- Armstrong World Industries recently raised its earnings guidance and reported strong second-quarter results, including sales of US$424.6 million and net income of US$87.8 million for the period ended June 30, 2025.

- The company also announced ongoing share repurchases and signaled plans for future acquisitions, reflecting its focus on both organic and inorganic growth opportunities.

- We'll examine how Armstrong's increased full-year earnings outlook and active acquisition strategy could influence its investment narrative moving forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Armstrong World Industries Investment Narrative Recap

To be a shareholder in Armstrong World Industries right now, you have to believe in the company's ability to steadily expand both organically and through acquisitions, even as near-term revenue trends are shaped by the pace of commercial construction activity. The recent upgrade to full-year earnings guidance is a notable positive but does not fundamentally change the main short-term catalyst for the stock: the company's execution on growth through new products and successful M&A. The biggest risk remains continued sensitivity to overall commercial construction trends, which the recent news does not materially address.

Of the recent announcements, Armstrong's raised 2025 earnings guidance stands out as most relevant, signaling management's confidence in ongoing sales growth and margin performance. That guidance, buoyed by robust second-quarter earnings and ongoing share repurchases, directly supports the investment case that Armstrong can deliver growth even in a slow or uneven market by leaning on product innovation and complementary acquisitions.

Yet, if commercial construction activity stays muted for longer than expected, the company’s reliance on acquisitions and pricing actions could expose investors to volatility that…

Read the full narrative on Armstrong World Industries (it's free!)

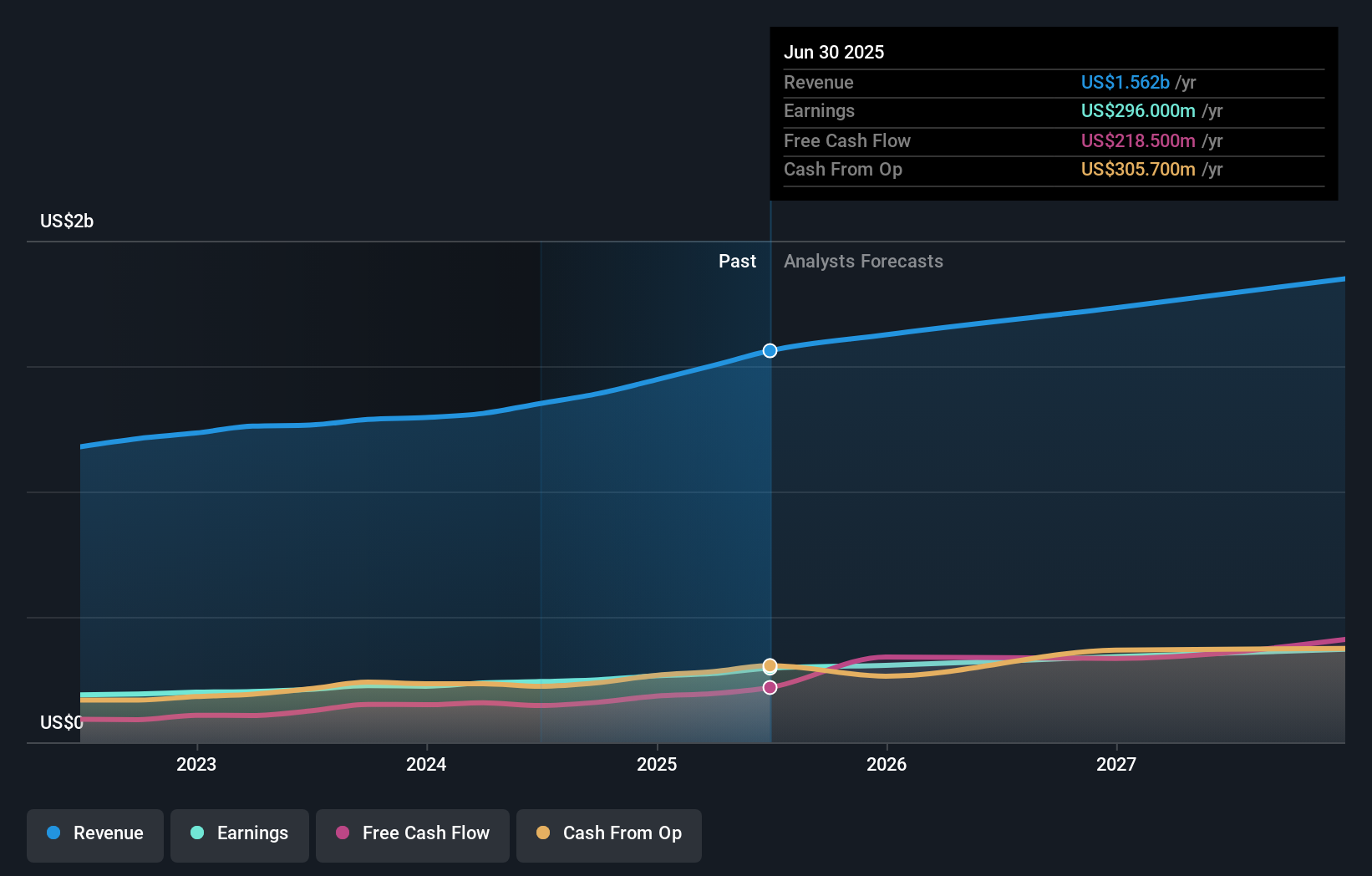

Armstrong World Industries is projected to achieve $1.9 billion in revenue and $389.4 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 6.9% and a $93.4 million increase in earnings from the current $296.0 million level.

Uncover how Armstrong World Industries' forecasts yield a $191.78 fair value, in line with its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community valued Armstrong at US$236.65 per share before the latest earnings. With ongoing acquisition plans now in focus, it is worth considering how future integration risks might affect long-term earnings and market confidence. Explore more opinions and weigh different approaches.

Explore another fair value estimate on Armstrong World Industries - why the stock might be worth just $236.65!

Build Your Own Armstrong World Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Armstrong World Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Armstrong World Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Armstrong World Industries' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com