- Shomoul Holding Company has appointed AECOM as the Project Management Consultant and engineer for Phase II of The Avenues - Riyadh, a transformative mixed-use development in Saudi Arabia valued at over US$4 billion and set to open in early 2026.

- This significant contract award highlights AECOM's growing position as a key player in delivering complex, high-profile projects aligned with Saudi Vision 2030.

- We'll explore how this major appointment, leveraging AECOM's advanced digital project management capabilities, could impact the company's future growth outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

AECOM Investment Narrative Recap

To be a shareholder in AECOM, you must believe in the company's ability to leverage growing global infrastructure spending, especially for complex and high-value projects. The recent appointment as project manager for The Avenues - Riyadh showcases AECOM’s potential to capture large, multi-year contracts in fast-growing regions, which could fuel near-term growth, though exposure to shifting public policy or economic cycles remains a key risk. Based on current information, the impact of this news supplements, but does not fundamentally shift, the main short-term drivers or risks.

Among recent company developments, AECOM's new guidance update for 2025, projecting GAAP EPS between US$5.08 and US$5.18, gives investors insight into the company's financial outlook alongside large project wins. This financial clarity is relevant in the context of major contract announcements as it sets expectations on how such awards might be reflected in future results, supporting the company's backlog-driven growth story for investors assessing near-term catalysts.

However, investors should also be aware that, despite headlines about transformative projects, margin pressure from rising labor or compliance costs...

Read the full narrative on AECOM (it's free!)

AECOM's narrative projects $18.9 billion revenue and $957.1 million earnings by 2028. This requires 5.5% yearly revenue growth and a $282.4 million earnings increase from $674.7 million today.

Uncover how AECOM's forecasts yield a $131.09 fair value, a 8% upside to its current price.

Exploring Other Perspectives

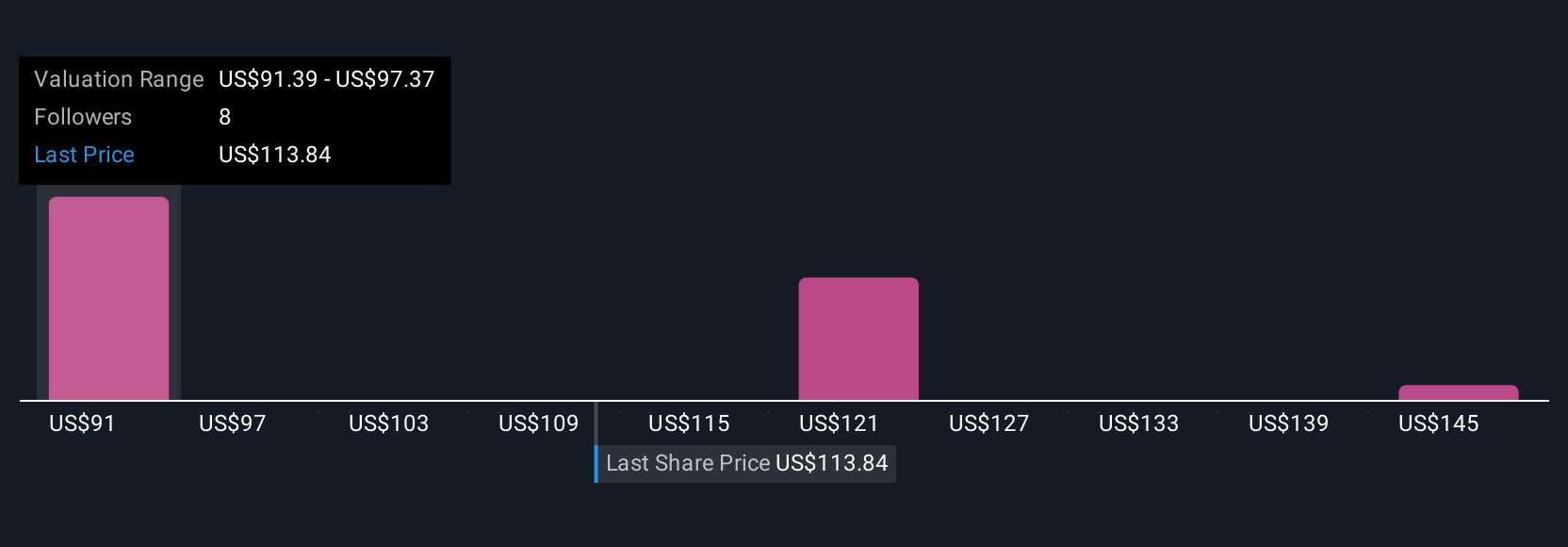

Four fair value estimates from the Simply Wall St Community range from US$85.28 to US$151.14 per share. While some see high potential, others point to the risk that accelerating industry adoption of digital technologies could pressure AECOM’s margins if it cannot maintain an edge, highlighting why it’s important to review several viewpoints before making a decision.

Explore 4 other fair value estimates on AECOM - why the stock might be worth 29% less than the current price!

Build Your Own AECOM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AECOM research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free AECOM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AECOM's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com