As the U.S. markets continue to reach new heights, with major indexes like the Nasdaq closing at record levels, investors are keenly observing opportunities amid a tech-driven rally. In this buoyant market environment, identifying undervalued stocks can be a strategic approach for those looking to capitalize on potential discrepancies between a stock's current price and its estimated intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| XPEL (XPEL) | $33.58 | $64.28 | 47.8% |

| VTEX (VTEX) | $4.31 | $8.55 | 49.6% |

| Shoals Technologies Group (SHLS) | $4.72 | $9.03 | 47.7% |

| Royal Gold (RGLD) | $168.97 | $331.23 | 49% |

| Rhythm Pharmaceuticals (RYTM) | $91.98 | $177.71 | 48.2% |

| Privia Health Group (PRVA) | $20.58 | $40.02 | 48.6% |

| Old National Bancorp (ONB) | $20.74 | $40.21 | 48.4% |

| Niagen Bioscience (NAGE) | $9.73 | $19.02 | 48.8% |

| Berkshire Hills Bancorp (BHLB) | $24.35 | $46.73 | 47.9% |

| ACNB (ACNB) | $42.43 | $81.27 | 47.8% |

Let's review some notable picks from our screened stocks.

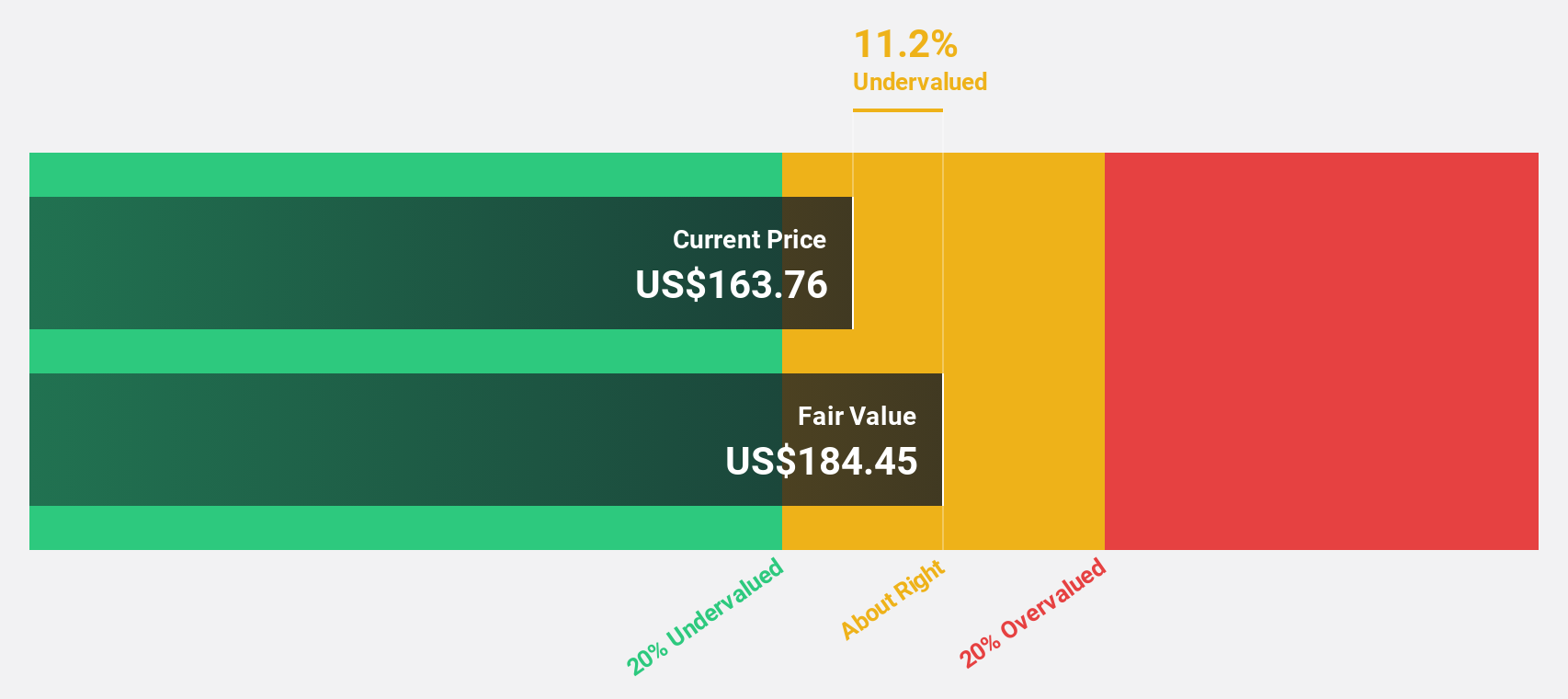

Natera (NTRA)

