- Watsco, Inc. reported its second quarter and first half 2025 results, revealing sales of US$2.06 billion and US$3.59 billion, with net income of US$183.61 million and US$263.67 million, respectively, both sales periods were lower than the prior year, but quarterly net income slightly increased.

- This mix of lower revenues alongside a small rise in quarterly net income highlights ongoing cost controls and operational resilience despite softer top-line performance.

- We’ll examine how Watsco’s ability to grow net income amid declining sales affects the company’s long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Watsco Investment Narrative Recap

To believe in Watsco as a long-term investment, shareholders must have confidence in its ability to preserve margins and profitability in an industry marked by regulation-driven changes and cost pressures. The recent quarterly results, featuring slightly higher net income despite lower sales, suggest cost discipline but do not materially alter the company’s biggest near-term catalyst: the ongoing transition to new A2L-compliant products. The key short-term risk remains potential margin pressure from tariff changes and OEM pricing actions, which are not resolved by these results.

The most relevant recent announcement alongside these financials is the 11% dividend increase to US$3.00 per share, paid in July. This move signals management’s ongoing confidence in the business’s cash flow despite temporary headwinds and aligns with the company’s history of returning value to shareholders. For investors tracking catalysts, the steady dividend growth underscores the importance of financial resilience as Watsco implements new product transitions and adapts to external pressures.

Yet, in contrast to steady dividend growth, investors should also be mindful of how tariffs and pricing actions...

Read the full narrative on Watsco (it's free!)

Watsco's narrative projects $9.1 billion revenue and $759.1 million earnings by 2028. This requires 6.5% yearly revenue growth and a $264.9 million earnings increase from $494.2 million today.

Uncover how Watsco's forecasts yield a $470.73 fair value, a 13% upside to its current price.

Exploring Other Perspectives

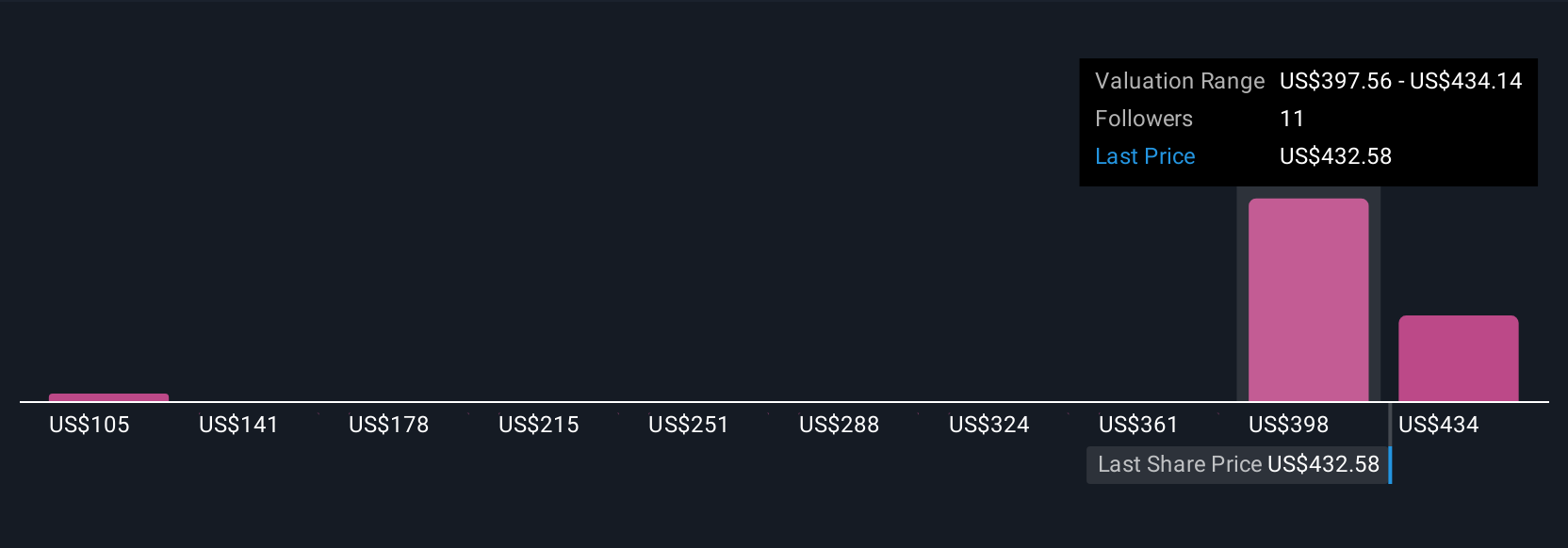

Three individual fair value estimates from the Simply Wall St Community span from US$104.90 to US$470.73, revealing broad differences in how the company’s prospects are valued. Amid this wide range of views, keep in mind that recent results highlight the importance of product transition as a driver for future performance, so you can benefit by exploring several alternative perspectives on Watsco’s outlook.

Explore 3 other fair value estimates on Watsco - why the stock might be worth less than half the current price!

Build Your Own Watsco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Watsco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Watsco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Watsco's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com