- Adtalem Global Education recently reported fourth quarter and full year 2025 results, posting US$457.11 million in quarterly sales and US$237.07 million in annual net income, alongside providing 2026 revenue guidance of US$1.9 billion to US$1.94 billion with anticipated year-over-year growth of 6.0% to 8.5%.

- Ahead of anticipated federal Grad PLUS loan program changes, Sallie Mae and Adtalem announced exploration of alternative financing solutions to support healthcare students, directly addressing sector talent shortages and evolving student funding needs.

- We'll explore how Adtalem's robust enrollment growth and healthcare education partnerships shape its investment narrative in light of these developments.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Adtalem Global Education's Investment Narrative?

To be a shareholder in Adtalem Global Education right now, you need to believe in the demand for healthcare professionals and the company’s ability to grow enrollments, deliver positive financial results, and adapt to major changes in student financing. The recent earnings report showed ongoing sales and profit growth, solidifying confidence in near-term operational catalysts like continued enrollment momentum and new partnerships, particularly in healthcare education. However, the new partnership with Sallie Mae takes on more significance with the upcoming phaseout of federal Grad PLUS loans in 2026. This move could reduce uncertainty around future student funding options, a critical risk previously hanging over the sector. At the same time, expanding the credit facility gives Adtalem extra financial flexibility, although rising tax rates and ongoing regulatory uncertainties still warrant attention. For now, the biggest immediate risk remains how the transition in federal loan programs will play out and whether alternative student financing solutions will be ready in time.

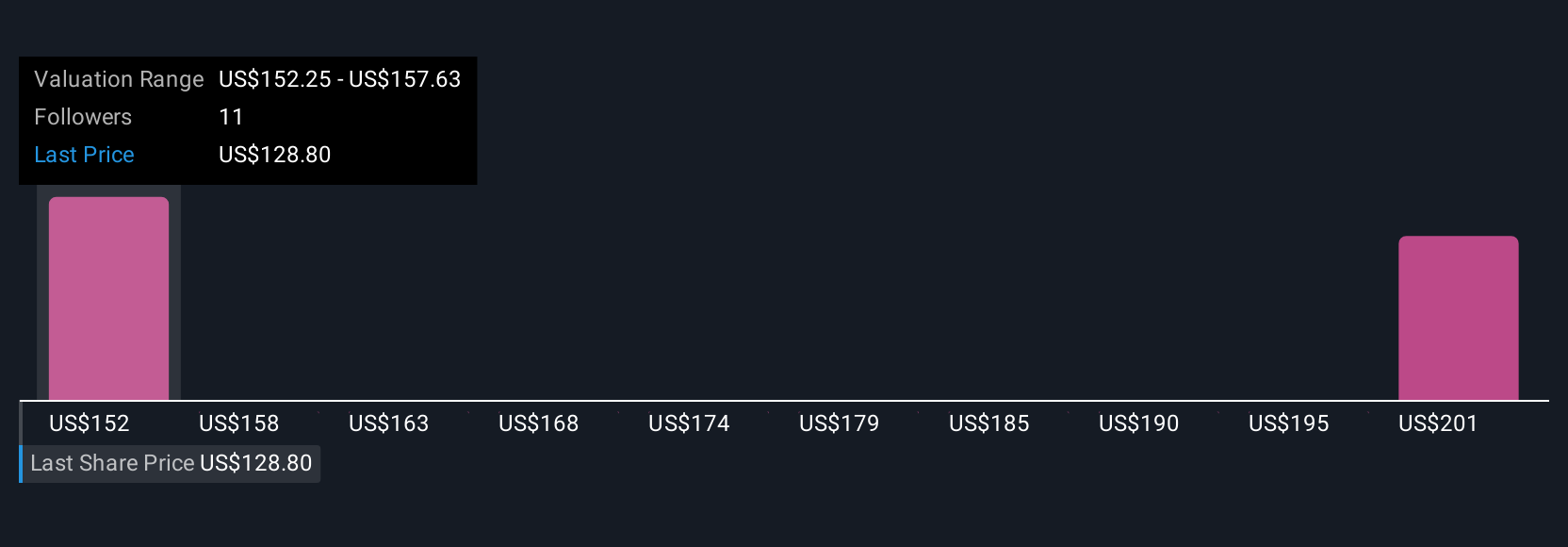

But while student financing solutions are progressing, regulatory shifts remain a key risk for investors. Adtalem Global Education's shares have been on the rise but are still potentially undervalued by 35%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth as much as 53% more than the current price!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com