- Patrick Industries reported its second quarter and first half 2025 results, with sales rising to US$1.05 billion and US$2.05 billion respectively, but net income and earnings per share declining compared to the previous year; the company also updated progress on its buyback program, having repurchased 277,800 shares for US$23 million in the most recent quarter.

- The ongoing share buyback demonstrates Patrick Industries' continued commitment to returning capital to shareholders despite pressures on earnings.

- We'll explore how the rise in quarterly sales alongside reduced profits could impact Patrick Industries' longer-term earnings outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Patrick Industries Investment Narrative Recap

To invest in Patrick Industries, you likely need confidence in the company’s position as a key supplier to RV, marine, and manufactured housing markets, and its ability to adapt through cycles. The recent quarter’s higher sales but declining net income doesn’t appear to alter the main short-term catalyst, potential demand rebound tied to economic conditions, or meaningfully shift the biggest risk, which remains exposure to cyclical, rate-sensitive end markets and ongoing margin pressures.

Of the latest announcements, Patrick Industries’ active buyback program stands out. The buyback, with 277,800 shares repurchased this quarter for US$23 million, signals ongoing efforts to return capital to shareholders and potentially offset earnings softness, a relevant move as investors weigh near-term catalysts like improving retail demand.

On the other hand, investors should be especially mindful of the continued risk if high interest rates persist and retail demand remains pressured, as...

Read the full narrative on Patrick Industries (it's free!)

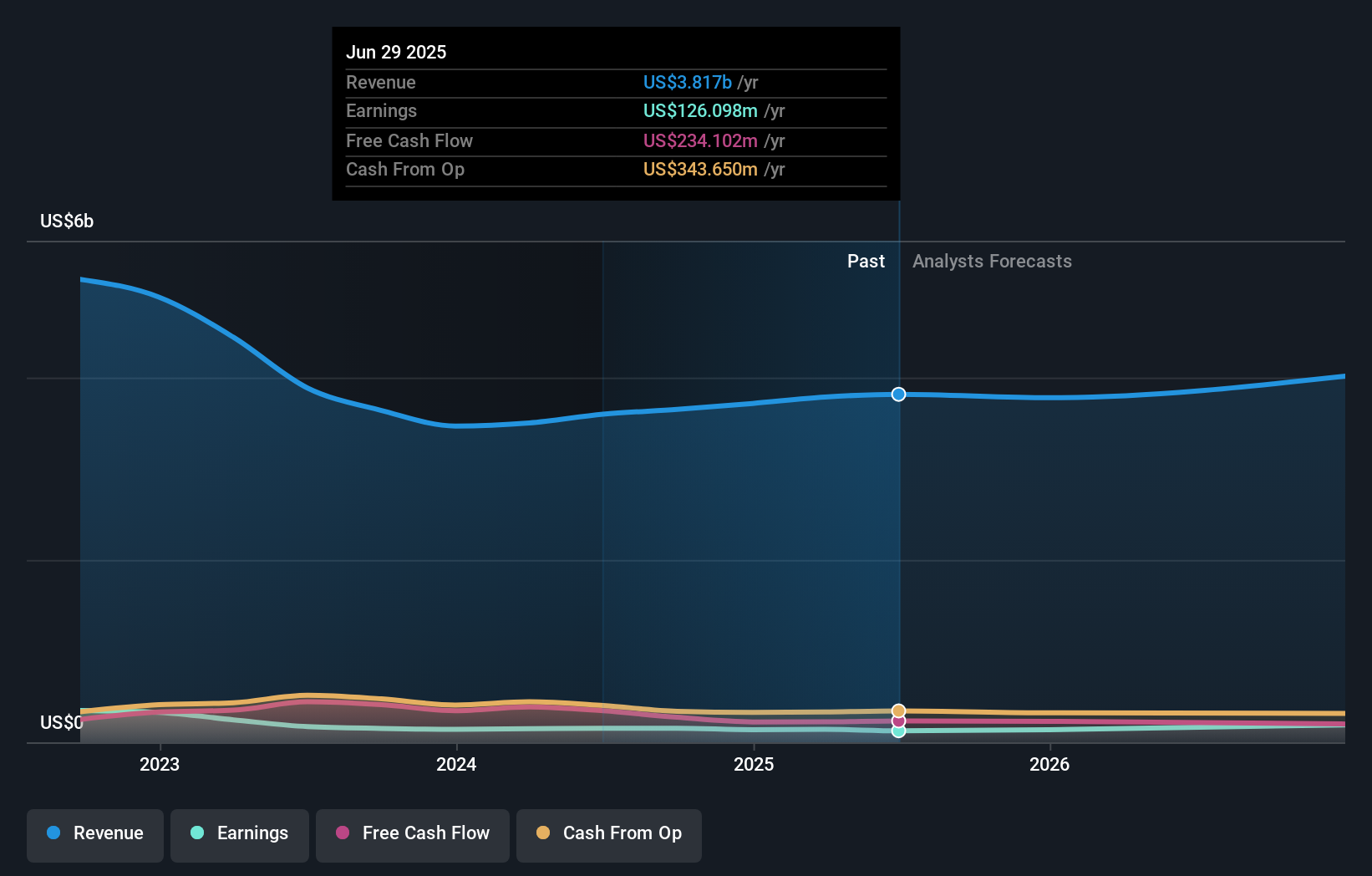

Patrick Industries' outlook anticipates $4.2 billion revenue and $274.3 million earnings by 2028. This implies a 3.2% annual revenue growth rate and a $148.2 million increase in earnings from the current $126.1 million.

Uncover how Patrick Industries' forecasts yield a $108.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span from US$79.49 to US$108, highlighting how differently investors can assess future performance. While some expect long-term growth in outdoor recreation demand, the risk of earnings volatility from cyclical end markets has many weighing the outlook with caution.

Explore 2 other fair value estimates on Patrick Industries - why the stock might be worth as much as $108.00!

Build Your Own Patrick Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patrick Industries research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Patrick Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patrick Industries' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com