- Kadant Inc. recently reported its second quarter earnings for 2025, revealing sales of US$255.27 million and diluted earnings per share of US$2.22, both lower than the prior year, and issued full-year guidance with revised lower GAAP EPS expectations.

- This combination of declining revenues and a guidance reduction marks a significant shift, reflecting ongoing operational pressures and changing demand dynamics.

- We’ll assess how Kadant’s lowered full-year earnings guidance affects the longer-term outlook shaped by resilient aftermarket and modernization demand.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Kadant Investment Narrative Recap

To be a Kadant shareholder, you need confidence in the company's ability to sustain aftermarket and modernization demand as manufacturing end markets evolve. The recent news of lowered earnings guidance reinforces near-term caution, but does not materially undermine the biggest short-term catalyst, persistent aftermarket sales driven by an aging installed base. The most significant risk remains margin pressure if replacement-driven revenues decline or high-margin parts sales begin to normalize.

Among recent announcements, Kadant’s revised 2025 earnings guidance directly ties to this quarter’s softer performance, underscoring management’s acknowledgment of operational headwinds and shifting market demand. This move brings greater focus to the company’s reliance on older equipment in the field, further connecting earnings quality to parts and consumables as a key profit driver.

However, investors should be aware that if customers accelerate replacement cycles and new equipment demand does not pick up, future parts sales could decline, potentially leading to...

Read the full narrative on Kadant (it's free!)

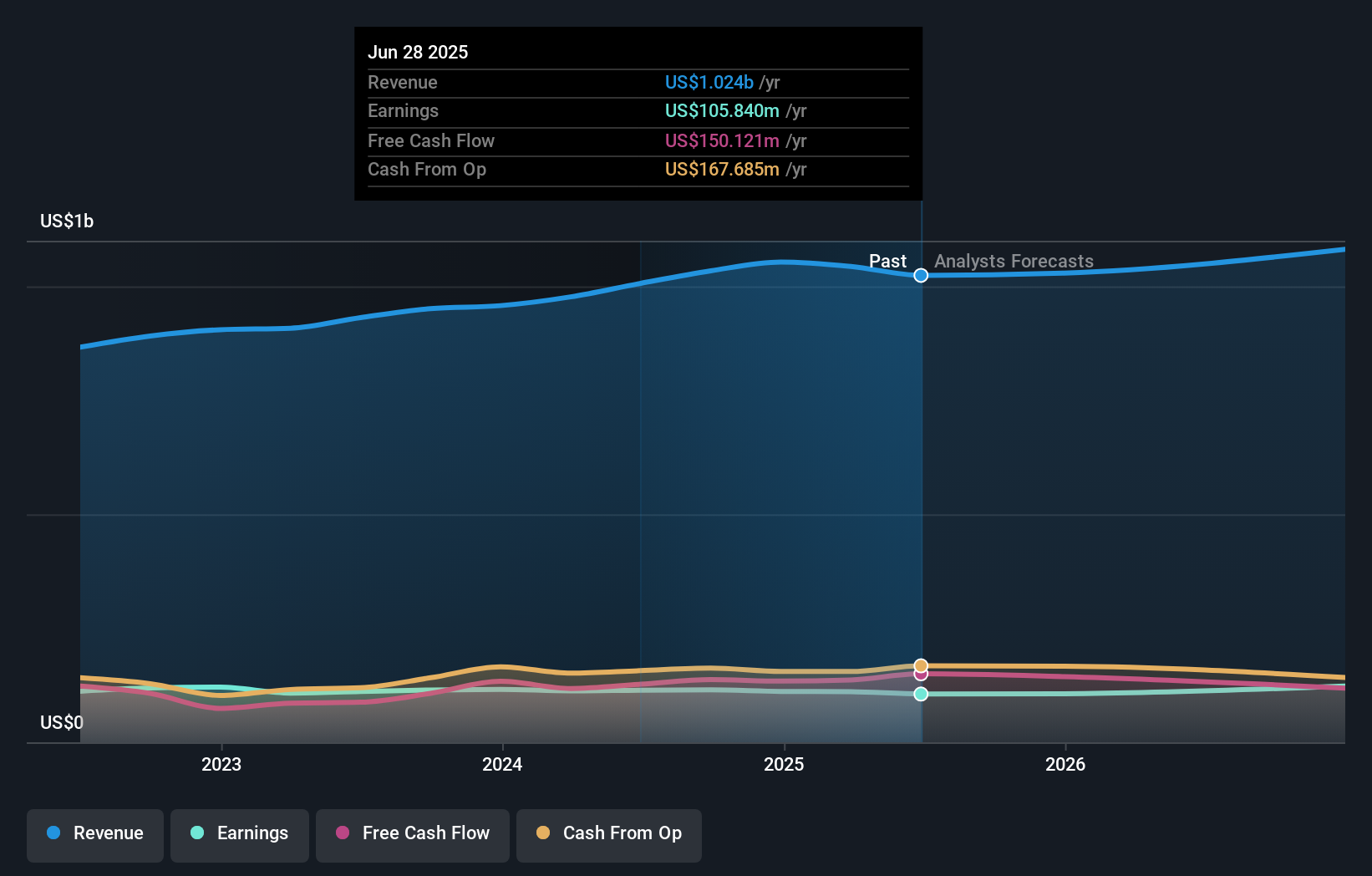

Kadant's outlook anticipates $1.1 billion in revenue and $141.4 million in earnings by 2028. This is based on a projected annual revenue growth rate of 3.5% and an earnings increase of $35.6 million from current earnings of $105.8 million.

Uncover how Kadant's forecasts yield a $343.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted two fair value estimates for Kadant, ranging from US$179.99 to US$200 per share. These views reflect diverse expectations, while ongoing reliance on high-margin aftermarket sales continues to be a focal point for the company’s performance outlook.

Explore 2 other fair value estimates on Kadant - why the stock might be worth as much as $200.00!

Build Your Own Kadant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kadant research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Kadant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kadant's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com