- United Parks & Resorts Inc. recently reported earnings for the second quarter and first half of 2025, revealing year-over-year declines in both revenue and net income, while also announcing a new share repurchase program of up to US$500 million, pending shareholder approval.

- The combination of weaker financial performance and the launch of a major buyback plan highlights leadership’s intent to balance operational headwinds with direct shareholder returns.

- We’ll now assess how the announced US$500 million share repurchase program could influence United Parks & Resorts’ investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

United Parks & Resorts Investment Narrative Recap

To own shares in United Parks & Resorts, an investor needs confidence that new attractions and operational efficiencies can reinvigorate growth and offset mounting competitive threats. The recent earnings report, with revenue and net income both down year-on-year, does not appear to meaningfully alter the most important near-term catalyst: the launch and popularity of new, one-of-a-kind rides and attractions for 2025. The main risk, significant visitor diversion from Universal's new Epic Universe Park in Orlando, remains material for the months ahead.

Of the company's recent announcements, the newly authorized US$500 million share repurchase program stands out. While this move signals a commitment to returning value to shareholders, it draws further attention to the importance of sustaining healthy cash flows, particularly in a period of softer earnings and rising competitive pressure from major theme park developments in the region.

Yet, set against the backdrop of exciting attraction launches, investors should also prepare for the impact of competitive risks, especially if visitor numbers were to unexpectedly shift due to…

Read the full narrative on United Parks & Resorts (it's free!)

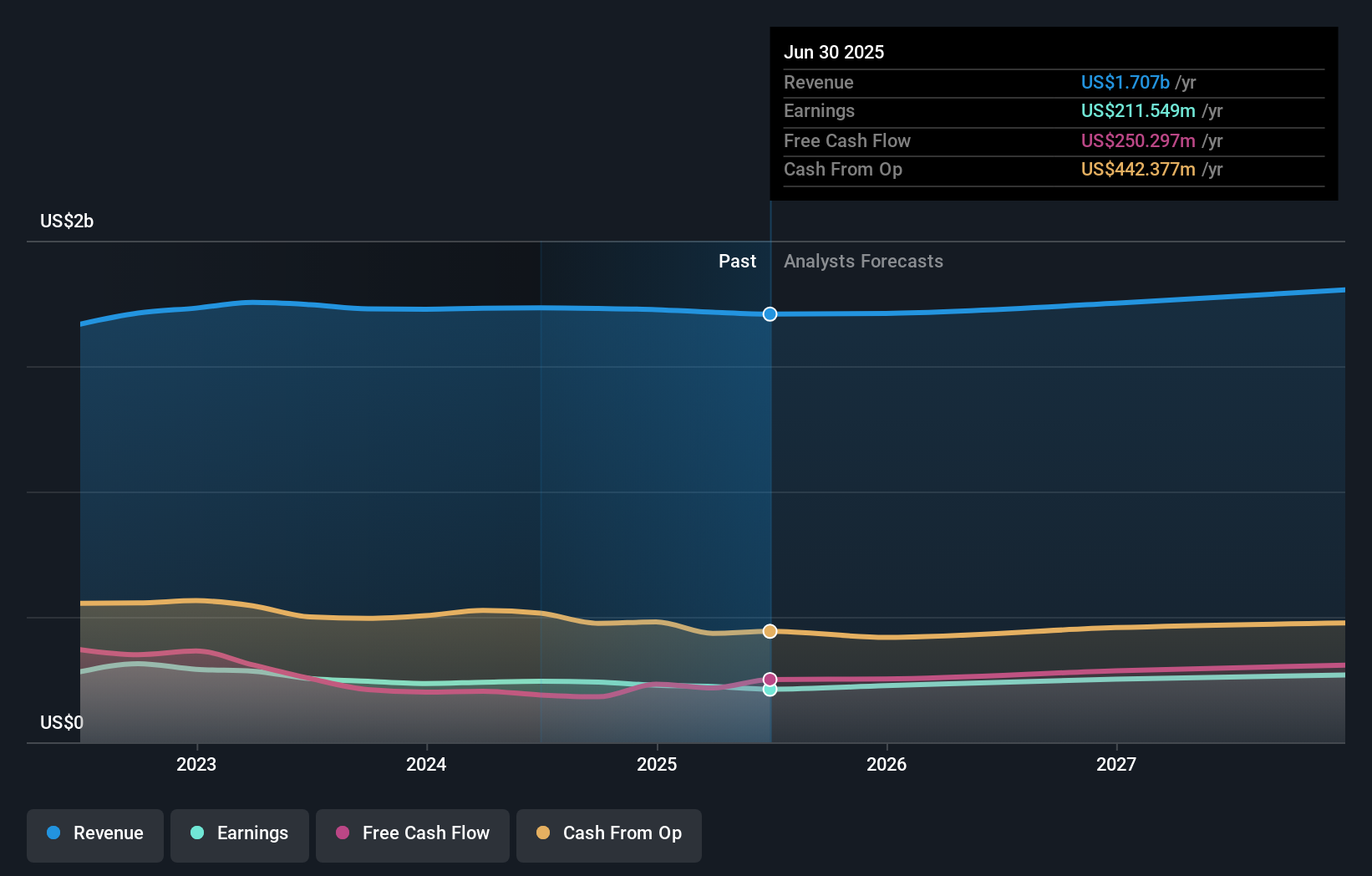

United Parks & Resorts is expected to reach $1.8 billion in revenue and $284.1 million in earnings by 2028. This forecast implies a 2.0% annual revenue growth rate and a $61.5 million increase in earnings from the current $222.6 million.

Uncover how United Parks & Resorts' forecasts yield a $56.55 fair value, a 13% upside to its current price.

Exploring Other Perspectives

One private investor in the Simply Wall St Community estimates United Parks & Resorts’ fair value at US$56.55. Amid optimism for new rides helping to drive attendance, divergent investor views highlight the value of exploring multiple perspectives on future growth.

Explore another fair value estimate on United Parks & Resorts - why the stock might be worth as much as 13% more than the current price!

Build Your Own United Parks & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parks & Resorts research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Parks & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parks & Resorts' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com