As the U.S. stock market navigates a landscape of fluctuating indices and economic data, investors are keeping a keen eye on inflation reports and potential Federal Reserve actions. Amidst this backdrop, dividend stocks remain an attractive option for those seeking steady income streams, as they can offer stability and resilience in uncertain times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.74% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.87% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.52% | ★★★★★★ |

| Ennis (EBF) | 5.56% | ★★★★★★ |

| Employers Holdings (EIG) | 3.10% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.82% | ★★★★★☆ |

| Dillard's (DDS) | 5.56% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.93% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.97% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.56% | ★★★★★☆ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

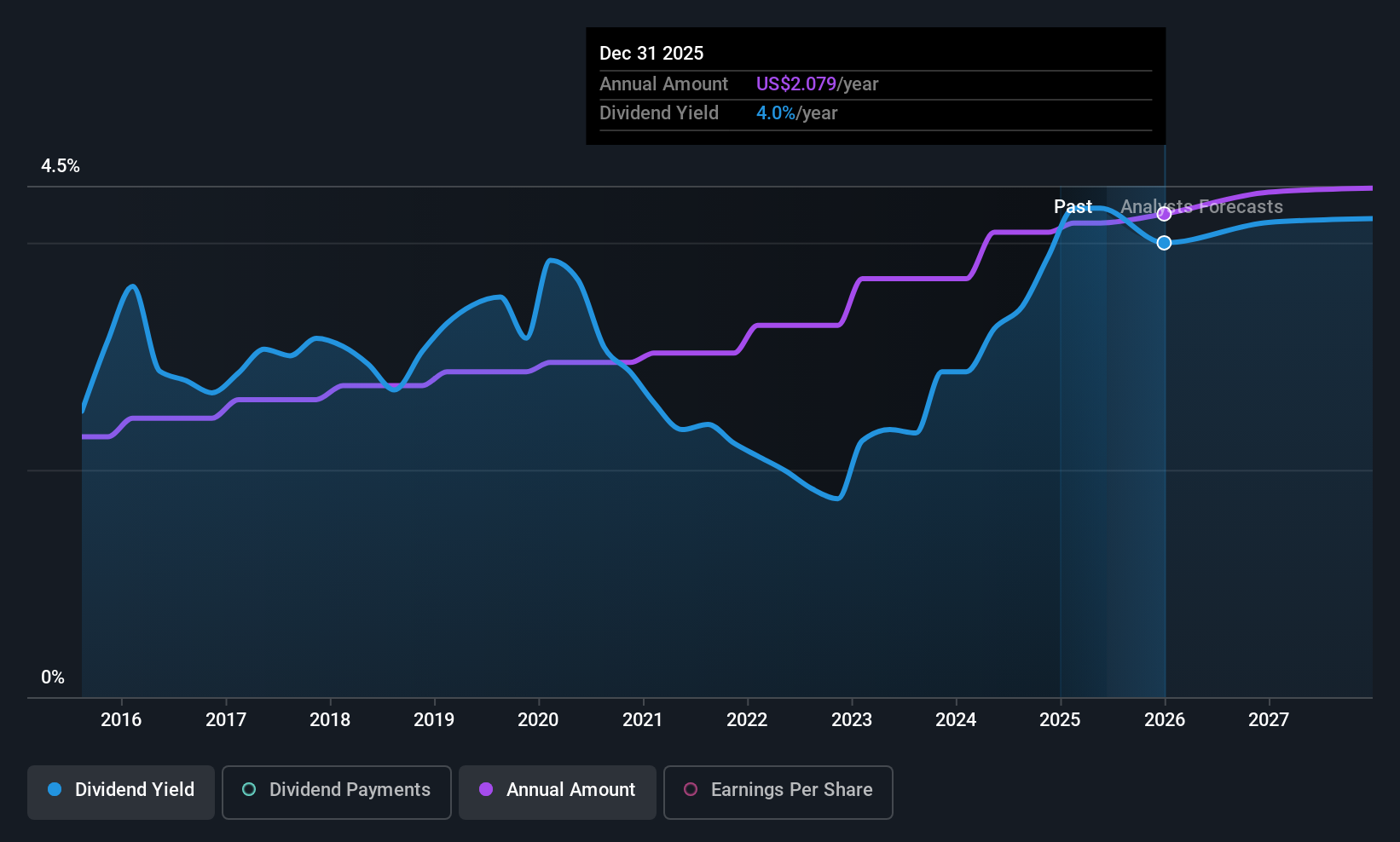

Archer-Daniels-Midland (ADM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Archer-Daniels-Midland Company operates in the procurement, transportation, storage, processing, and merchandising of agricultural commodities and related products with a market cap of approximately $27.79 billion.

Operations: Archer-Daniels-Midland Company's revenue segments include the processing and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Dividend Yield: 3.5%

Archer-Daniels-Midland has declared a cash dividend of US$0.51 per share, payable on September 10, 2025. The company maintains a stable and reliable dividend history over the past decade, with payments well-covered by cash flows (23.9% payout ratio). Despite recent earnings declines—net income fell to US$219 million in Q2 2025 from US$486 million a year ago—the dividend remains sustainable with an 88.6% payout ratio against earnings and offers a yield of 3.5%.

