- In recent weeks, Adobe announced the integration of advanced AI features into its digital experience solutions, with major products like GenStudio and Firefly Services aiming to deliver new monetization opportunities and creative capabilities for customers.

- The combination of strong analyst sentiment, upward earnings estimate revisions, and increased insider buying reflects growing confidence in Adobe's AI-driven innovation, even as competition intensifies in the creative software sector.

- We'll examine how analyst optimism tied to Adobe's raised revenue and earnings outlook might influence the company's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Adobe Investment Narrative Recap

To be a shareholder in Adobe, you need conviction in the company’s ability to maintain its creative software edge while leveraging AI to power new revenue opportunities. The recent integration of advanced AI features and upward revisions in analyst earnings estimates are a positive development for the short-term outlook. However, these updates do not fundamentally alter the critical risk: rising competition in the AI creative market, which could pressure Adobe’s growth and profitability if rivals outpace its innovation.

One recent announcement that stands out is the rollout of GenStudio and Firefly Services, which are directly linked to Adobe’s strategy of integrating generative AI across its platforms. These products aim to help enterprises optimize marketing workflows and unlock new monetization streams, adding weight to the company’s focus on AI-driven growth as a catalyst for near-term investor confidence.

Yet, investors should be mindful that, despite strong analyst optimism, intensifying competition in AI-powered creative tools remains...

Read the full narrative on Adobe (it's free!)

Adobe's outlook anticipates $29.3 billion in revenue and $8.7 billion in earnings by 2028. This scenario is based on a 9.0% annual revenue growth rate and a $1.8 billion increase in earnings from $6.9 billion today.

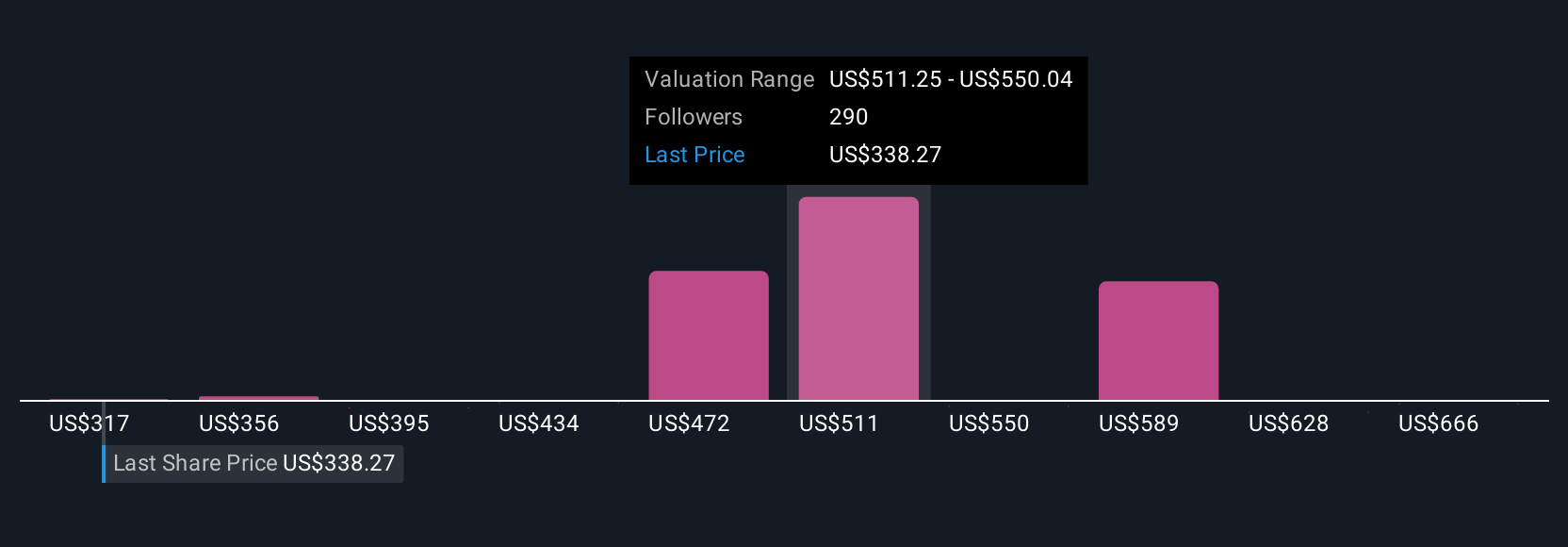

Uncover how Adobe's forecasts yield a $480.60 fair value, a 42% upside to its current price.

Exploring Other Perspectives

In contrast, some of the most bullish analysts previously expected Adobe’s AI push to double related business and drive revenues to about US$30.9 billion by 2028. If you agree with this more optimistic outlook, it assumes that the company’s AI investments and global expansion will outpace industry rivals, but this perspective does not fully account for the accelerating competitive risks that recent developments are beginning to highlight. It is a good reminder that expert opinions can differ widely and it pays to compare these viewpoints as new information emerges.

Explore 70 other fair value estimates on Adobe - why the stock might be worth over 2x more than the current price!

Build Your Own Adobe Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adobe research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Adobe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adobe's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com