- Earlier this month, Motorola Solutions reported record second-quarter 2025 results, with revenue rising to US$2.77 billion and net income reaching US$513 million, while also raising its full-year revenue and earnings forecast following the completed acquisition of Silvus Technologies.

- A key insight is that strong growth in software and services is supporting a shift toward recurring revenue, while integrating Silvus further expands Motorola's offerings in unmanned systems and public safety technologies.

- We'll examine how the raised annual outlook and increased software-driven recurring revenue influence Motorola Solutions' investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

Motorola Solutions Investment Narrative Recap

To be a shareholder in Motorola Solutions, you need to believe in the company's ability to grow recurring revenues from software and services, capitalize on secular demand in public safety and security, and manage integration and cost risks from ongoing acquisitions. The recent record Q2 results and raised annual outlook further highlight strong demand and software momentum, but they do not fully resolve concerns about rising tariff-related costs, which remain a key short-term risk to earnings consistency.

A particularly relevant announcement is the acquisition of Silvus Technologies, now included in the updated guidance, which directly expands Motorola’s offerings in drone and unmanned system technologies. This move supports the most important catalyst, growing recurring software-driven revenues, yet still leaves exposure to integration risks and any unexpected cost escalation as the portfolio broadens.

In contrast, investors should be aware of ongoing cost pressures tied to tariffs and international sourcing, which could...

Read the full narrative on Motorola Solutions (it's free!)

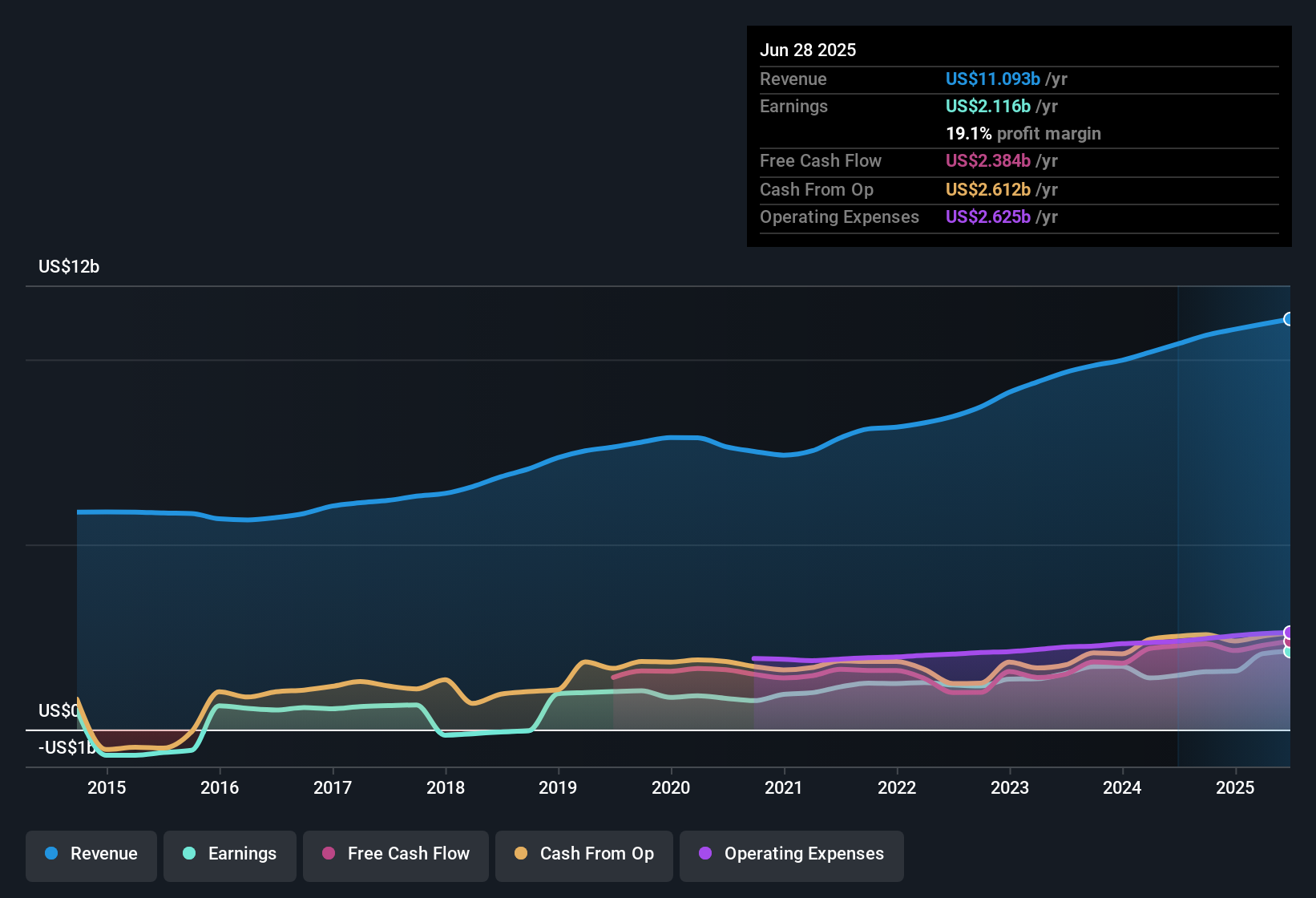

Motorola Solutions' narrative projects $13.0 billion revenue and $2.7 billion earnings by 2028. This requires 5.9% yearly revenue growth and a $0.7 billion earnings increase from $2.0 billion today.

Uncover how Motorola Solutions' forecasts yield a $496.89 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Five recent fair value estimates from the Simply Wall St Community range from US$364 to US$508 per share, covering a broad span of views. While many focus on the company’s software-driven revenue growth as a catalyst, the diversity in opinions reflects ongoing debate around sustainability of margins and short-term earnings risks.

Explore 5 other fair value estimates on Motorola Solutions - why the stock might be worth as much as 10% more than the current price!

Build Your Own Motorola Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Motorola Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Motorola Solutions' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com