- Bloom Energy recently reported improved quarterly financial results with revenue rising to US$401.24 million and a reduced net loss, while also appointing Jim Hagemann Snabe, current Chairman of Siemens AG and former Co-CEO of SAP AG, to its board of directors.

- The addition of a high-profile executive with significant experience in digital transformation and sustainability is seen as strengthening Bloom Energy’s corporate leadership and governance at a key time for the company.

- We'll take a look at how Jim Hagemann Snabe's board appointment influences Bloom Energy's investment narrative amid recent operational improvements.

Find companies with promising cash flow potential yet trading below their fair value.

Bloom Energy Investment Narrative Recap

To be a shareholder of Bloom Energy, you need to believe that on-site solid-oxide fuel cell systems will continue to carve out a crucial role as high-demand data centers and critical infrastructure strain traditional power grids. The appointment of Jim Hagemann Snabe to the board enhances Bloom’s governance and digital expertise but does not materially shift the company’s most important short term catalyst: accelerating adoption in hyperscaler data center markets; nor does it directly address the ongoing risk from battery storage advances eroding Bloom’s competitive position.

Of the company’s recent announcements, the July deployment of fuel cell systems at Oracle Cloud Infrastructure data centers stands out as reinforcing Bloom’s data center catalyst, underscoring ongoing traction with key commercial partners and the urgent need for resilient, scalable power solutions that Bloom is aiming to provide.

However, investors should also be aware that, in contrast, the pace of innovation and cost reduction in battery storage remains a...

Read the full narrative on Bloom Energy (it's free!)

Bloom Energy's narrative projects $2.7 billion in revenue and $395.4 million in earnings by 2028. This requires 19.0% yearly revenue growth and a $371.7 million increase in earnings from the current $23.7 million.

Uncover how Bloom Energy's forecasts yield a $34.57 fair value, a 8% downside to its current price.

Exploring Other Perspectives

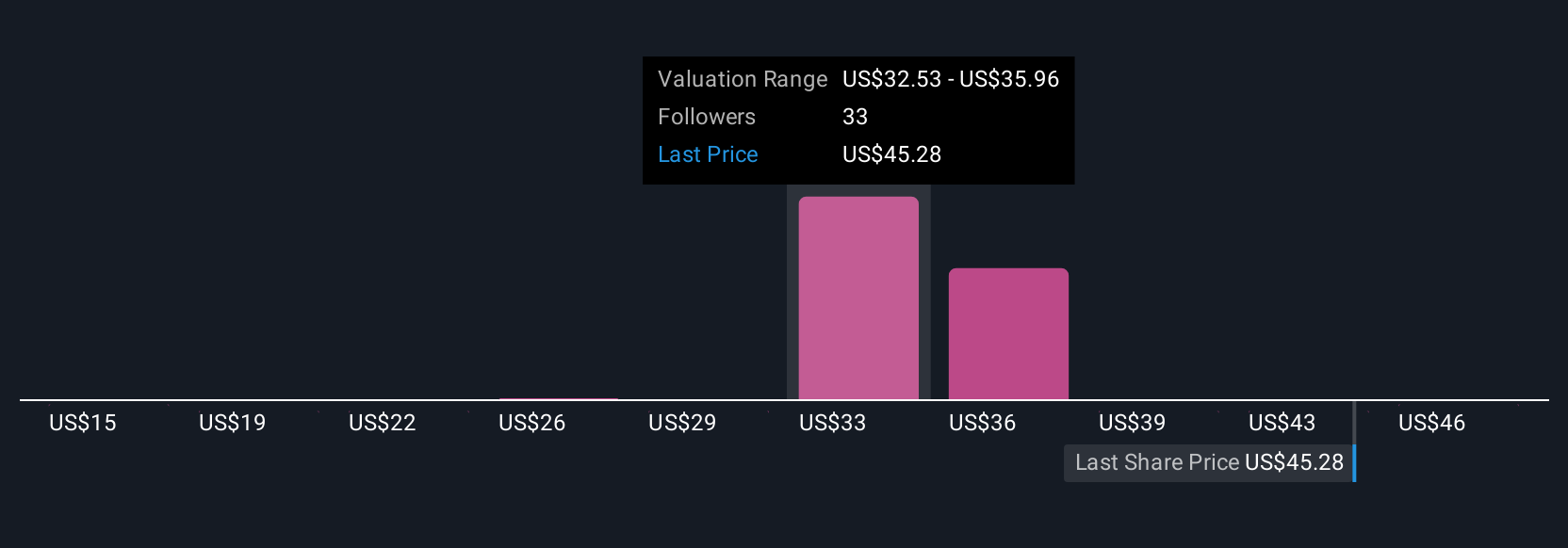

Simply Wall St Community members recently provided seven fair value estimates for Bloom Energy, ranging from US$15.38 to US$49.68 per share. While these opinions diverge, the company’s reliance on natural gas feedstock continues to pose a risk if competitors accelerate toward fully zero-emissions alternatives in the near future.

Explore 7 other fair value estimates on Bloom Energy - why the stock might be worth less than half the current price!

Build Your Own Bloom Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bloom Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bloom Energy's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com