- Arthur J. Gallagher & Co. recently reported its second quarter and first half 2025 earnings, highlighting increases in both revenue and net income from the prior year, and simultaneously declared a regular quarterly cash dividend of US$0.65 per share.

- An interesting aspect is that, despite the robust financial results and ongoing dividend payments, the company reported no share repurchases during the quarter under its previously announced buyback program.

- With the company posting higher revenue and earnings, we will examine how this financial momentum influences Arthur J. Gallagher's investment narrative.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Arthur J. Gallagher Investment Narrative Recap

Owning Arthur J. Gallagher requires confidence in the company’s ability to leverage increasing global risk complexity and execute on disciplined M&A to drive steady growth. The latest news, strong revenue and earnings gains coupled with a continued dividend, but no share buybacks, does not alter the near-term catalyst of client demand for advanced risk solutions or the primary risk stemming from falling property insurance rates. Overall, these developments do not materially shift the investment thesis or risk profile for now.

The most relevant announcement in light of the latest news is the company’s Q2 results, which reported higher revenue and net income year-over-year. This underlines the importance of organic growth and margin expansion as central drivers, even as the absence of buyback activity leaves the share count unchanged, reinforcing reliance on core business strength over financial engineering to meet investor expectations. Yet, investors should watch closely as one risk, further declines in property insurance rates and the potential impact on commission income, remains a real concern...

Read the full narrative on Arthur J. Gallagher (it's free!)

Arthur J. Gallagher's outlook suggests $19.5 billion in revenue and $3.3 billion in earnings by 2028. Achieving these targets calls for annual revenue growth of 19.1% and a $1.7 billion increase in earnings from the current $1.6 billion.

Uncover how Arthur J. Gallagher's forecasts yield a $334.58 fair value, a 15% upside to its current price.

Exploring Other Perspectives

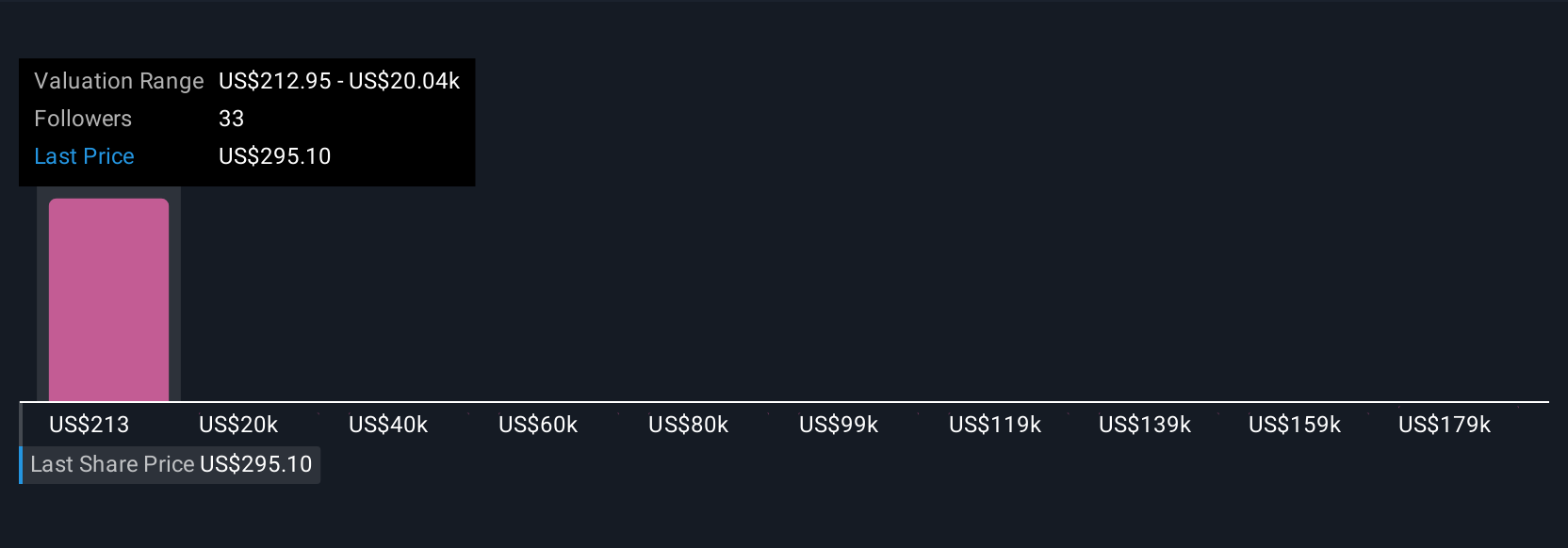

Simply Wall St Community members submitted seven independent fair value estimates for Arthur J. Gallagher, ranging from US$210.91 up to an extreme US$198,517.72. Despite this wide spread, ongoing pressure from lower property insurance rates could materially affect future revenue and profitability, so consider how different views reflect the risks and opportunities ahead.

Explore 7 other fair value estimates on Arthur J. Gallagher - why the stock might be a potential multi-bagger!

Build Your Own Arthur J. Gallagher Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arthur J. Gallagher research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arthur J. Gallagher research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arthur J. Gallagher's overall financial health at a glance.

No Opportunity In Arthur J. Gallagher?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com