- Federal Signal Corporation reported strong second-quarter results in the past, with sales rising to US$564.6 million and net income growing to US$71.4 million, alongside raising its full-year 2025 net sales guidance to a new range of US$2.07 billion to US$2.13 billion.

- An interesting development is the company’s ongoing focus on mergers and acquisitions, with leadership highlighting promising early synergies from the recent Hog acquisition and an active M&A pipeline aimed at expanding the business both organically and through future deals.

- We’ll examine how Federal Signal’s raised sales outlook and positive earnings momentum could shape its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Federal Signal Investment Narrative Recap

To have confidence in Federal Signal as a shareholder, one needs to believe in the company’s ability to sustain growth by expanding its product lines and realizing value from acquisitions, while effectively managing integration risk. The recent share buyback update is not material to the company's most important near-term catalyst, continued growth in order intake and synergy realization from new acquisitions, nor does it alter the primary risk from potential disruptions in municipal budgets and public funding cycles.

Among the latest announcements, the raised full-year sales guidance stands out. This signals management’s confidence in ongoing demand and integration of recent acquisitions, which is key to supporting the company’s positive earnings momentum and underpins the most important near-term catalyst for shareholders.

But while growth is front and center, investors should not overlook the ongoing risk tied to Federal Signal’s dependence on municipal budgets and public project funding cycles...

Read the full narrative on Federal Signal (it's free!)

Federal Signal's outlook forecasts $2.6 billion in revenue and $336.9 million in earnings by 2028. This projection is based on a 9.2% annual revenue growth rate and an increase in earnings of $115.3 million from the current $221.6 million.

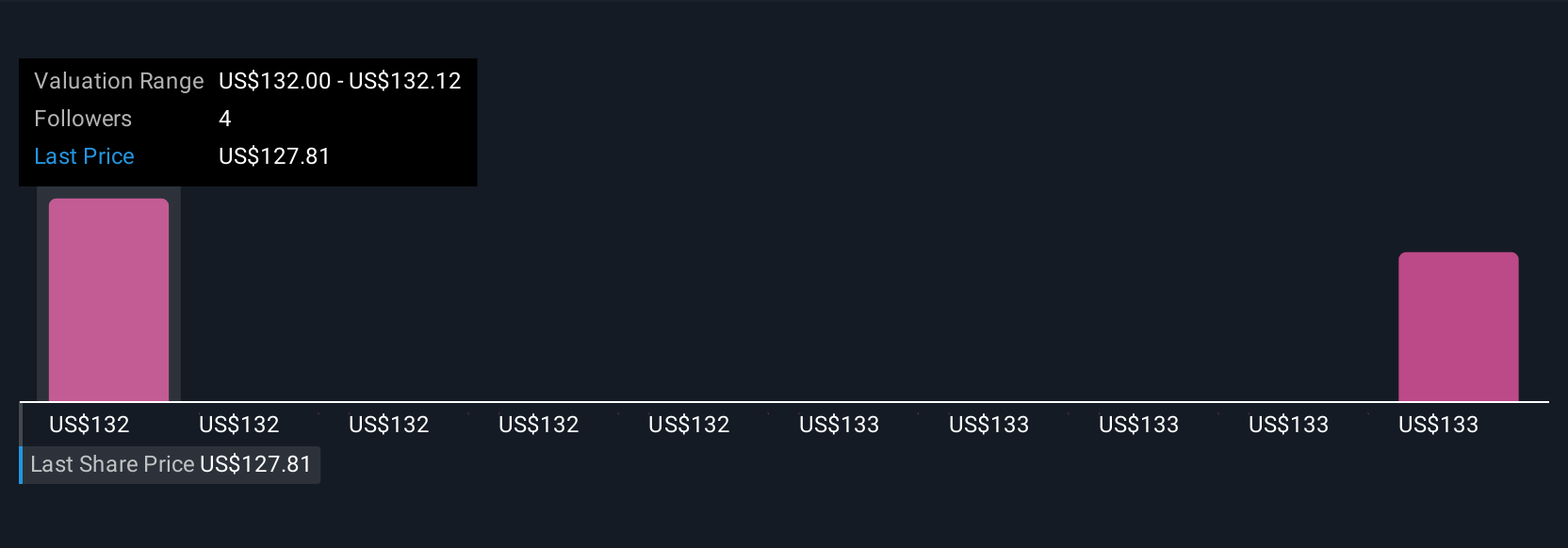

Uncover how Federal Signal's forecasts yield a $132.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Two fair value estimates for Federal Signal from the Simply Wall St Community cluster tightly between US$132.00 and US$133.25. This range of views sits alongside the latest raised guidance, reminding you that perspectives on future growth and share value can differ, be sure to consider several viewpoints before making decisions.

Explore 2 other fair value estimates on Federal Signal - why the stock might be worth as much as 5% more than the current price!

Build Your Own Federal Signal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal Signal research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Federal Signal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal Signal's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com