- Unlock comprehensive insights into our analysis of Archer-Daniels-Midland stock in this dividend report.

- Upon reviewing our latest valuation report, Archer-Daniels-Midland's share price might be too optimistic.

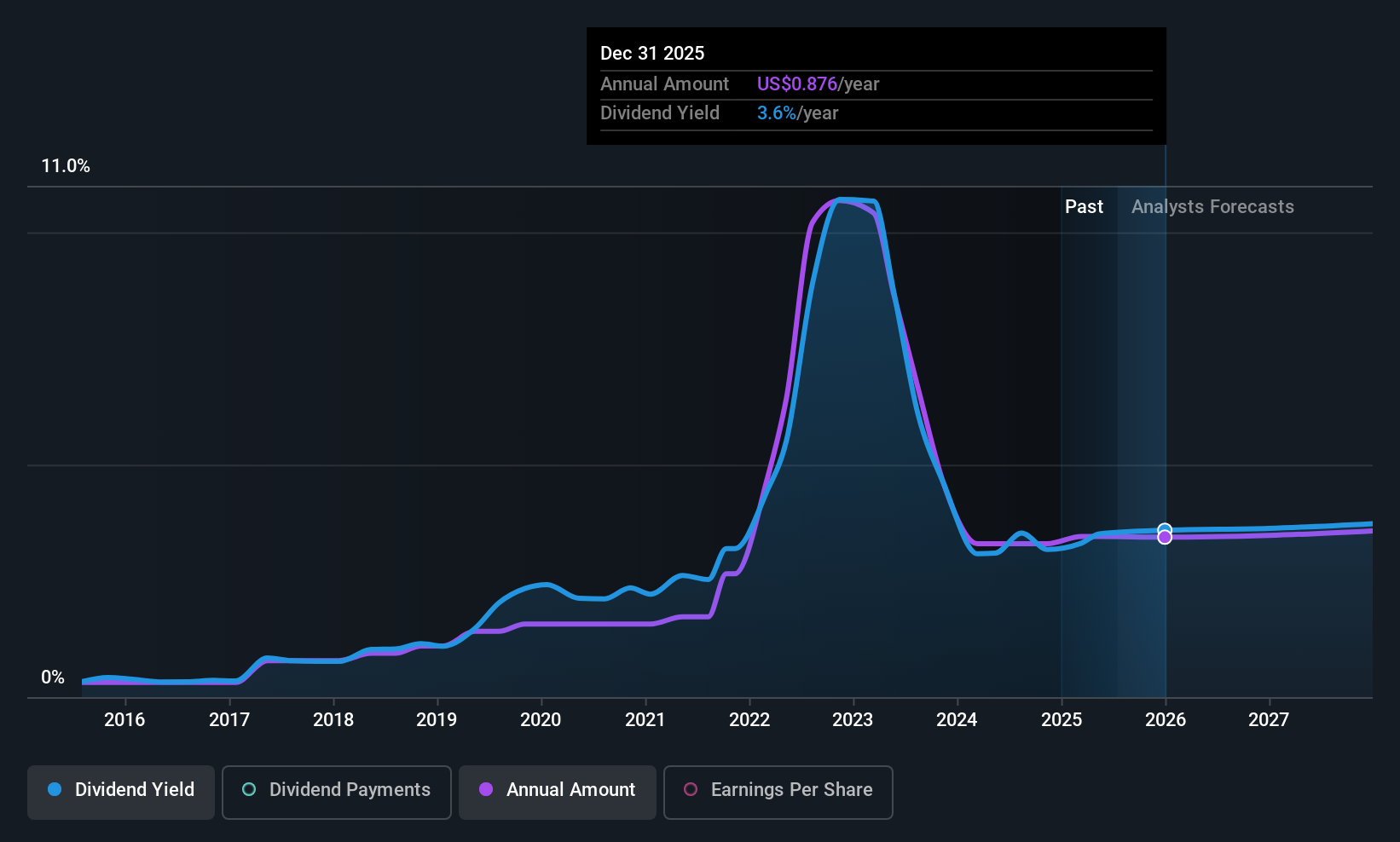

Coterra Energy (CTRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coterra Energy Inc. is an independent oil and gas company focused on the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States, with a market cap of $18.33 billion.

Operations: Coterra Energy Inc.'s revenue primarily comes from its activities in natural gas and oil development, exploitation, exploration, and production, amounting to $6.23 billion.

Dividend Yield: 3.7%

Coterra Energy has declared a quarterly dividend of US$0.22 per share, offering a 3.6% annualized yield. Despite its lower yield compared to top-tier dividend stocks, the payout is well-covered by earnings and cash flows with payout ratios of 40.8% and 45.4%, respectively. The company's dividends have been volatile over the past decade, but recent strong financial performance—US$511 million in Q2 net income—supports current distributions amidst insider selling concerns.

