- On August 6, 2025, PVH Corp., owner of the Calvin Klein and Tommy Hilfiger brands, announced the Board's Executive Committee declared a quarterly cash dividend of US$0.0375 per share, payable September 24 to shareholders of record on September 3, 2025.

- Alongside this, optimism is rising as PVH has a positive Earnings ESP and continues its streak of outperforming recent earnings estimates, with the next earnings report due August 26, 2025.

- We will examine how growing investor optimism for a potential Federal Reserve rate cut may influence PVH's investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

PVH Investment Narrative Recap

To invest in PVH, shareholders must believe in the long-term value of its iconic Calvin Klein and Tommy Hilfiger brands and the company’s ability to grow margins through operational simplification despite persistent macroeconomic pressures, especially in North America and China. While the newly declared quarterly cash dividend signals confidence, it is not likely to change the immediate focus on the upcoming earnings report, which remains the most important short term catalyst. The primary risk continues to be weakening consumer demand in China, and the latest news leaves this risk unresolved.

The ongoing share repurchase program, announced in June, is particularly relevant as it illustrates PVH’s approach to shareholder capital return amid ongoing margin and demand uncertainty. These buybacks coincide with higher analyst earnings forecasts and a potentially more supportive macro backdrop if interest rates fall, but do not directly address China-specific risks or the operational challenges associated with Calvin Klein’s product pipeline.

By contrast, it’s important for investors to also be aware of how China’s post-holiday slowdown could still…

Read the full narrative on PVH (it's free!)

PVH's outlook anticipates $9.3 billion in revenue and $682.0 million in earnings by 2028. This scenario assumes 2.5% annual revenue growth and a $279.7 million increase in earnings from the current $402.3 million.

Uncover how PVH's forecasts yield a $91.21 fair value, a 23% upside to its current price.

Exploring Other Perspectives

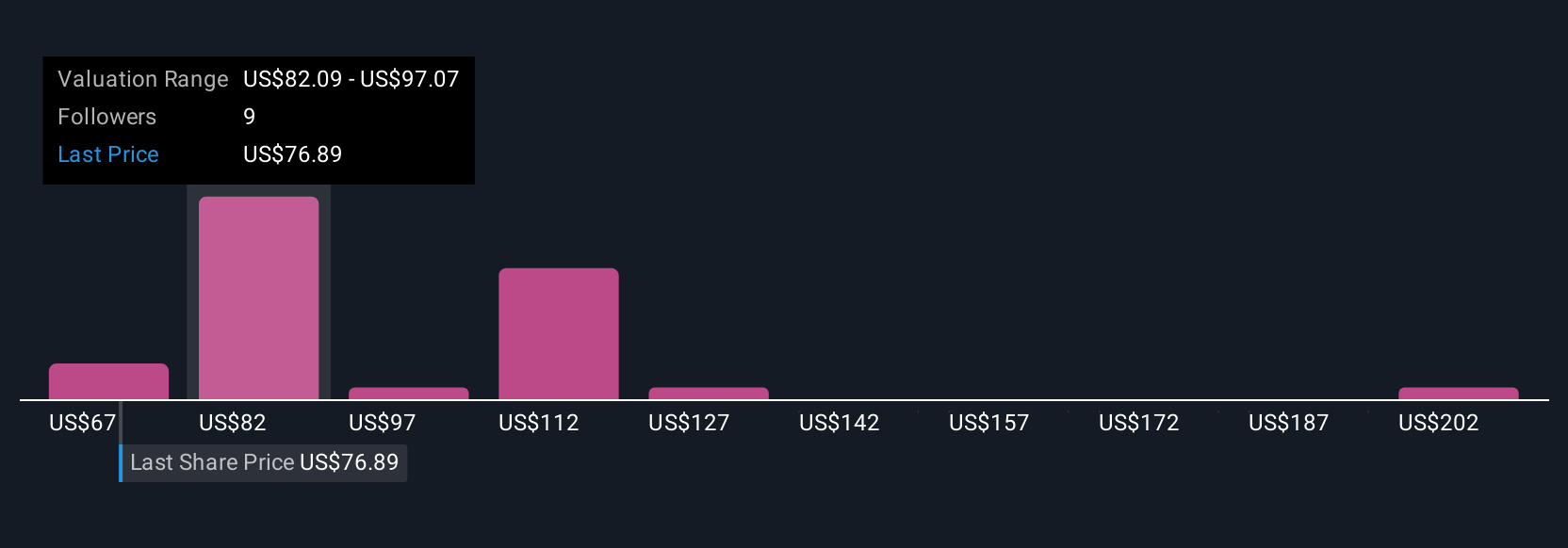

Retail investors in the Simply Wall St Community estimate PVH’s fair value between US$67.10 and US$216.96 based on seven different perspectives. Such a broad range, coupled with current concerns about China’s retail slowdown, shows just how much opinions can differ when assessing the company’s future performance.

Explore 7 other fair value estimates on PVH - why the stock might be worth 9% less than the current price!

Build Your Own PVH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PVH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PVH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PVH's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com