- On August 5, 2025, Northwest Natural Holding Company released its second quarter and six-month 2025 earnings results, reporting higher sales and improved net earnings compared to the prior year, and updated its 2025 GAAP EPS guidance to US$2.60 to US$2.80 due to acquisition- and business development-related costs.

- The guidance adjustment, tied to the final transaction costs from the Pines acquisition and new business development efforts, highlights the financial impact of the company’s recent expansion and ongoing diversification.

- We'll assess how updated earnings guidance, reflecting costs from the Pines acquisition, shapes expectations for Northwest Natural Holding’s investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Northwest Natural Holding Investment Narrative Recap

For shareholders in Northwest Natural Holding, belief in the company's long-term earnings reliability and successful execution of its Texas expansion form the big picture thesis. The recent earnings update, which reflects final Pines acquisition costs and business development, does not materially alter the biggest near-term catalyst: robust customer and meter growth in Texas, driven by signed contracts and population gains. However, the core risk still centers on the company's ability to recover high capital expenditures through positive rate case outcomes in its Pacific Northwest utility business, particularly as regulatory attitudes toward gas utilities may shift unfavorably due to ongoing decarbonization initiatives. Of the latest announcements, the Q2 2025 earnings release is most pertinent here. While higher sales and net earnings over last year showcase progress, the updated guidance due to acquisition costs frames how integration and growth investments can impact short-term earnings, even as customer growth in Texas is seen as the primary earnings lever going forward. But in contrast, investors should be aware that shifting regulatory environments in the Pacific Northwest could...

Read the full narrative on Northwest Natural Holding (it's free!)

Northwest Natural Holding's outlook projects $1.5 billion in revenue and $147.4 million in earnings by 2028. This is based on a 7.3% annual revenue growth rate and an increase of $44.1 million in earnings from the current level of $103.3 million.

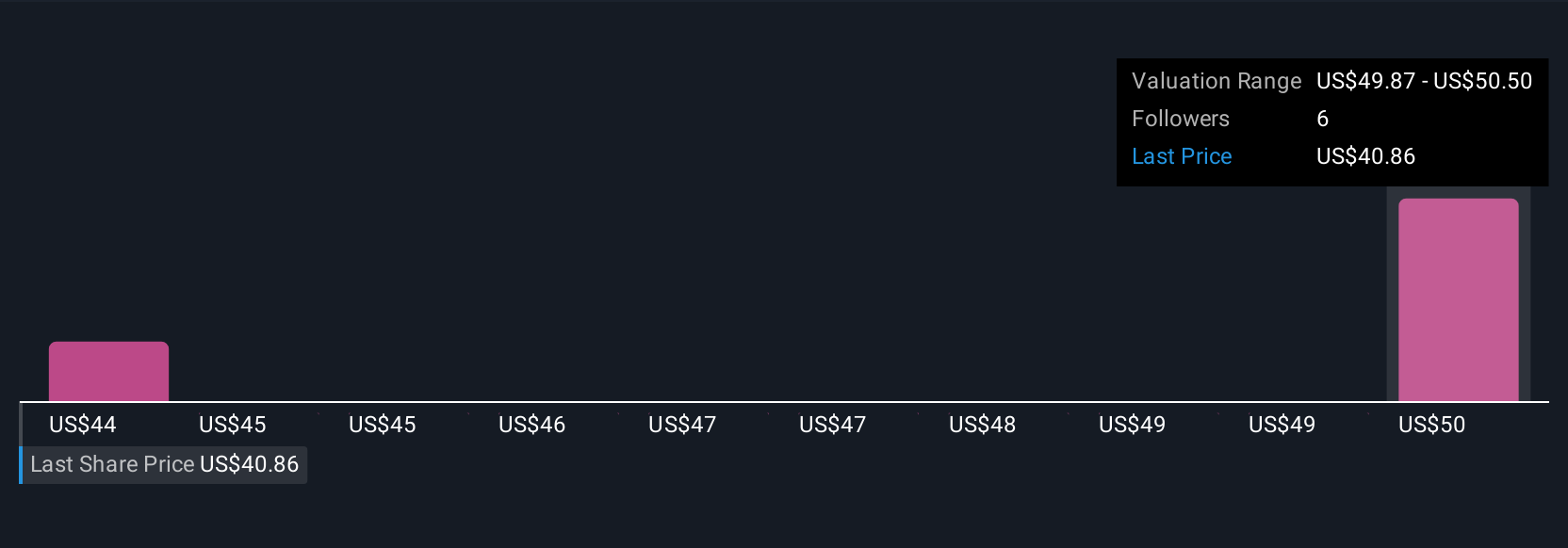

Uncover how Northwest Natural Holding's forecasts yield a $50.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offers two fair value estimates for Northwest Natural Holding, ranging from US$41.89 to US$50.50. While some place higher weight on Texas customer growth, the company's dependency on constructive rate cases means your outlook may differ from others', review multiple viewpoints before making your own assessment.

Explore 2 other fair value estimates on Northwest Natural Holding - why the stock might be worth as much as 25% more than the current price!

Build Your Own Northwest Natural Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Natural Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northwest Natural Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Natural Holding's overall financial health at a glance.

No Opportunity In Northwest Natural Holding?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com