- Edgewell Personal Care recently reported third quarter results showing sales of US$627.2 million and net income of US$29.1 million, and lowered its full-year guidance, now anticipating a 1.3% decline in organic net sales and GAAP EPS of about US$1.73.

- Despite ongoing share buybacks and a maintained quarterly dividend, management’s move to cut outlook highlights near-term operational challenges facing the company.

- We'll explore how Edgewell’s reduced full-year outlook affects the company's investment narrative of international expansion and margin recovery.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

Edgewell Personal Care Investment Narrative Recap

To be a shareholder in Edgewell Personal Care, you’d need to believe the company can reinvigorate its mature brands and return to growth through innovation and international expansion, while restoring margins. After the latest quarterly results and revised guidance, now projecting a 1.3% decline in organic net sales and lowered EPS, momentum in top-line recovery has clearly weakened, and the risk of further margin pressure in core categories is now a more pressing concern in the near term.

Among recent announcements, the continued pace of share buybacks stands out, with 855,220 shares repurchased this quarter for US$24.5 million. While this signals ongoing capital return to shareholders, it does not offset the operational challenges now reflected in management’s guidance cut, and does little to revive optimism around the company’s short-term volume and profit trends.

By contrast, investors should be aware that risks linked to deepening competition and margin pressure in Edgewell’s key categories may...

Read the full narrative on Edgewell Personal Care (it's free!)

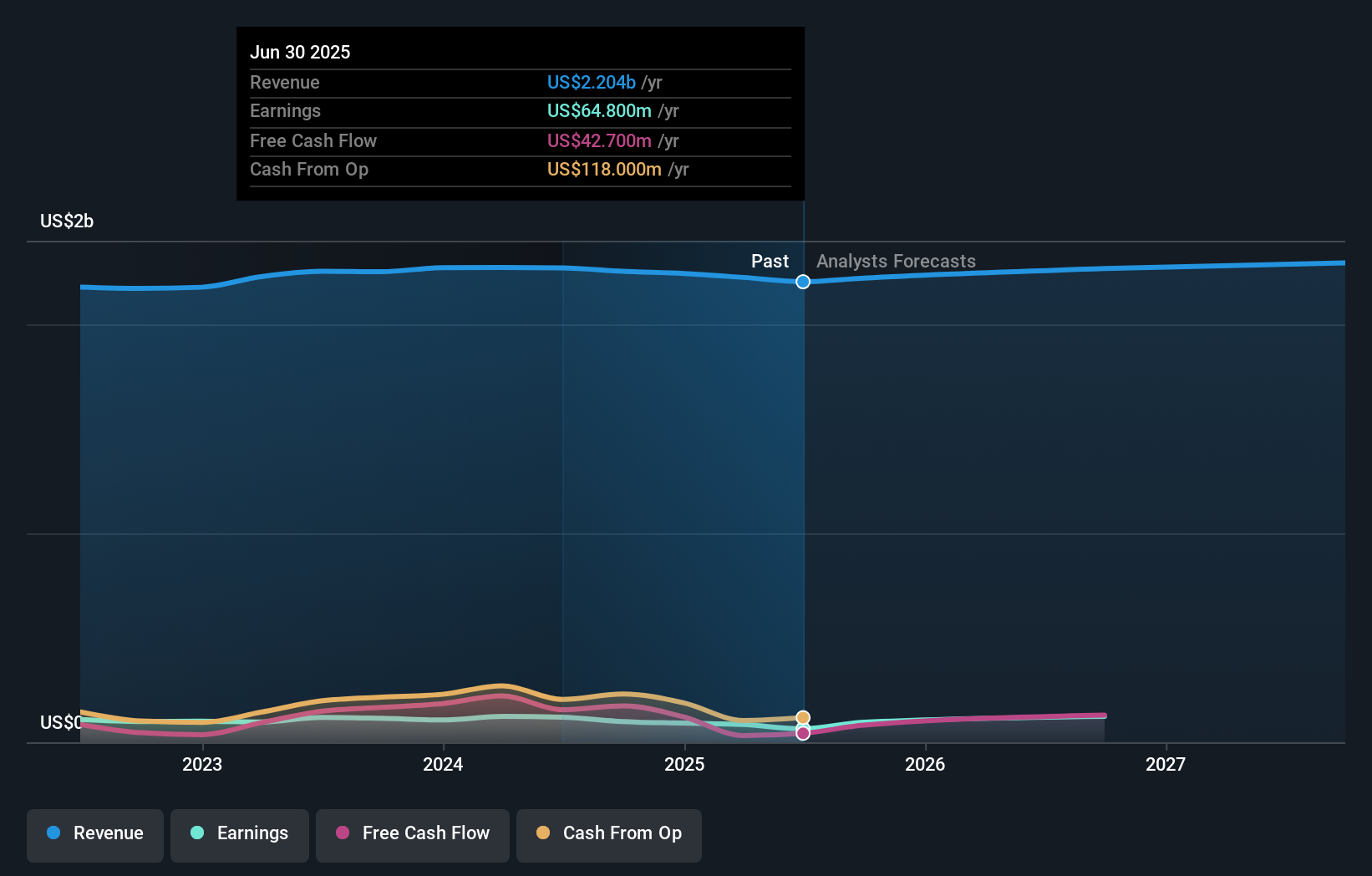

Edgewell Personal Care's narrative projects $2.4 billion in revenue and $242.7 million in earnings by 2028. This requires 2.3% yearly revenue growth and an increase of $177.9 million in earnings from the current $64.8 million.

Uncover how Edgewell Personal Care's forecasts yield a $26.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community have posted fair value estimates for Edgewell ranging from US$26 to US$31.51, based on their own growth forecasts. Against these varied perspectives, persistent revenue and margin pressures underline why your view on market share risks could prove crucial.

Explore 2 other fair value estimates on Edgewell Personal Care - why the stock might be worth just $26.00!

Build Your Own Edgewell Personal Care Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edgewell Personal Care research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Edgewell Personal Care research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edgewell Personal Care's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com