Deepwater Asset Management’s Gene Munster believes Apple Inc. (NASDAQ:AAPL) could be poised for a standout year in 2025, predicting that the company will rank among the top two performers in the so-called “Mag 7” group of large-cap tech stocks.

A Better Place To Beat Forecasts

On Tuesday, Munster said Apple's ability to exceed expectations will be driven by a combination of accelerating iPhone growth, new hardware, and the potential for an AI-related perception shift, while speaking on CNBC’s “Squawk Box.”

He noted that Wall Street is projecting about 5% revenue growth for Apple next year, and said he's confident the company is in a stronger position to surpass those expectations.

Munster pointed to iPhone sales reaccelerating in the June quarter, despite the company not releasing any new products or features. Looking ahead, he sees additional upside from the September 2025 debut of the “iPhone Air,” which he describes as a kind of launch that has historically given a sales lift.

| Stock / ETF | Year-To-Date Performance |

| Apple Inc. (NASDAQ:AAPL) | -5.82% |

| Microsoft Corp. (NASDAQ:MSFT) | +26.44% |

| Amazon.com Inc. (NASDAQ:AMZN) | +0.57% |

| Alphabet Inc. (NASDAQ:GOOG) | +7.10% |

| Meta Platforms Inc. (NASDAQ:META) | +31.83% |

| NVIDIA Corp. (NASDAQ:NVDA) | +32.39% |

| Tesla Inc. (NASDAQ:TSLA) | -10.13% |

| Roundhill Magnificent Seven ETF (BATS:MAGS) | +11.84% |

The ‘Bar Is Very Low' On AI

On AI, Munster pushed back against the narratives suggesting that Apple’s privacy-first approach constrains its capabilities. “They have a ton of information that they still can use and create unique insights around AI,” he said, while adding that the punch line is that the “bar is very low” when it comes to AI for Apple.

Here Munster is trying to convey that investor expectations are so muted on Apple’s AI offerings that even moderate advancements could positively surprise the markets.

Munster made similar claims over a month ago, noting that the stock rallied by 2% on mere rumors of upgrades to Siri, the company’s digital assistant program. He said the “move is testimony to how low the investor AI bar is for AAPL.”

Analyst Dan Ives of Wedbush Securities recently called AI the “elephant in the room” for Apple, noting that while the rest of the world was focused on monetizing AI, Apple’s growth strategy in this regard was “invisible.”

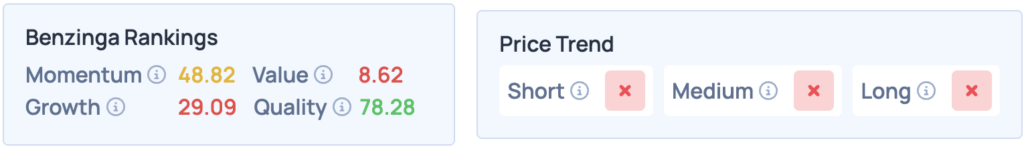

Shares of Apple were up 1.09% on Tuesday, trading at $229.65, and the stock is down 0.06% after hours. It scores poorly in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Photo Courtesy: View Apart on Shutterstock.com

Read More: