Pfizer (PFE) recently announced positive results from its Phase 3 EV-303 clinical trial in collaboration with Astellas Pharma, showing significant improvements in event-free and overall survival for bladder cancer patients, a development that showcases the company's ongoing commitment to oncological advancements. This announcement, among other positive updates like the FDA's acceptance of the NDA for Vepdegestrant, likely contributed to Pfizer’s 7.48% price increase over the last quarter, aligning with broader market optimism as major indexes reached all-time highs following anticipated inflation data, which reassured investors about potential Federal Reserve interest rate cuts.

We've spotted 2 warning signs for Pfizer you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent successful results from Pfizer’s Phase 3 EV-303 clinical trial could potentially enhance the company's narrative of innovation in oncology, possibly strengthening its pipeline despite broader challenges such as patent expirations and regulatory hurdles. These developments may provide a supportive tailwind for Pfizer's revenue and earnings forecasts, potentially offsetting some of the negative impacts foreseen due to aggressive drug pricing negotiations and market competition. However, the long-term success hinges on the effective commercialization of these advancements.

Over the past year, Pfizer's total shareholder return, including share price and dividends, experienced a 7.54% decline. This underperformance contrasts with the broader market, where major indices reached record heights. Relative to its industry over the same period, Pfizer's performance fell short, as the US Pharmaceuticals industry posted an overall return of negative 15.1%, while the US stock market saw significant gains.

In terms of valuation, Pfizer's recent price move to US$24.58 brings it closer to the bearish analyst price target of US$24.0, which is only a 2.4% reduction from the current market price. This marginal difference suggests that Pfizer's market valuation is close to what some analysts predict in light of existing challenges and uncertainties. Investors may keep an eye on how the positive trial results and future R&D successes might influence Pfizer's ability to meet or exceed these targets, while the company's dividend yield remains a critical factor in overall shareholder returns.

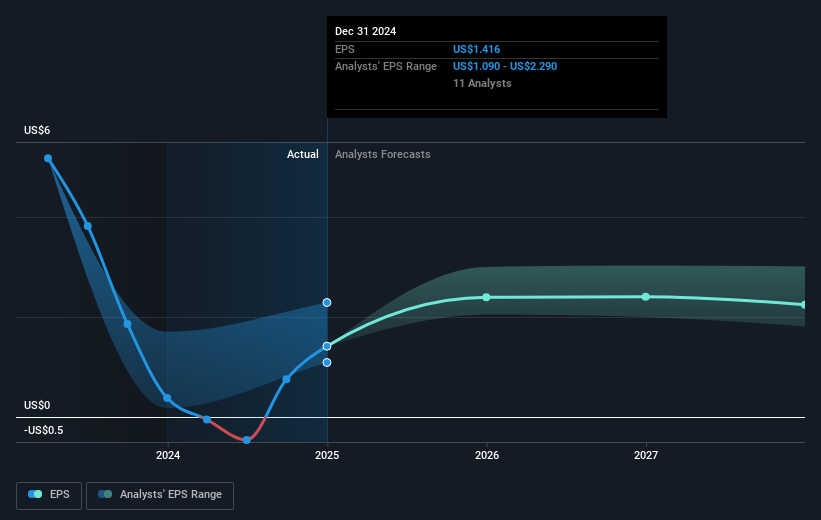

Understand Pfizer's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com