Wall Street experienced a robust rally on Tuesday as both the S&P 500 and Nasdaq 100 indices soared to new record highs. The positive momentum was fueled by July’s inflation data, which eased concerns about widespread tariff-related cost pressures. The headline Consumer Price Index (CPI) remained steady at 2.7% year-over-year, while the core CPI, excluding energy and food, rose to 3.1% annually, surpassing expectations.

The Dow Jones Industrial Average climbed 1.1% to 44,458.61 on the day, matching the S&P 500's 1.1% gain to 6,445.76, while the tech-heavy Nasdaq advanced nearly 1.4% to 21,681.90.

These are the top stocks that gained the attention of retail traders and investors through the day:

CoreWeave Inc. (NASDAQ:CRWV)

CoreWeave’s stock surged 6.42% to close at $148.75, reaching an intraday high of $148.80 and a low of $130.43. The stock has a 52-week range of $33.52 to $187. The shares fell sharply by 10.4% to $133.25 in the after-hours session. The company’s second-quarter earnings revealed a revenue beat, although earnings per share fell short. The company attributed its continued momentum to the unprecedented demand for AI services. Revenue for the period came in at $1.21 billion, which surpassed estimates of $1.08 billion. The firm reported an adjusted loss of 27 cents per share, greater than the 17 cents per share estimate.

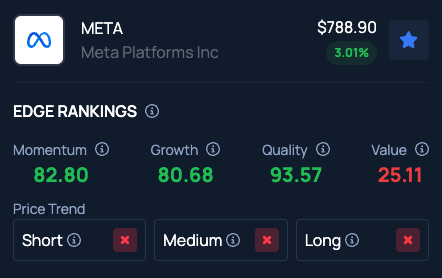

Meta Platforms Inc. (NASDAQ:META)

See Also: Just In: Crypto.com Suspends These Withdrawals, Deposits On Solana Chain – Benzinga

Meta’s shares rose 3.15%, closing at $790, with an intraday high of $793.67 and a low of $772.43. The stock’s 52-week range is $479.80 to $793.67. Meta’s stock hit a new high as its Threads platform surpassed 400 million users, marking a significant milestone since its launch as a competitor to Twitter.

Cava Group Inc. (NYSE:CAVA)

Cava’s stock climbed 2.67% to end the day at $84.50, with a high of $85.15 and a low of $82.6. The stock’s 52-week range is $70 to $172.43. Despite an earnings-per-share beat, Cava’s second-quarter revenue missed estimates, leading to a decline in share price due to softer same-store sales growth expectations. The restaurant chain reported second-quarter revenue of $278.25 million, which missed the consensus estimates of $286.58 million.

American Airlines Group Inc. (NASDAQ:AAL)

American Airlines’ stock soared 12.04%, closing at $12.98, with an intraday high of $13.02 and a low of $11.77. The stock’s 52-week range is $8.5 to $19.10. The airline’s shares rose significantly following the release of favorable inflation data, which highlighted a drop in gasoline prices, a key operating cost for airlines.

Circle Internet Group, Inc. (NYSE:CRCL)

Circle’s stock increased 1.27% to finish at $163.21, with a high of $189.92 and a low of $161.51. The stock’s 52-week range is $64 to $298.99. The shares slipped 6% to $153.34 in the after-hours trading. The company’s shares declined in extended trading after announcing a public offering of 10 million shares of its Class A common stock. Earlier in the day, the company reported its first earnings, where revenue came in at $658.08 million for the second quarter, ahead of the $540.02 million consensus estimate.

Benzinga's Edge Stock Rankings indicate Meta doesn’t rank high on Short, Medium and Long Price Trends. How do other Magnificent 7 rivals stack up?

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Photo Courtesy: Supawat Bursuk on Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal