareholder in IPG Photonics today needs confidence in the company’s ability to rejuvenate core laser markets while successfully scaling new applications such as medical or battery manufacturing. The latest buyback completion and executive appointments do not materially alter the short-term catalyst, which remains recovery in industrial laser demand, or reduce the current risk that weak core markets could hold back revenue and profit growth in the near term.

The recent appointment of Jennifer Kartono as Chief Human Resources Officer stands out as especially relevant, given ongoing organizational transformation. By focusing on talent and operational capability, this move supports management’s aim to align the team with IPG’s evolving growth priorities, potentially reinforcing the impact of any upturn in its end markets.

But against these efforts, investors should be aware that persistent softness in core materials processing...

Read the full narrative on IPG Photonics (it's free!)

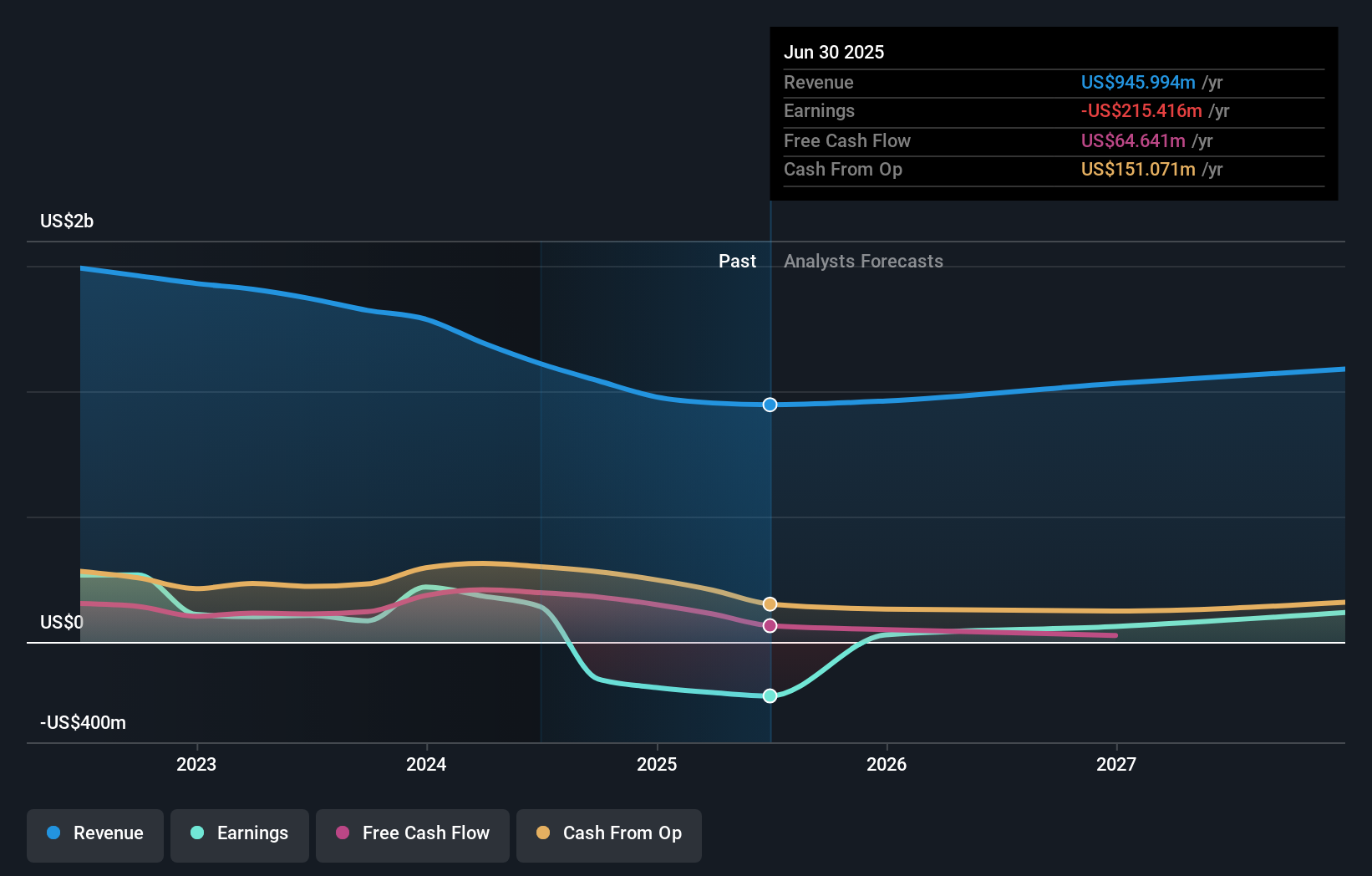

IPG Photonics' outlook anticipates $1.1 billion in revenue and $185.5 million in earnings by 2028. This implies a 6.3% annual revenue growth and a $400.9 million increase in earnings from the current -$215.4 million level.

Uncover how IPG Photonics' forecasts yield a $75.80 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members shared three fair value estimates for IPG Photonics, from as low as US$3.91 up to US$75.80 per share. While such opinions vary widely, ongoing revenue declines in core applications may weigh on performance and are a key consideration as you review these varied assessments.

Explore 3 other fair value estimates on IPG Photonics - why the stock might be worth less than half the current price!

Build Your Own IPG Photonics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IPG Photonics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free IPG Photonics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IPG Photonics' overall financial health at a glance.

No Opportunity In IPG Photonics?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com