- CDW Corporation recently announced its second-quarter 2025 results, reporting US$5.98 billion in sales, up from US$5.42 billion a year ago, alongside continued share repurchases totaling 900,000 shares for US$155.82 million and a quarterly dividend affirmation of US$0.625 per share.

- Significantly, CDW has now completed a repurchase of 54.6 million shares, representing 36.21% of its shares, under its multi-year buyback program that began in 2014.

- We'll explore how CDW's accelerating share repurchases and ongoing dividend support may influence its long-term earnings growth outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CDW Investment Narrative Recap

For investors considering CDW, the core rationale centers on the company's ability to scale its IT solutions and services business while maintaining operational efficiency and stable returns to shareholders. The recent news of strong Q2 sales growth and continued share buybacks provides reassurance around capital allocation, but softer net income and only modest EPS growth suggest the most significant short-term catalyst remains margin recovery. Risks tied to funding headwinds and competitive pricing pressures in enterprise deals still weigh on the near-term outlook; the impact from this news on those risks appears immaterial.

The appointment of Mukesh Kumar as Chief Services and Solutions Officer stands out as particularly relevant, given CDW’s stated focus on expanding its professional and managed services capabilities. His experience in building technology partnerships and scaling services teams may serve as a lever to boost growth in higher-margin areas, which links directly to the company’s key catalyst: ongoing digital transformation initiatives that can potentially support earnings momentum, if executed well.

Yet, in contrast to the improving revenue, investors should be aware that persistently lower net margins could continue to pressure earnings if...

Read the full narrative on CDW (it's free!)

CDW's narrative projects $24.0 billion in revenue and $1.4 billion in earnings by 2028. This requires 3.1% yearly revenue growth and a $0.3 billion increase in earnings from the current $1.1 billion.

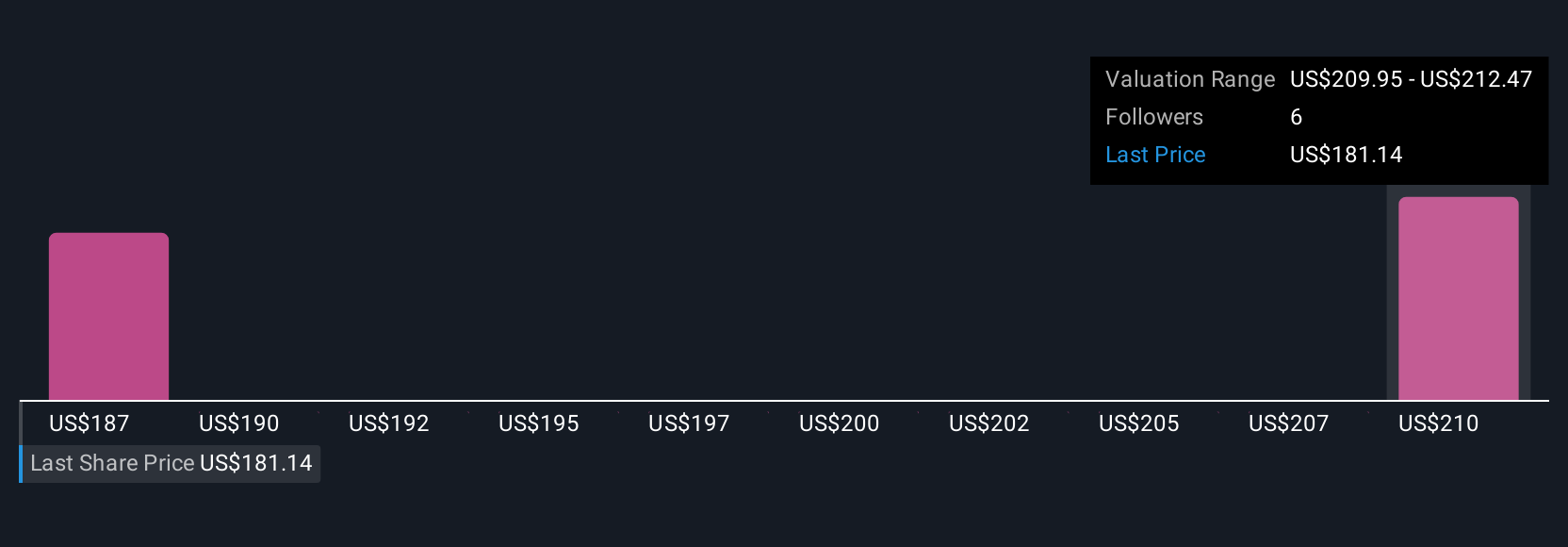

Uncover how CDW's forecasts yield a $213.20 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Three individual estimates from the Simply Wall St Community place CDW’s fair value between US$202.95 and US$234.14 per share. While many see potential value, concerns remain around margin pressure and competitive pricing continuing to affect earnings quality, consider how these different outlooks might shape your own view.

Explore 3 other fair value estimates on CDW - why the stock might be worth as much as 43% more than the current price!

Build Your Own CDW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CDW research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CDW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CDW's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com