ZipRecruiter, Inc. (NYSE:ZIP) reported better-than-expected second-quarter results and issued third-quarter sales guidance above estimates on Monday.

ZipRecruiter posted a quarterly loss of 10 cents per share, versus market estimates of a loss of 12 cents per share. The company's sales came in at $112.23 million versus expectations of $111.91 million.

ZipRecruiter said it sees third-quarter sales of $113.000 million versus estimates of $112.97 million.

“While the broader labor market remains soft, ZipRecruiter’s financial performance shows early signs of momentum. Quarterly Paid Employers have grown sequentially since Q4’24, and the midpoint of our guidance would mark the first time since 2021 that revenue grows sequentially from Q2 to Q3. These trends reinforce our belief that a return to modest year-over-year revenue growth in the fourth quarter is an increasingly likely scenario,” said Ian Sigel, CEO of ZipRecruiter. “Through the past three years of this historically challenged labor market, ZipRecruiter has continuously improved our product for both sides of the marketplace, leveraging our brand and financial strength to operate with a long-term focus. We believe we are well-positioned to emerge from this period as a stronger company, poised to capture outsized market share with both employers and job seekers in the years ahead.”

ZipRecruiter shares rose 8.8% to trade at $3.7850 on Tuesday.

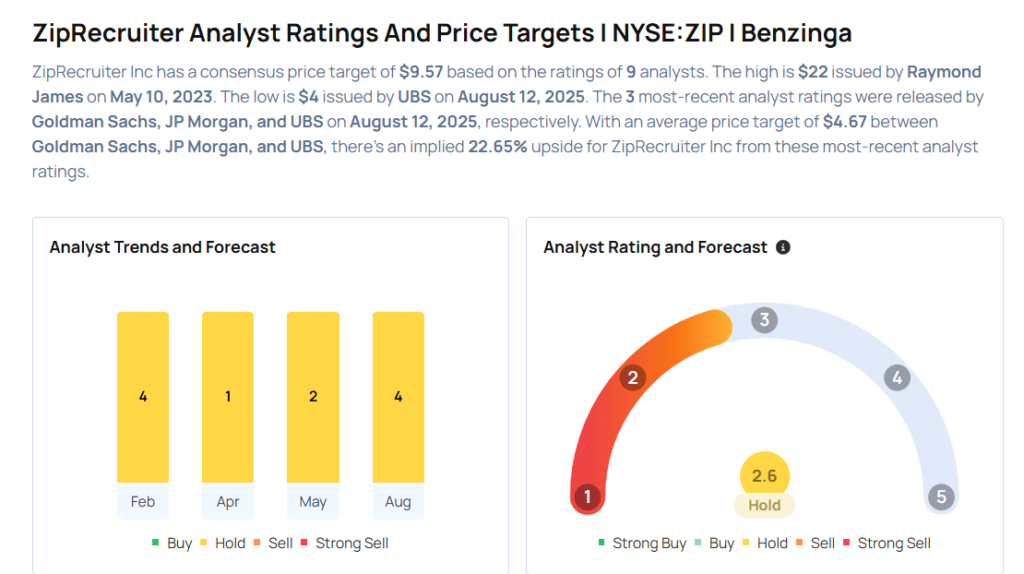

These analysts made changes to their price targets on ZipRecruiter following earnings announcement.

- Barclays analyst Trevor Young maintained ZipRecruiter with an Equal-Weight rating and lowered the price target from $6 to $5.

- UBS analyst Kunal Madhukar maintained ZipRecruiter with a Neutral and lowered the price target from $6 to $4.

- JP Morgan analyst Doug Anmuth maintained the stock with a Neutral and lowered the price target from $7 to $5.

- Goldman Sachs analyst Eric Sheridan maintained ZipRecruiter with a Neutral and lowered the price target from $7 to $5.

Considering buying ZIP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock