Hewlett Packard Enterprise (HPE) recently announced significant advancements in its AI portfolio, notably enhancing NVIDIA AI Computing and introducing new HPE ProLiant servers. These developments, alongside the launch of HPE Private Cloud AI, could have been influential in the company's stock ending the quarter with a 15% increase. While the market broadly trended upwards, marked by record highs in major indices like the Nasdaq and S&P 500, HPE's moves in AI may have further bolstered investor sentiment. Such innovations could add momentum to the company’s price performance, aligning HPE's trajectory with broader market gains.

We've identified 4 warning signs for Hewlett Packard Enterprise that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent enhancements in Hewlett Packard Enterprise's AI portfolio, including strengthened partnerships with NVIDIA and the launch of new HPE ProLiant servers, are likely to reinforce its focus on AI and cloud strategies. These developments appear aligned with HPE's trajectory of capturing high-margin AI workloads, potentially boosting revenue and earnings forecasts. Although certain regulatory and market challenges persist, these innovations might cushion some of the narrative's emphasized risks, such as competition and operational hurdles.

Over the past five years, HPE's total shareholder return, combining share price appreciation and dividends, has been a very large 155.18%. This performance casts a positive light on its long-term strategy and suggests resilience in capturing growth opportunities. When compared over the past year, HPE has outperformed the US Tech industry, which saw a return of 4.7%, indicating a stronger relative position in the sector despite noted challenges.

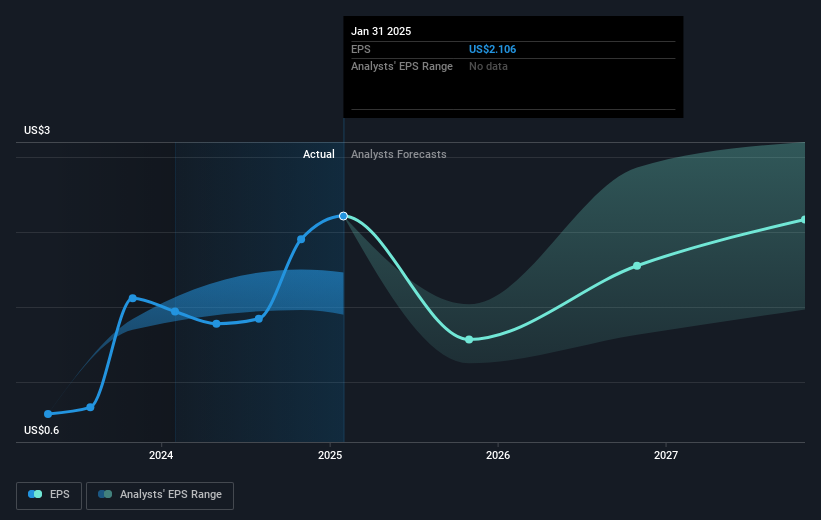

Regarding the stock's pricing, with a current share price of US$20.59, there remains a discount to the consensus analyst price target of US$23.24, suggesting room for potential upside if key growth drivers such as AI advancements take hold. This provides context to the recent 15% quarterly increase, further supported by market-wide upward trends, especially in major indices like the Nasdaq and S&P 500. These elements reinforce the optimism surrounding HPE's future revenue and earnings progression, albeit with cautious acknowledgment of the existing hurdles noted in the narrative.

Our valuation report here indicates Hewlett Packard Enterprise may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com