- In the past week, Sociedad Química y Minera de Chile (SQM) saw a significant increase in market capitalization without any related public news or company disclosures.

- This unusual market movement points to possible shifts in investor sentiment, sector rotation, or macroeconomic factors driving interest in lithium and related assets.

- We’ll now explore how this sharp change in market capitalization may shape SQM’s investment narrative, particularly around investor expectations.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

Sociedad Química y Minera de Chile Investment Narrative Recap

To be a shareholder in Sociedad Química y Minera de Chile (SQM) means believing in the long-term story of expanding lithium demand, especially from electric vehicles and energy storage, and the company’s ability to scale production profitably despite sector shifts. The recent sharp market capitalization jump, absent supporting news, does not appear to materially alter the most important near-term catalyst, SQM’s lithium production growth, or address the biggest risk, which remains exposure to fluctuating lithium prices and capital needs.

Of the recent company announcements, the 2025 guidance for a 15% increase in sales volumes stands out. This is consistent with investor optimism around lithium capacity expansion as a primary catalyst and signals momentum in delivering on growth targets, even as market volatility and operational risks persist.

Yet, with lithium markets remaining sensitive to oversupply and price changes, investors should also be alert to the fact that...

Read the full narrative on Sociedad Química y Minera de Chile (it's free!)

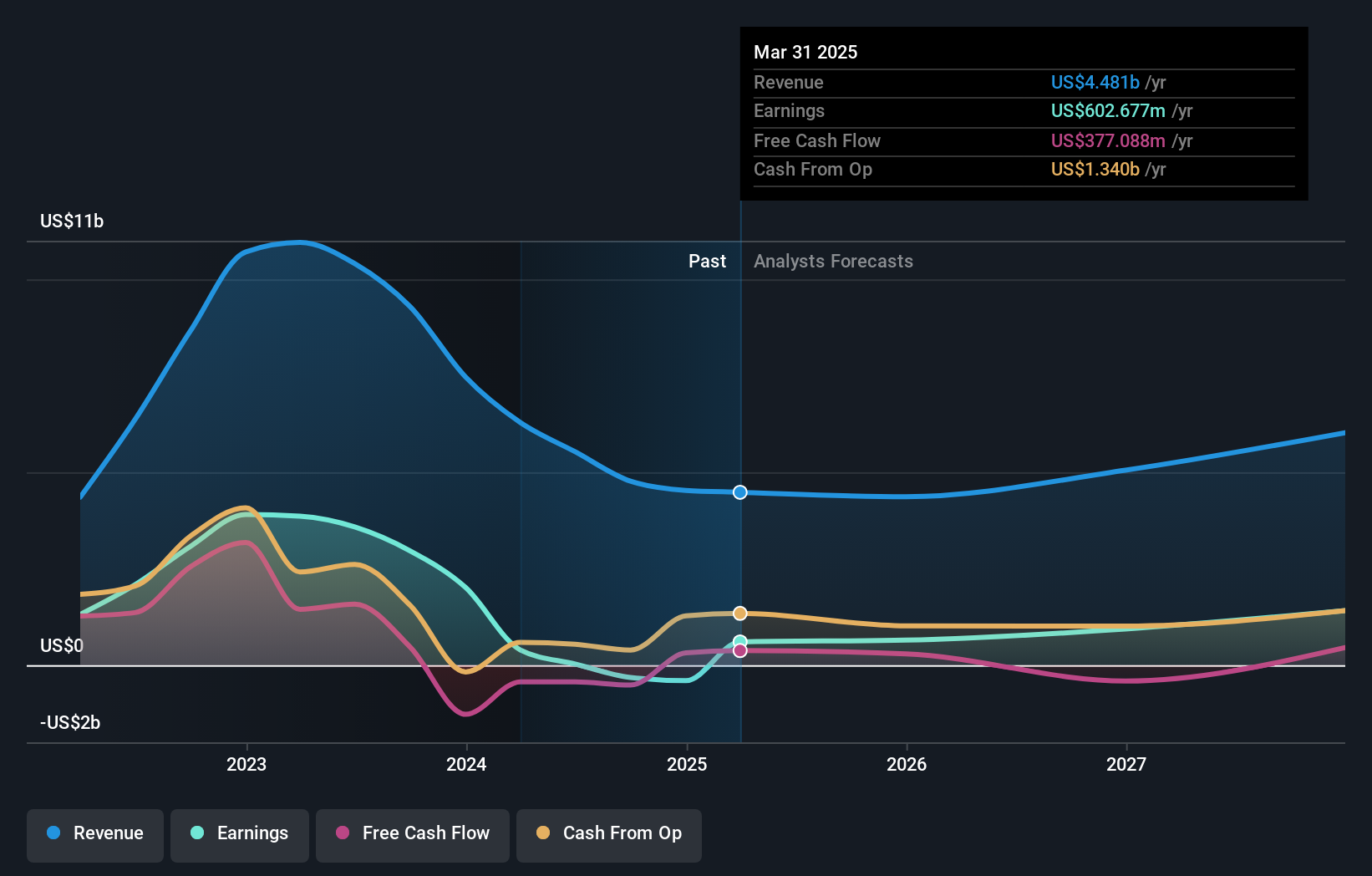

Sociedad Química y Minera de Chile is projected to reach $6.3 billion in revenue and $1.7 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 11.8% and an earnings increase of $1.1 billion from current earnings of $602.7 million.

Uncover how Sociedad Química y Minera de Chile's forecasts yield a $48.61 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 9 fair value opinions for SQM, ranging from US$4.86 to US$48.61 per share. As you consider their varying forecasts, keep in mind that supply and pricing risks may play an outsize role in company performance over the coming quarters.

Explore 9 other fair value estimates on Sociedad Química y Minera de Chile - why the stock might be worth less than half the current price!

Build Your Own Sociedad Química y Minera de Chile Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sociedad Química y Minera de Chile research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sociedad Química y Minera de Chile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sociedad Química y Minera de Chile's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com