Corpay (NYSE:CPAY) has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

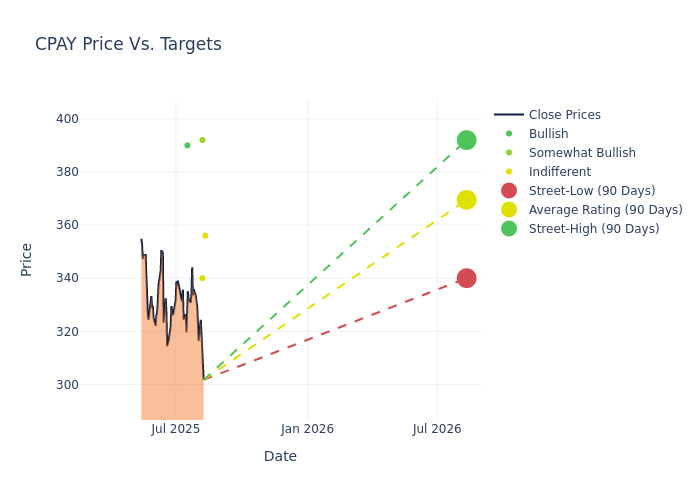

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $369.5, along with a high estimate of $392.00 and a low estimate of $340.00. Highlighting a 2.68% decrease, the current average has fallen from the previous average price target of $379.67.

Understanding Analyst Ratings: A Comprehensive Breakdown

The analysis of recent analyst actions sheds light on the perception of Corpay by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Faucette | Morgan Stanley | Lowers | Equal-Weight | $356.00 | $360.00 |

| Roger Boyd | UBS | Lowers | Neutral | $340.00 | $365.00 |

| John Davis | Raymond James | Lowers | Outperform | $392.00 | $414.00 |

| Nate Svensson | Deutsche Bank | Announces | Buy | $390.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Corpay. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Corpay compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Corpay's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Corpay's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Corpay analyst ratings.

All You Need to Know About Corpay

Corpay Inc is a corporate payments company that helps businesses and consumers manage and pay their expenses. Its suite of modern payment solutions helps customers manage vehicle-related expenses, lodging expenses, and corporate payments. Its reportable segments are; Vehicle Payments, Corporate Payments, Lodging Payments, and Other. The group's geographic areas are the United States, Brazil, the United Kingdom, and Other.

A Deep Dive into Corpay's Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Corpay's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 12.95%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Corpay's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 25.79% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Corpay's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 7.7%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Corpay's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 1.46%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Corpay's debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.07, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.