Overview: Natera, Inc. is a diagnostics company that provides molecular testing services globally and has a market cap of approximately $20.85 billion.

Operations: The company generates revenue of $1.96 billion from the development and commercialization of molecular testing services.

Estimated Discount To Fair Value: 21.8%

Natera's stock appears undervalued based on cash flows, trading at US$151.95, below its estimated fair value of US$194.23. Despite a net loss increase to US$100.94 million in Q2 2025, revenue grew significantly to US$546.6 million from the previous year, and the company raised its annual revenue outlook by $80 million at the midpoint for 2025. The company's innovative product launches and strong expected revenue growth further support its potential as an undervalued investment opportunity.

- The analysis detailed in our Natera growth report hints at robust future financial performance.

- Click here to discover the nuances of Natera with our detailed financial health report.

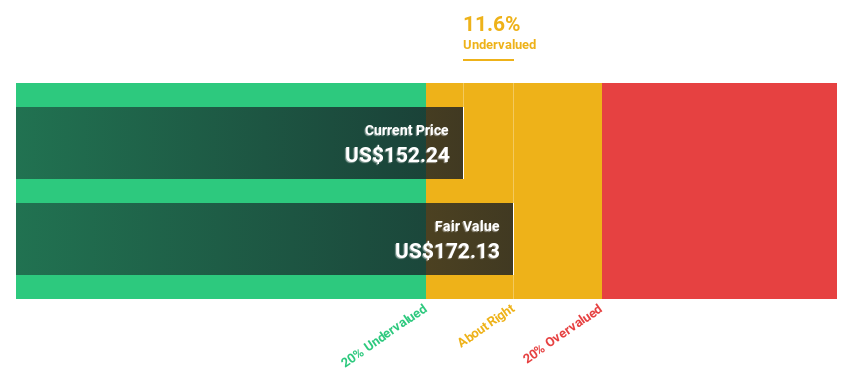

Royal Gold (RGLD)

Overview: Royal Gold, Inc. acquires and manages precious metal streams, royalties, and related interests, with a market cap of approximately $11.12 billion.

Operations: The company's revenue primarily comes from stream interests, generating $513.49 million, and royalty interests, contributing $278.44 million.

Estimated Discount To Fair Value: 49%

Royal Gold is trading at US$168.97, significantly below its fair value estimate of US$331.23, highlighting its potential as an undervalued stock based on cash flows. The company's recent earnings report showed strong performance with Q2 2025 sales rising to US$207.44 million and net income increasing to US$132.35 million from a year ago. Additionally, Royal Gold's strategic acquisition discussions and extended credit facilities suggest robust future growth prospects amidst solid financial health.

- Insights from our recent growth report point to a promising forecast for Royal Gold's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Royal Gold.

Pure Storage (PSTG)

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market cap of approximately $19.15 billion.

Operations: The company's revenue is primarily derived from its Computer Storage Devices segment, amounting to $3.25 billion.

Estimated Discount To Fair Value: 37.3%

Pure Storage is trading at US$58.58, significantly below its estimated fair value of US$93.37, suggesting undervaluation based on cash flows. Recent executive changes include the appointment of Tarek Robbiati as CFO, bringing extensive financial leadership experience that could enhance operational efficiency and profitability. The company reported Q1 2025 revenue growth to US$778.49 million and reduced net loss to US$14 million, indicating improving financial performance amidst strategic product expansions and collaborations in high-demand sectors.

- Our earnings growth report unveils the potential for significant increases in Pure Storage's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Pure Storage.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 169 Undervalued US Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com