- Peet's Coffee recently announced a new partnership making it the official coffee provider on all Southwest Airlines flights, with the launch featuring their Off the Grid™ medium roast blend and a co-branded promotional event in Chicago timed to the city's Air and Water Show.

- This collaboration marks Peet's first venture with a major U.S. airline and is designed to enhance the in-flight experience while expanding brand visibility across key travel hubs.

- We'll explore how this differentiated onboard offering could influence Southwest Airlines' investment narrative and customer engagement initiatives.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Southwest Airlines Investment Narrative Recap

For a shareholder in Southwest Airlines, the investment case often centers on the company’s ability to balance cost efficiency, operational reliability, and customer experience while navigating industry headwinds like economic uncertainty and travel demand volatility. The Peet’s Coffee partnership stands out as a brand upgrade that may boost passenger satisfaction, yet it’s unlikely to materially shift the near-term catalyst, which remains focused on booking trends and seat demand, or significantly blunt the primary risk of weakened leisure travel demand.

Among recent announcements, the August 2025 dividend affirmation, maintaining a quarterly payout of US$0.18 per share, provides an indication of continued capital returns amid recent operational changes. While a consistent dividend may help support the stock’s appeal, it does not directly address the core risk of demand softness or heightened competition within key airports that could pressure revenue targets in the coming quarters.

By contrast, investors should be aware that ongoing uncertainty in leisure travel demand could mean...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines' narrative projects $32.6 billion in revenue and $1.9 billion in earnings by 2028. This requires 5.9% annual revenue growth and a $1.5 billion increase in earnings from $392.0 million today.

Uncover how Southwest Airlines' forecasts yield a $31.86 fair value, a 4% upside to its current price.

Exploring Other Perspectives

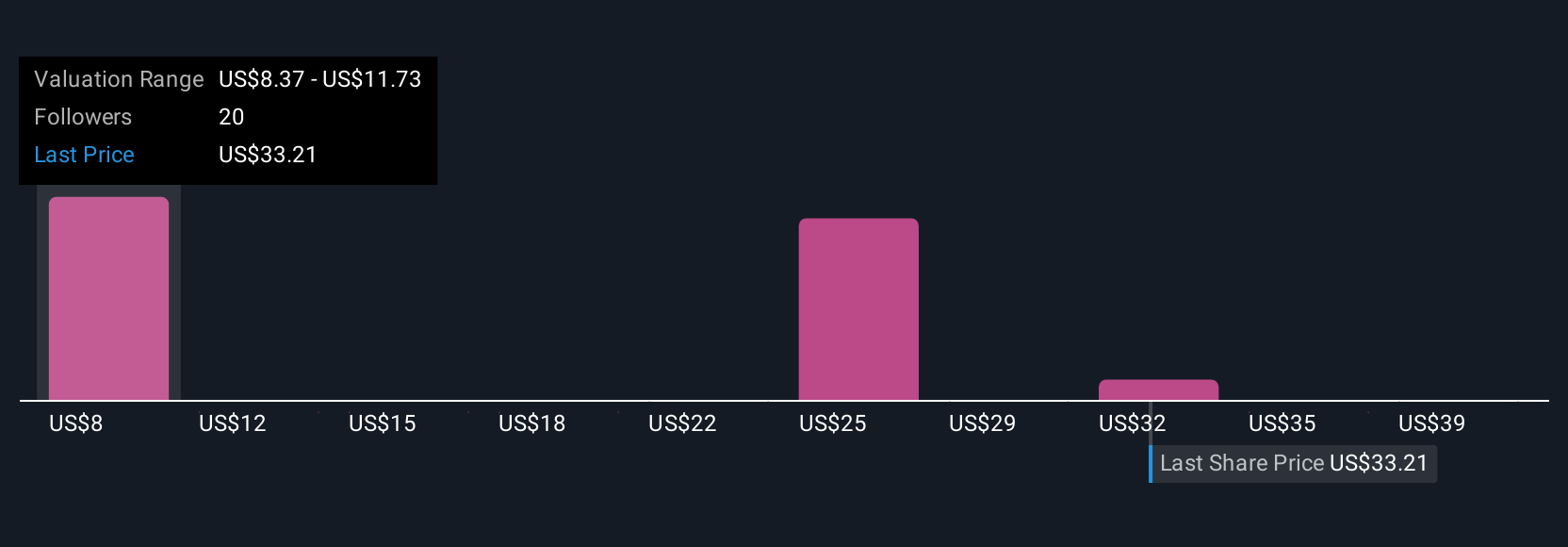

Simply Wall St Community members submitted eight fair value estimates for Southwest Airlines, ranging widely from US$7.66 to US$46 per share. With uncertain leisure travel demand remaining a key issue for the business, you can compare these divergent opinions against broader market challenges and explore several alternative viewpoints.

Explore 8 other fair value estimates on Southwest Airlines - why the stock might be worth less than half the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com