- In August 2025, Watts Water Technologies reported solid second-quarter earnings, with sales rising to US$643.7 million and net income increasing to US$100.9 million compared to a year earlier, alongside an improved outlook for the remainder of the year.

- The company's raised sales and margin guidance reflects management's increased confidence in both operational performance and market demand, as reinforced by active share repurchases and a dividend affirmation.

- Next, we'll examine how Watts’ raised full-year outlook and stronger earnings shape the investment narrative and near-term growth expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Watts Water Technologies Investment Narrative Recap

To be a shareholder in Watts Water Technologies today, you need to believe in the ongoing potential for margin improvement and steady revenue growth, especially as the company’s strong Q2 results and raised full-year guidance indicate operational resilience. While the updated outlook highlights management’s confidence, the biggest short term catalyst remains further execution on cost efficiencies, yet the persistent risk is ongoing European market weakness, which could still pressure volumes and margins if economic uncertainty drags on. The magnitude of this risk was not meaningfully changed by the latest results, but it remains important to monitor.

Among the recent corporate updates, the revised full-year 2025 guidance is most relevant, as management is now projecting reported sales growth of 2% to 5% and an operating margin of 17.2% to 17.8%. This guidance update, factoring in tariffs and current market conditions, directly connects to core catalysts such as productivity initiatives and cost control efforts that underpin the narrative for improved margins and stable earnings in 2025.

In contrast, despite rising confidence in operational execution, investors should be aware that exposure to further economic softness in Europe could...

Read the full narrative on Watts Water Technologies (it's free!)

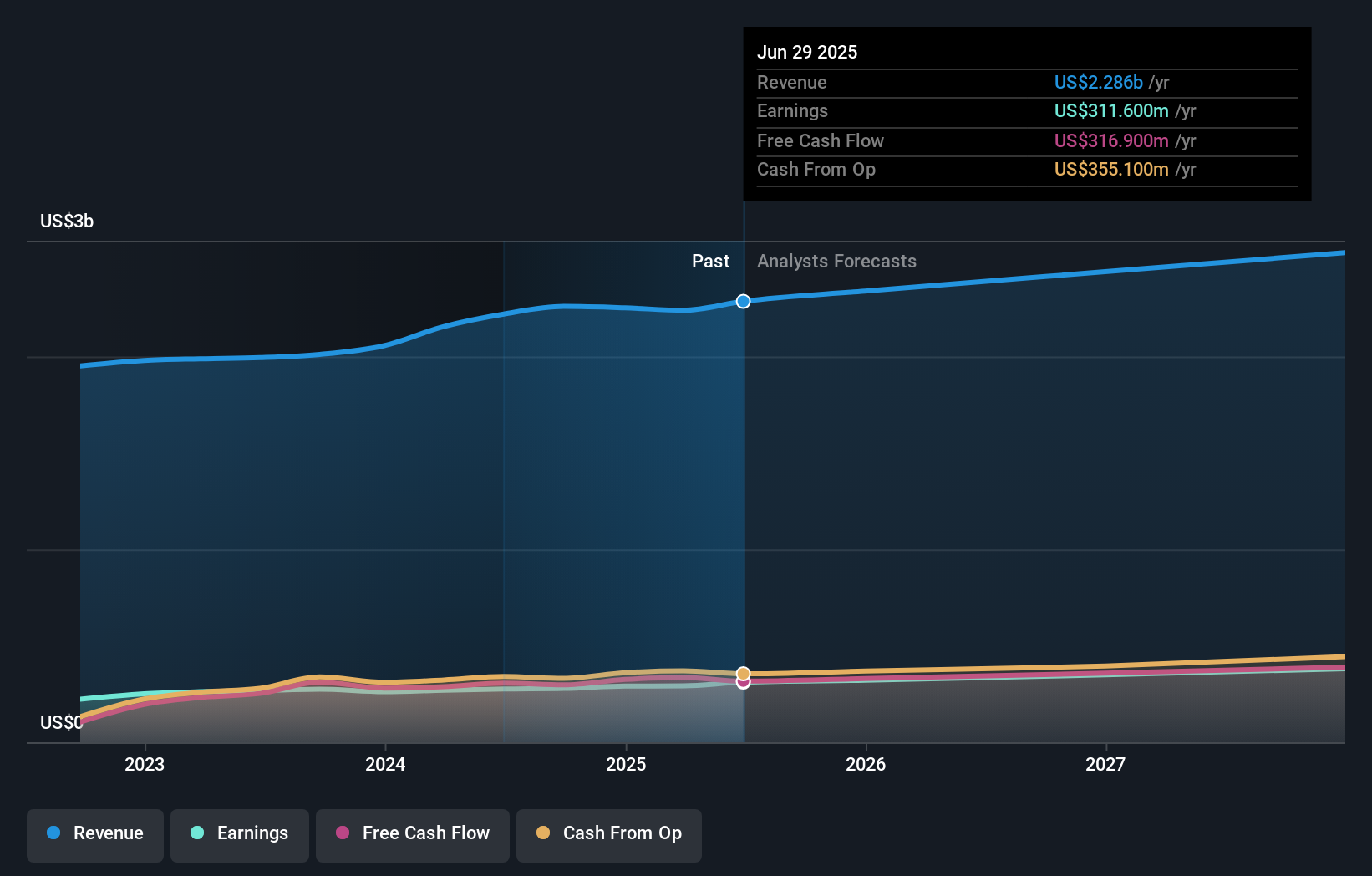

Watts Water Technologies is projected to reach $2.5 billion in revenue and $367.4 million in earnings by 2028. This outlook assumes 4.0% annual revenue growth and a $74.8 million increase in earnings from the current $292.6 million.

Uncover how Watts Water Technologies' forecasts yield a $272.80 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for Watts Water Technologies between US$269.13 and US$272.80, capturing just two viewpoints so far. While the range is tight, keep in mind that the company’s reliance on margin improvements and exposure to European demand mean performance drivers can shift quickly, so exploring more views may provide additional useful context.

Explore 2 other fair value estimates on Watts Water Technologies - why the stock might be worth as much as $272.80!

Build Your Own Watts Water Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Watts Water Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Watts Water Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Watts Water Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com