- AEG recently announced an expanded global partnership with American Express, making Amex the official payment partner across more than 40 premier venues and events spanning four continents, and further enriching cardholder benefits in live music, sports, and entertainment experiences.

- This broadened alliance firmly embeds Amex within AEG's marquee assets, amplifying its global entertainment footprint and reinforcing the company's ongoing investment in enhancing unique customer experiences.

- We'll explore how American Express's enhanced presence at top entertainment venues worldwide may accelerate its pursuit of personalized, premium brand experiences.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American Express Investment Narrative Recap

To be a shareholder in American Express, you need to believe in the company's ability to leverage its premium brand and global partnerships to drive superior fee-based revenue and maintain strong customer loyalty, even as competition in the premium card segment intensifies. The recent AEG partnership expands Amex's reach in live entertainment, reinforcing its brand value among high-spending cardmembers. However, this development does not materially alter the most important short-term catalyst, ongoing product refreshes and premium card retention, or offset the biggest current risk from escalating competition and acquisition costs.

The most relevant announcement in context is the rumored Apple Card portfolio acquisition, in which Amex was a contender but may fall behind JPMorgan. While this decision's immediate impact is limited, it highlights the ongoing competition for affluent, high-velocity spenders, a key battleground underpinning both the company's short-term growth and long-term differentiation goals.

By contrast, it’s worth noting that investors should be aware that while Amex’s brand is deeply embedded at the top of the market, the shift toward digital wallets and real-time payment alternatives...

Read the full narrative on American Express (it's free!)

American Express’ outlook anticipates $85.7 billion in revenue and $13.5 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 10.6% and an earnings increase of $3.5 billion from current earnings of $10.0 billion.

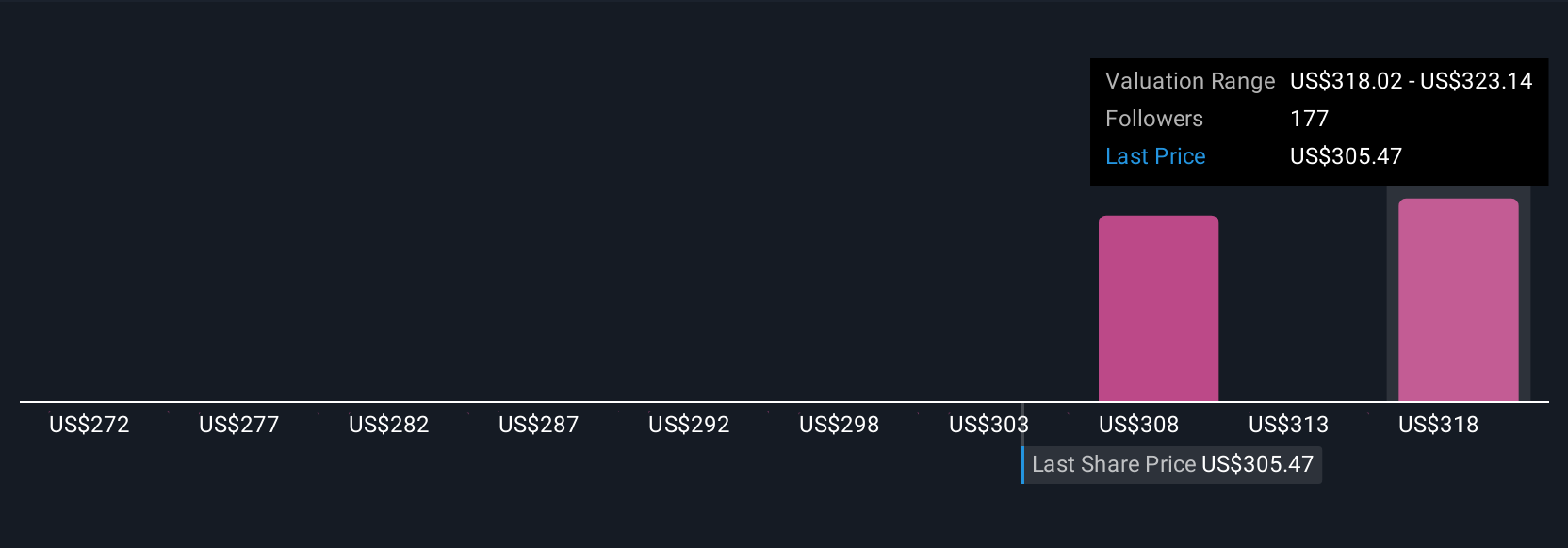

Uncover how American Express' forecasts yield a $323.14 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts saw American Express hitting US$85 billion in revenue and US$14.7 billion in earnings by 2028, expecting tech-driven growth from younger and international consumers to offset disruption risks. Your opinion could be very different, especially as new digital payment challenges and partnerships may alter the path ahead, exploring multiple viewpoints is essential.

Explore 7 other fair value estimates on American Express - why the stock might be worth 10% less than the current price!

Build Your Own American Express Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Express research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Express research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Express' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com