- Earlier this month, Universal Technical Institute reported strong third quarter and nine-month results for the period ended June 30, 2025, highlighted by sales of US$204.3 million and net income of US$10.66 million for the quarter, alongside an upward revision of its full-year revenue guidance to between US$830 million and US$835 million.

- These robust results were accompanied by higher net income and earnings per share across both reporting periods, reflecting ongoing momentum in enrollment and operational execution.

- We'll explore how the raised full-year guidance strengthens Universal Technical Institute's investment narrative amid evolving program expansion and industry partnerships.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

Universal Technical Institute Investment Narrative Recap

Universal Technical Institute’s recent earnings surprise and raised revenue guidance reinforce the story for shareholders who believe in the company's growth and diversification strategy, especially through expanding program offerings and industry partnerships. The improved outlook adds weight to the short-term catalyst of heightened student start performance, but does not materially reduce the key risk of revenue volatility linked to deferred student starts as enrollment trends remain sensitive to broader regulatory and market factors.

Among the recent updates, the launch of four new electrical programs across select campuses stands out as most relevant, accelerating program expansion efforts that are critical to maintaining enrollment momentum and supporting near-term revenue growth. These additions complement the positive signals from the latest results, aligning with the ongoing business catalyst that emphasizes broadening trade-related offerings while addressing workforce demand.

By contrast, investors should also remain attentive to the risk that shifts in regulation impacting outcomes-based comparisons could...

Read the full narrative on Universal Technical Institute (it's free!)

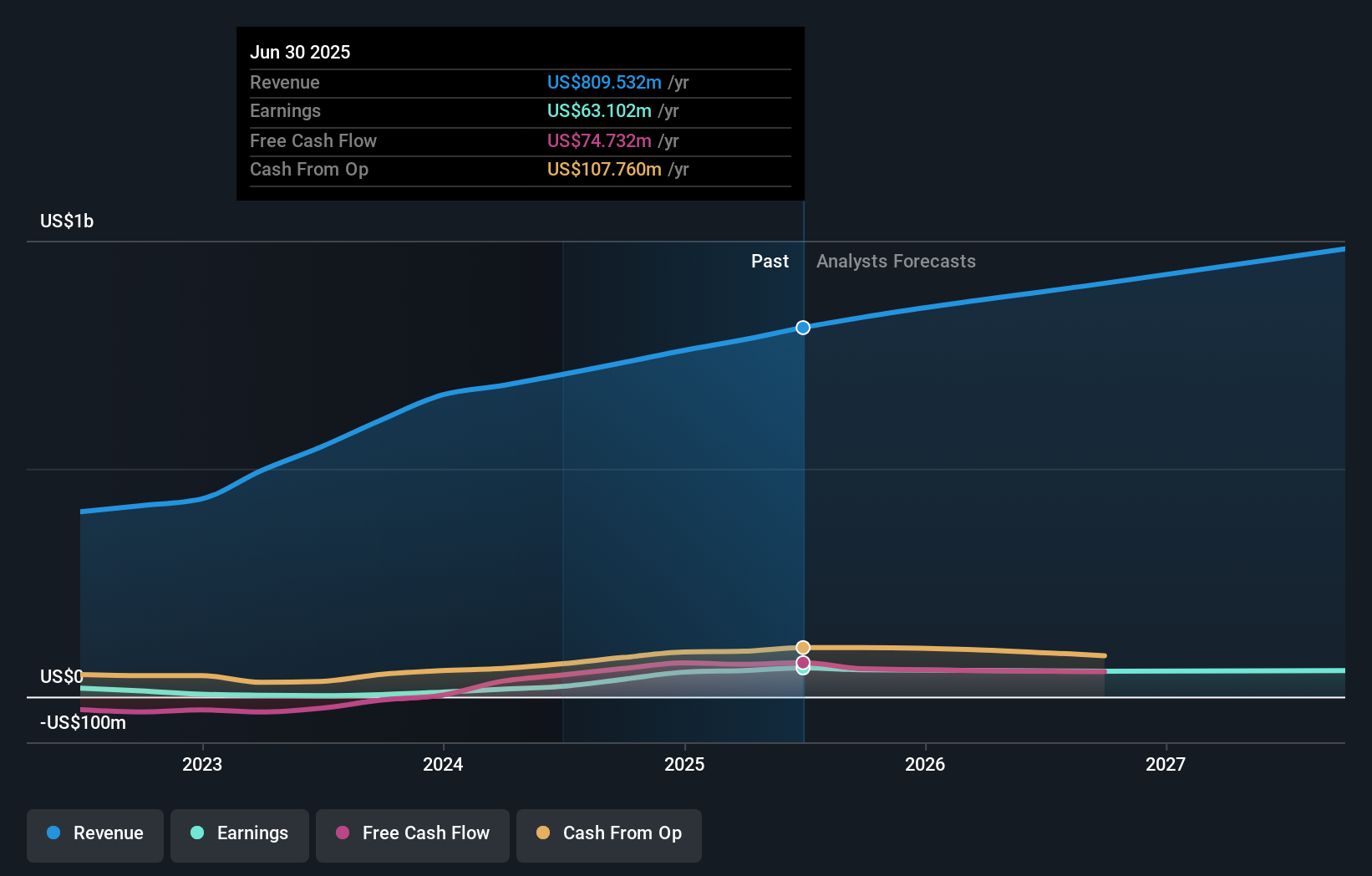

Universal Technical Institute's outlook forecasts $1.0 billion in revenue and $68.7 million in earnings by 2028. Achieving these targets would require an 8.7% annual revenue growth and an $11.3 million increase in earnings from the current $57.4 million.

Uncover how Universal Technical Institute's forecasts yield a $37.33 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for UTI range from US$18.19 to US$37.33, reflecting analyses from two participants. Despite this spread, UTI’s recent program launches highlight how varied growth expectations can shape diverging investor outlooks on future performance.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth 31% less than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com