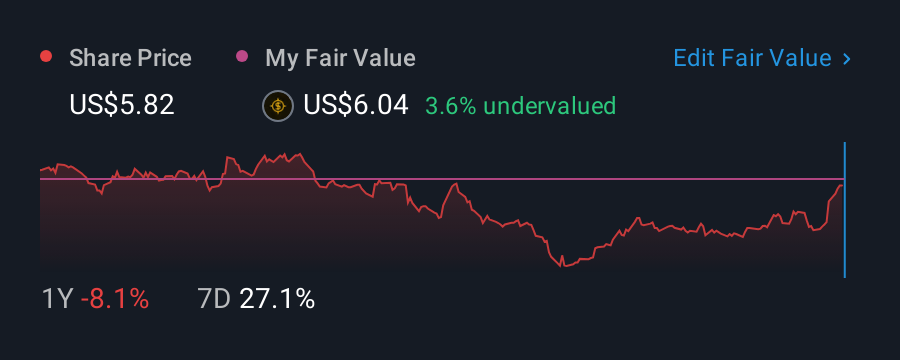

American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) shares have had a really impressive month, gaining 26% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.6% in the last twelve months.

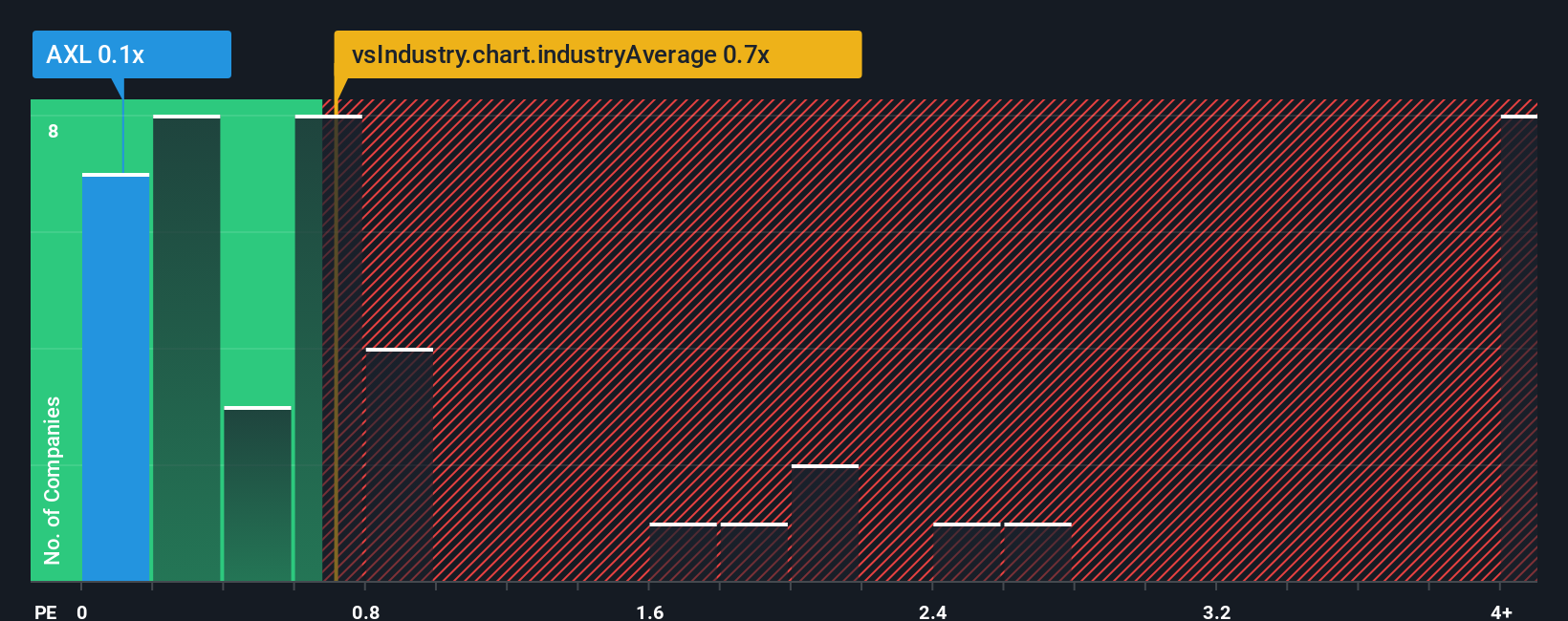

Although its price has surged higher, American Axle & Manufacturing Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Auto Components industry in the United States have P/S ratios greater than 0.7x and even P/S higher than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for American Axle & Manufacturing Holdings

What Does American Axle & Manufacturing Holdings' Recent Performance Look Like?

American Axle & Manufacturing Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think American Axle & Manufacturing Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is American Axle & Manufacturing Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like American Axle & Manufacturing Holdings' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.6% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 0.4% over the next year. With the industry predicted to deliver 11% growth, that's a disappointing outcome.

In light of this, it's understandable that American Axle & Manufacturing Holdings' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From American Axle & Manufacturing Holdings' P/S?

The latest share price surge wasn't enough to lift American Axle & Manufacturing Holdings' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that American Axle & Manufacturing Holdings' P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for American Axle & Manufacturing Holdings you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.