- Dana Incorporated recently reported its second quarter 2025 earnings, posting sales of US$1.94 billion, which was lower than the previous year and below analyst expectations, while net income rose to US$27 million compared to US$16 million a year ago.

- Despite higher net income, Dana's sales missed forecasts and the company also completed a large share repurchase and debt financing, signaling a period of major operational adjustments.

- We’ll now assess how Dana’s lower-than-expected sales and earnings directly impact the company’s investment narrative, particularly around future growth assumptions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Dana Investment Narrative Recap

For investors to feel confident owning Dana stock, they need to believe the company can overcome weaker top-line trends through improved operational discipline and capitalize on electrification growth opportunities after its Off-Highway exit. The recent Q2 results, with both lower-than-expected sales and increased net income, may challenge near-term optimism about earnings momentum, while the most important short-term catalyst, margin expansion through cost reductions, faces fresh scrutiny. The biggest risk right now remains Dana’s heavier exposure to cyclical Light Vehicle markets, which is reinforced by these results but not fundamentally altered by them.

Among the recent announcements, Dana's completion of a major US$250 million share buyback, representing over 10% of outstanding shares, stands out. This move follows through on management’s commitment to boost returns to shareholders and may provide some support, but it does not fully counter the uncertainties raised by lagging sales and execution risks tied to future margin gains.

In contrast, investors should be aware that Dana’s increased focus on North American Light Vehicle markets now makes its business even more sensitive to...

Read the full narrative on Dana (it's free!)

Dana's outlook forecasts $8.5 billion in revenue and $303.5 million in earnings by 2028. This scenario assumes revenues will decline 4.9% per year and earnings will improve by $338.5 million from the current -$35.0 million.

Uncover how Dana's forecasts yield a $23.43 fair value, a 31% upside to its current price.

Exploring Other Perspectives

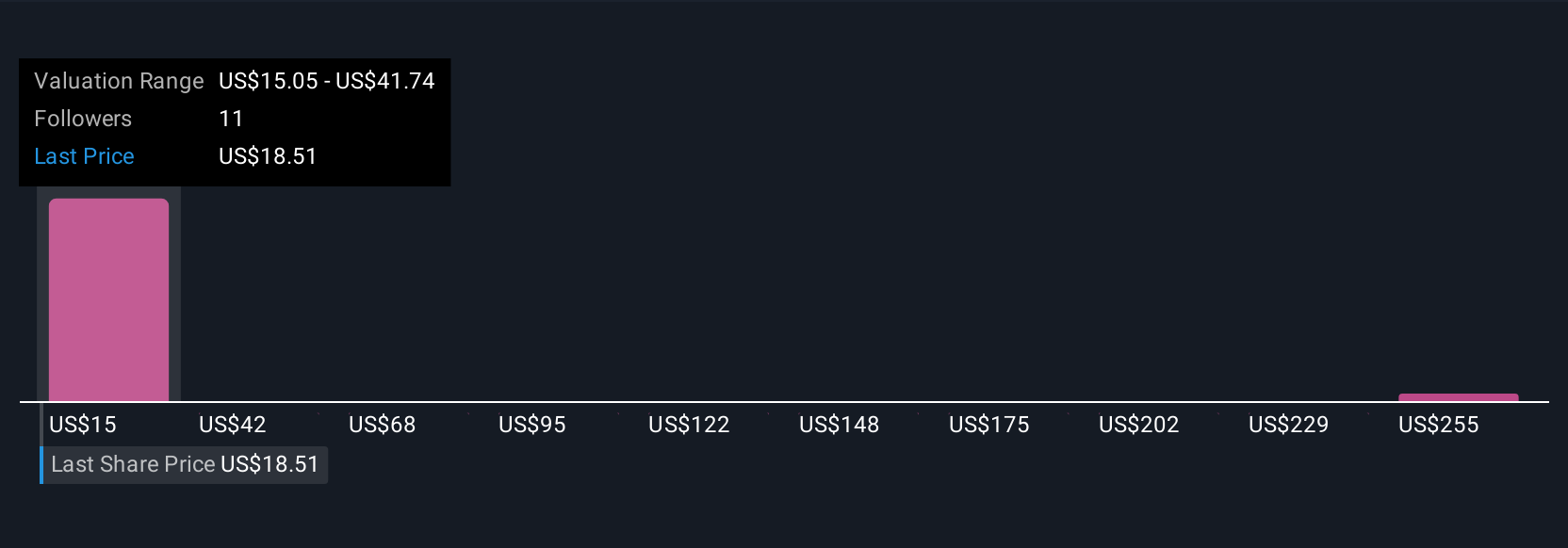

Simply Wall St Community members estimate Dana's fair value from US$14.34 to US$23.43, across two distinct perspectives. Against this wide range, fresh cost-cutting pressures and reliance on a few large vehicle makers could weigh on Dana's long-term stability, explore what this could mean for future returns.

Explore 2 other fair value estimates on Dana - why the stock might be worth 20% less than the current price!

Build Your Own Dana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dana's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com