- Marqeta, Inc. recently reported second quarter 2025 results, with quarterly sales reaching US$150.39 million, up from US$125.27 million a year earlier, while moving from a net income of US$119.11 million last year to a small net loss of US$647,000.

- The company also raised its full-year 2025 revenue growth outlook following strong transaction volume growth across core lending and expense management verticals, despite some macroeconomic uncertainties.

- We’ll now explore how Marqeta’s upgraded full-year revenue guidance and improving sales momentum may reshape its investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Marqeta Investment Narrative Recap

To believe in Marqeta as a shareholder, you have to trust in its ability to capture long-term demand for embedded fintech and digital payments solutions in a rapidly evolving market. The company’s raised revenue outlook and steady transaction growth keep sales momentum as the key short-term catalyst, even as reliance on several major customers remains the most significant risk, a risk the latest results do not materially reduce.

Among recent announcements, the updated guidance for third and fourth quarter revenue growth of 15% to 17% stands out. This outlook underpins near-term optimism tied to transaction volume gains, reinforcing the central role of sales momentum as Marqeta’s most actionable investment catalyst right now.

But, while revenue momentum appears robust, it’s important to also remain aware of ongoing client concentration risk, especially if...

Read the full narrative on Marqeta (it's free!)

Marqeta's outlook forecasts $906.9 million in revenue and $11.3 million in earnings by 2028. This is based on an annual revenue growth rate of 17.9% and a $76 million increase in earnings from the current level of -$64.7 million.

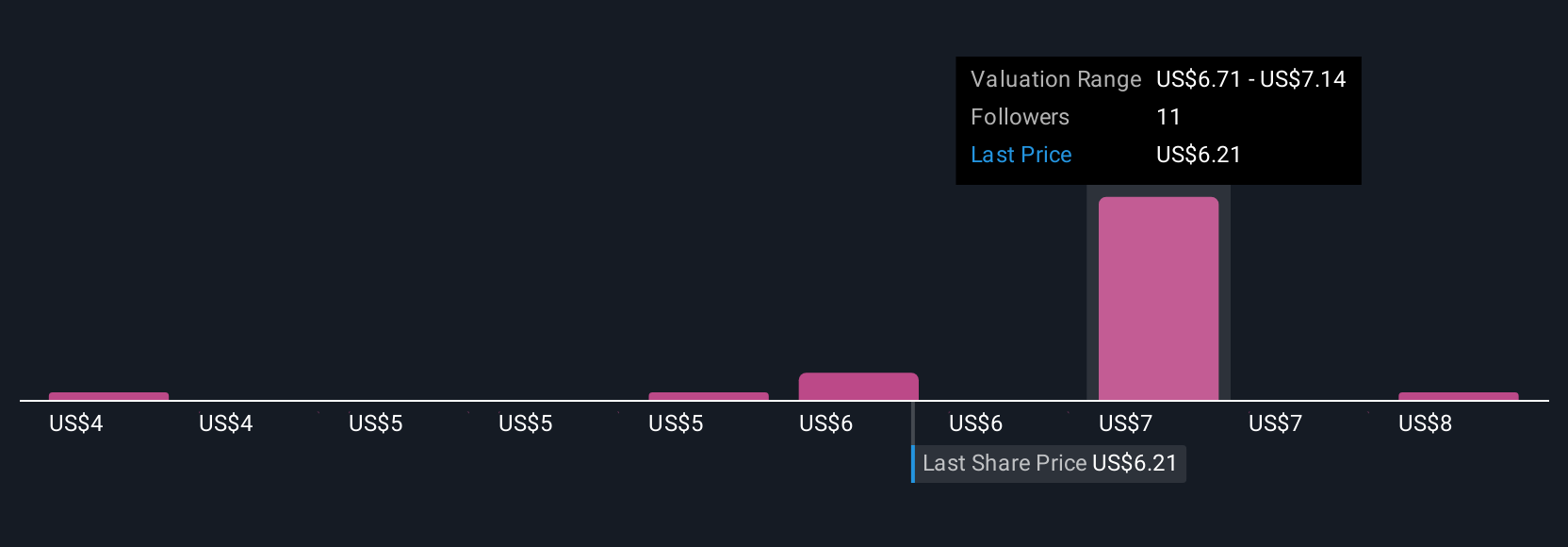

Uncover how Marqeta's forecasts yield a $6.78 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently estimate Marqeta’s fair value anywhere from US$3.70 to US$8.00 based on six independent perspectives. Set against persistent dependence on key clients, you can explore these distinct viewpoints to see how market participants weigh up both opportunity and risk.

Explore 6 other fair value estimates on Marqeta - why the stock might be worth 42% less than the current price!

Build Your Own Marqeta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marqeta research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Marqeta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marqeta's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com