- Topgolf Callaway Brands Corp. recently reported second quarter 2025 results showing a decline in revenue to US$1.11 billion and net income to US$20.3 million, and lowered its full-year 2025 consolidated net revenue guidance to a range between US$3.80 billion and US$3.92 billion from its previous projection.

- The company also announced the upcoming resignation of CEO Artie Starrs, who will remain with the business until September 2025 to assist with the leadership transition.

- With the lowered full-year revenue guidance underscoring operational headwinds, we'll examine how these developments affect Topgolf Callaway Brands' investment narrative.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Topgolf Callaway Brands Investment Narrative Recap

To be a shareholder in Topgolf Callaway Brands, you need to believe in the long-term appeal of experiential, social recreation and the company’s ability to translate increased traffic into sustainable, profitable growth. The recent revenue miss and lower guidance highlight near-term execution and margin risks, especially as value initiatives boost visitation but put pressure on average spend, a dynamic that could weigh on both the short-term catalyst of traffic-driven recovery and the long-term risk of earnings erosion if discounting persists.

Among recent announcements, the decision to lower full-year revenue expectations is the most relevant for investors assessing catalysts: it signals management’s acknowledgement of softer consumer spending and weakness in certain business segments, shifting focus from near-term growth to defending margins and stabilizing operations until demand patterns improve. In contrast, investors should also be aware of…

Read the full narrative on Topgolf Callaway Brands (it's free!)

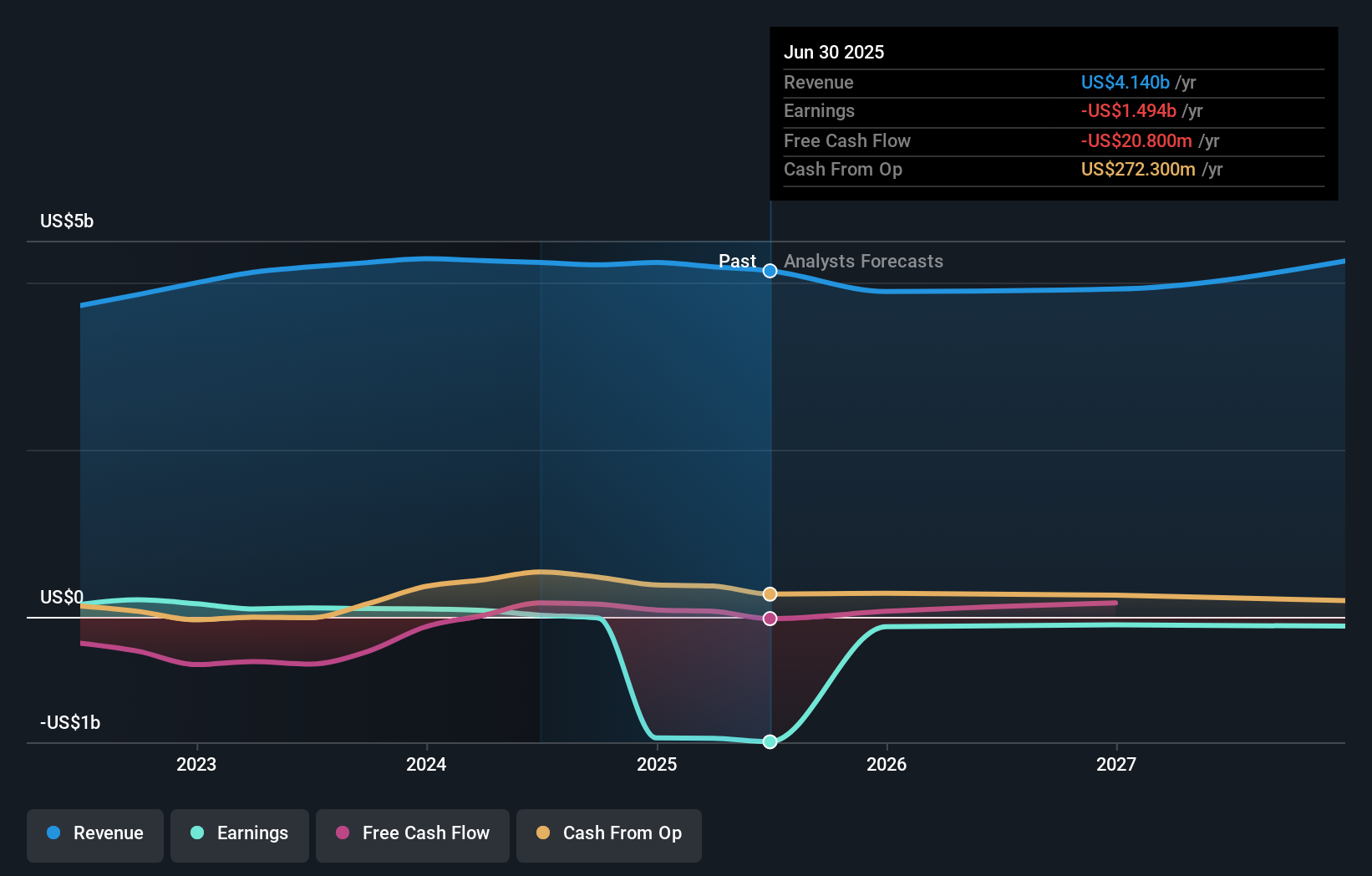

Topgolf Callaway Brands is projected to reach $3.9 billion in revenue and $198.2 million in earnings by 2028. This outlook assumes a -2.7% annual revenue decline and represents a $1.7 billion improvement in earnings from the current -$1.5 billion.

Uncover how Topgolf Callaway Brands' forecasts yield a $10.14 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range widely, from US$2 to US$15 per share. Despite this spread, recent operational headwinds and lowered guidance may give investors pause when weighing the impact of aggressive discounting on future earnings, explore alternate viewpoints to get the full picture.

Explore 5 other fair value estimates on Topgolf Callaway Brands - why the stock might be worth less than half the current price!

Build Your Own Topgolf Callaway Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Topgolf Callaway Brands research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Topgolf Callaway Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Topgolf Callaway Brands' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com