Chubb (CB) recently announced executive leadership changes within its Global Surety segment, appointing Steve Haney as President and Chief Underwriting Officer and Teresa Black as Division President of North America Surety. These moves underscore the company's focus on enhanced operational performance and could have added weight to its 1.22% share price increase last week. The increase occurred within a broader market upswell, as both the S&P 500 and Nasdaq reached new highs amid optimism about potential Federal Reserve rate cuts. These executive changes may align with broader market sentiment, potentially supporting Chubb's modest upward price movement.

We've discovered 1 risk for Chubb that you should be aware of before investing here.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

The recent executive leadership changes at Chubb could influence the company's strategic direction, particularly as it aims to expand in international markets and digital channels. With Steve Haney and Teresa Black at the helm of the Global Surety segment, Chubb might further enhance its operational performance. This could have implications for its revenue and earnings forecasts, especially given its focus on disciplined underwriting and capital deployment strategies. These initiatives could potentially align well with the broader market environment, contributing to sustainable profitability.

Over the past five years, Chubb delivered a substantial total return of 133.82%, reflecting robust shareholder value creation through both share price appreciation and dividends. This performance offers context to its recent share price movements and aligns with Chubb's efforts to engage in effective capital management strategies such as share repurchases and ongoing dividends.

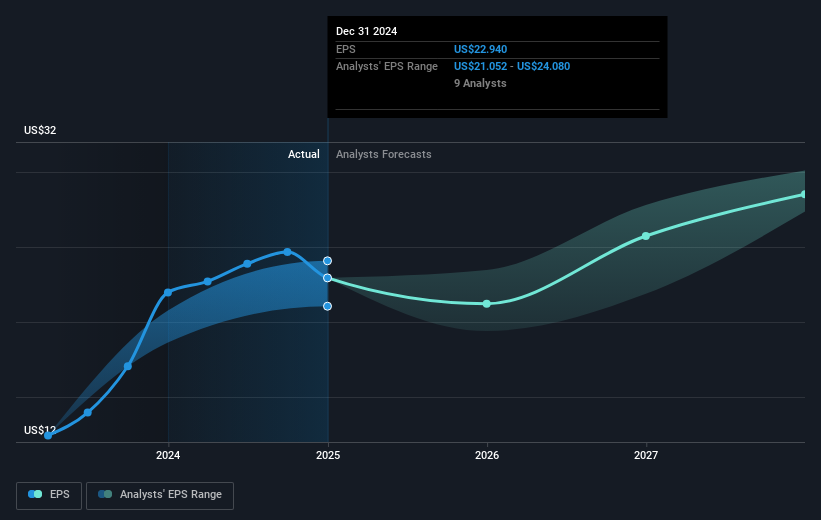

In the shorter term, the stock underperformed the US insurance industry, returning less than the industry's 7.1% gain over the last year. This contrast highlights a period of slower relative growth for Chubb. However, with a current share price of $271.00, it remains at a 10.86% discount to the consensus analyst target of $300.42. This suggests potential upward mobility if forecasts are met. Investors might weigh the balance between Chubb’s ongoing strategic initiatives, which include potential revenue pressures and the company's robust cash flow and capital flexibility, as they consider its future performance in an evolving market landscape.

The valuation report we've compiled suggests that Chubb's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com