Tilray Brands Inc. (NASDAQ:TLRY) stock surged by 14.13%, to $1.05 during after-hours on Monday. This surge follows a report suggesting that President Donald Trump is contemplating reclassifying marijuana, a move that could significantly impact the industry.

What Happened: The stock of major cannabis companies, including Tilray, Canopy Growth Corp (NASDAQ:CGC), and Aurora Cannabis Inc (NASDAQ:ACB), experienced a significant boost on Monday. This surge was triggered by a report from the Wall Street Journal indicating that Trump is considering reclassifying marijuana as a less dangerous drug. Such a move could have substantial financial implications for the industry.

The potential policy shift comes after cannabis companies made significant financial contributions to the president’s political groups. The reclassification, specifically moving marijuana to a Schedule III drug classification, would ease federal restrictions and potentially make the multibillion-dollar cannabis industry more profitable. This is because it would allow cannabis companies to take normal business tax deductions, a benefit they are currently denied under the existing tax code.

With a market capitalization of about $1.01 billion, the Canada-based pharmaceutical company has a trading volume of 246.6 million shares. TLRY traded between $0.35 and $1.98 over the past 52 weeks.

Why It Matters: The news of a potential federal shift in marijuana’s classification has sparked a significant market reaction. This development could reshape the cannabis industry’s financial landscape, with companies like Tilray standing to benefit significantly.

Price Action: Tilray Brands closed at $0.92 on Monday, capping a 41.82% surge for the day, according to Benzinga Pro data.

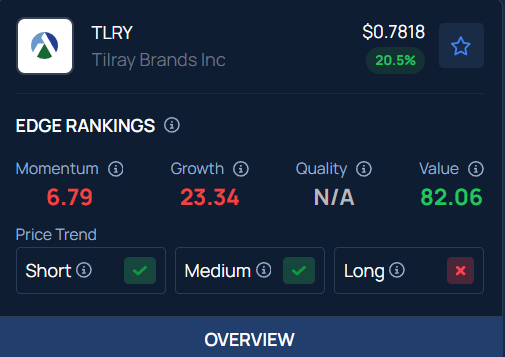

Benzinga's Edge Stock Rankings indicate that TLRY stock is showing an uptick in both the short- and medium-term. Here is how the stock fares on other parameters.

Read Next:

Photo: Below the Sky / Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.