- Get an in-depth perspective on Coterra Energy's performance by reading our dividend report here.

- Our valuation report unveils the possibility Coterra Energy's shares may be trading at a discount.

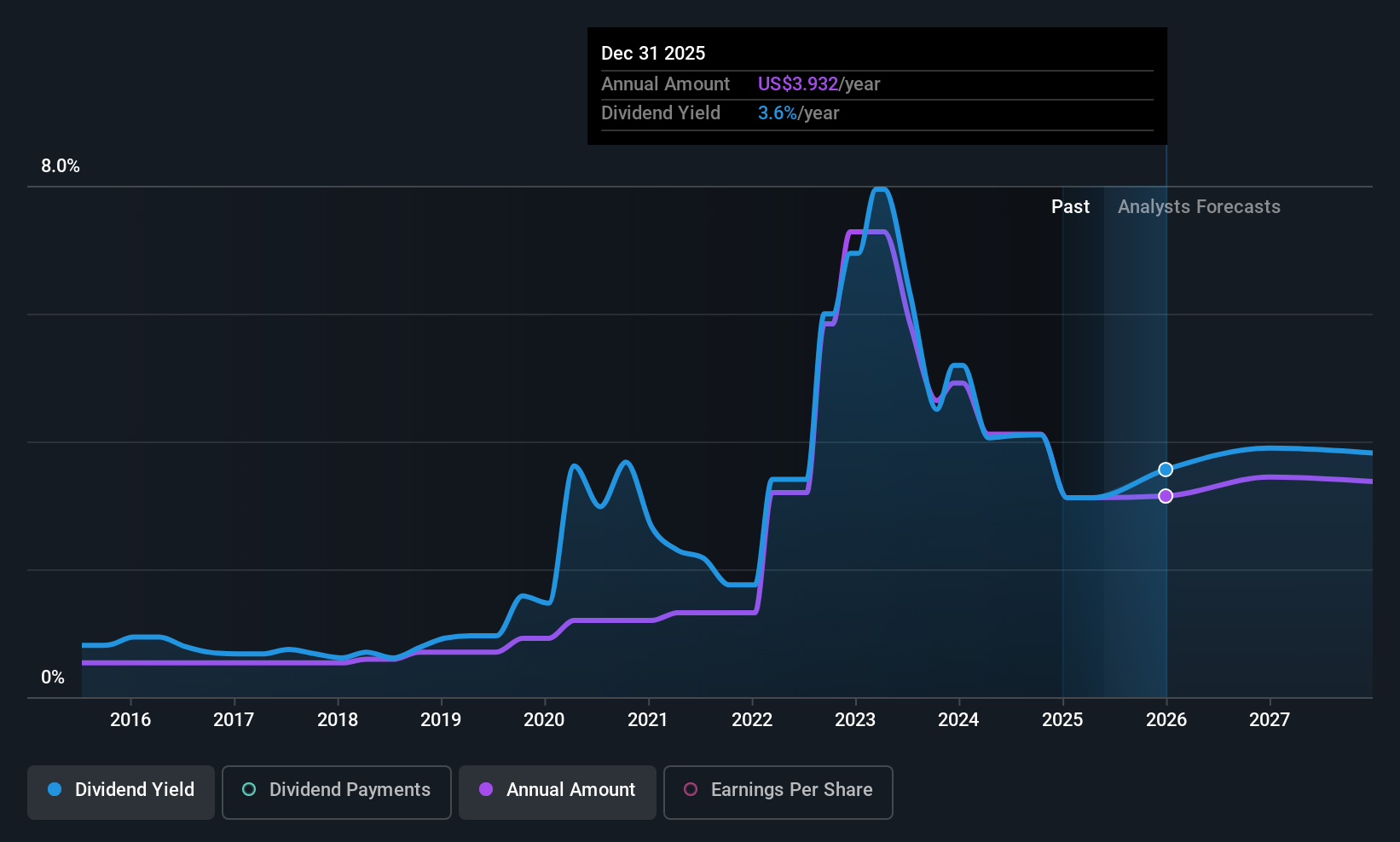

EOG Resources (EOG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EOG Resources, Inc. is involved in the exploration, development, production, and marketing of crude oil, natural gas liquids, and natural gas across the United States and internationally with a market cap of $63.49 billion.

Operations: EOG Resources generates revenue of $22.80 billion from its crude oil and natural gas exploration and production activities.

Dividend Yield: 3.5%

EOG Resources offers a dividend yield of 3.49%, below the top 25% of US dividend payers, yet its dividends are well-covered by earnings and cash flows with payout ratios of 37% and 49.2%, respectively. The company's dividend history is unstable, showing volatility over the past decade despite recent increases. EOG trades at a significant discount to estimated fair value, supported by robust cash flow management and strategic share buybacks totaling US$5.58 billion since November 2021.

- Navigate through the intricacies of EOG Resources with our comprehensive dividend report here.

- The analysis detailed in our EOG Resources valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Click through to start exploring the rest of the 139 Top US Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com