- On August 1, 2025, AngloGold Ashanti plc announced a surge in net income to US$1.11 billion for the half year ended June 30, 2025, alongside higher gold production and an interim dividend of US$0.80 per share.

- The company's sharp increase in earnings per share, up to US$2.19 from US$0.74 a year earlier, highlights a substantial jump in profitability compared to the previous year.

- We'll examine how AngloGold Ashanti's strong earnings growth and dividend announcement could influence its investment narrative going forward.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

AngloGold Ashanti Investment Narrative Recap

For shareholders in AngloGold Ashanti, the core belief is in the company’s ability to realize operating efficiencies and manage costs, translating higher gold production into robust earnings and returns, even as short-term catalysts hinge on maintaining this performance. The recent surge in profitability, supported by management’s reaffirmed full-year production guidance, does not materially shift the biggest near-term risk: the company’s ongoing vulnerability to cost inflation and commodity price swings.

Among the recent updates, the declaration of an interim dividend of US$0.80 per share stands out, signaling confidence in near-term cash flow after a period of sharply rising earnings. This move may reinforce the investment case for those focused on income amid ongoing production and margin improvements, foregrounding the company's sensitivity to operational risks and gold market volatility.

However, investors should be aware that despite stronger earnings, production challenges from climate or higher costs remain a key consideration if…

Read the full narrative on AngloGold Ashanti (it's free!)

AngloGold Ashanti's outlook anticipates $9.6 billion in revenue and $3.0 billion in earnings by 2028. This requires a 7.8% annual revenue growth rate and a $1.2 billion increase in earnings from the current $1.8 billion level.

Uncover how AngloGold Ashanti's forecasts yield a $53.83 fair value, a 6% downside to its current price.

Exploring Other Perspectives

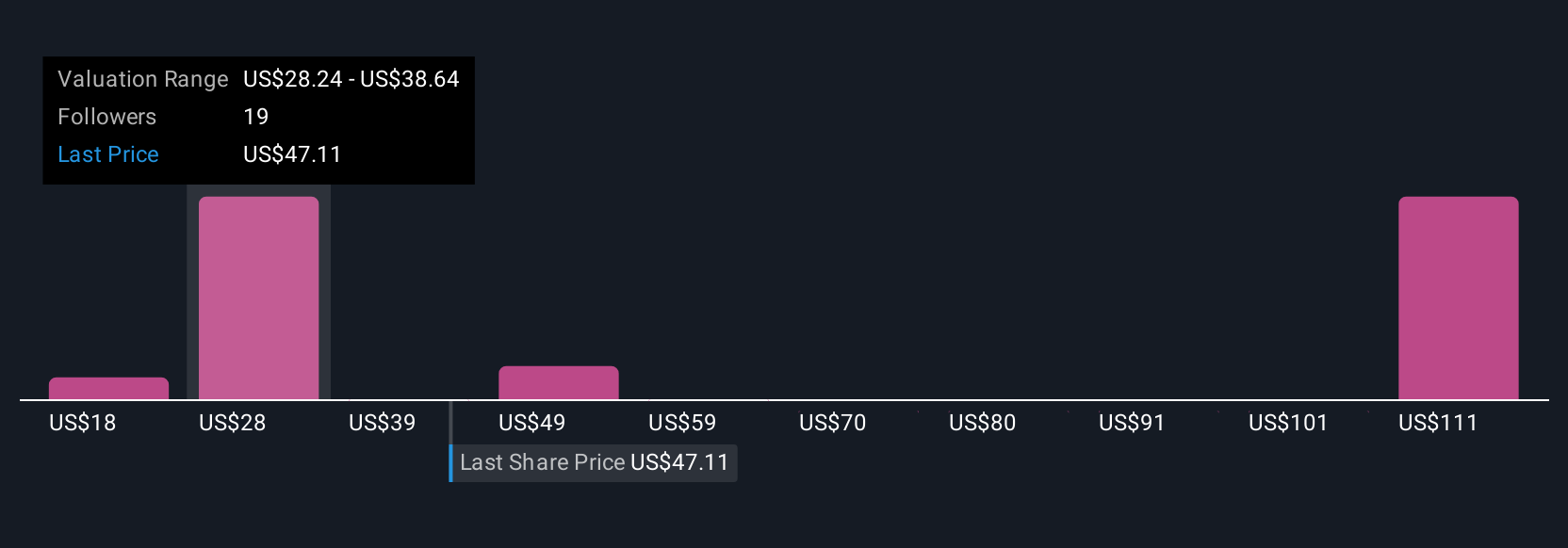

Eleven members of the Simply Wall St Community estimate AngloGold Ashanti’s fair value anywhere from US$17.84 to US$70 per share. While views vary widely, the company’s reaffirmed production and cost guidance remains front of mind as these estimates reflect different outlooks on future performance.

Explore 11 other fair value estimates on AngloGold Ashanti - why the stock might be worth less than half the current price!

Build Your Own AngloGold Ashanti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AngloGold Ashanti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngloGold Ashanti's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com