- In early August 2025, Encompass Health announced plans to construct a new 50-bed inpatient rehabilitation hospital in Haslet, Texas, set to open in 2027, while also reporting robust second-quarter earnings, increasing annual guidance, and expanding its network through additional hospital openings and share buybacks.

- These strong operational milestones coincided with negative headlines and legal investigations into patient safety and regulatory compliance at some Encompass facilities, creating a complex outlook for the company's reputation and growth trajectory.

- We'll explore how the combination of hospital expansion and ongoing regulatory scrutiny may influence Encompass Health's long-term investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Encompass Health Investment Narrative Recap

To invest in Encompass Health, you need to believe in the sustained demand for inpatient rehabilitation services driven by an aging population and complex care needs. The recent announcement of a new 50-bed hospital in Haslet reflects the company’s confidence in capturing growth, although ongoing regulatory and legal scrutiny may weigh on reputational risk more than any immediate operational or financial catalyst. For now, the short-term outlook is shaped less by expansion news and more by how these investigations evolve.

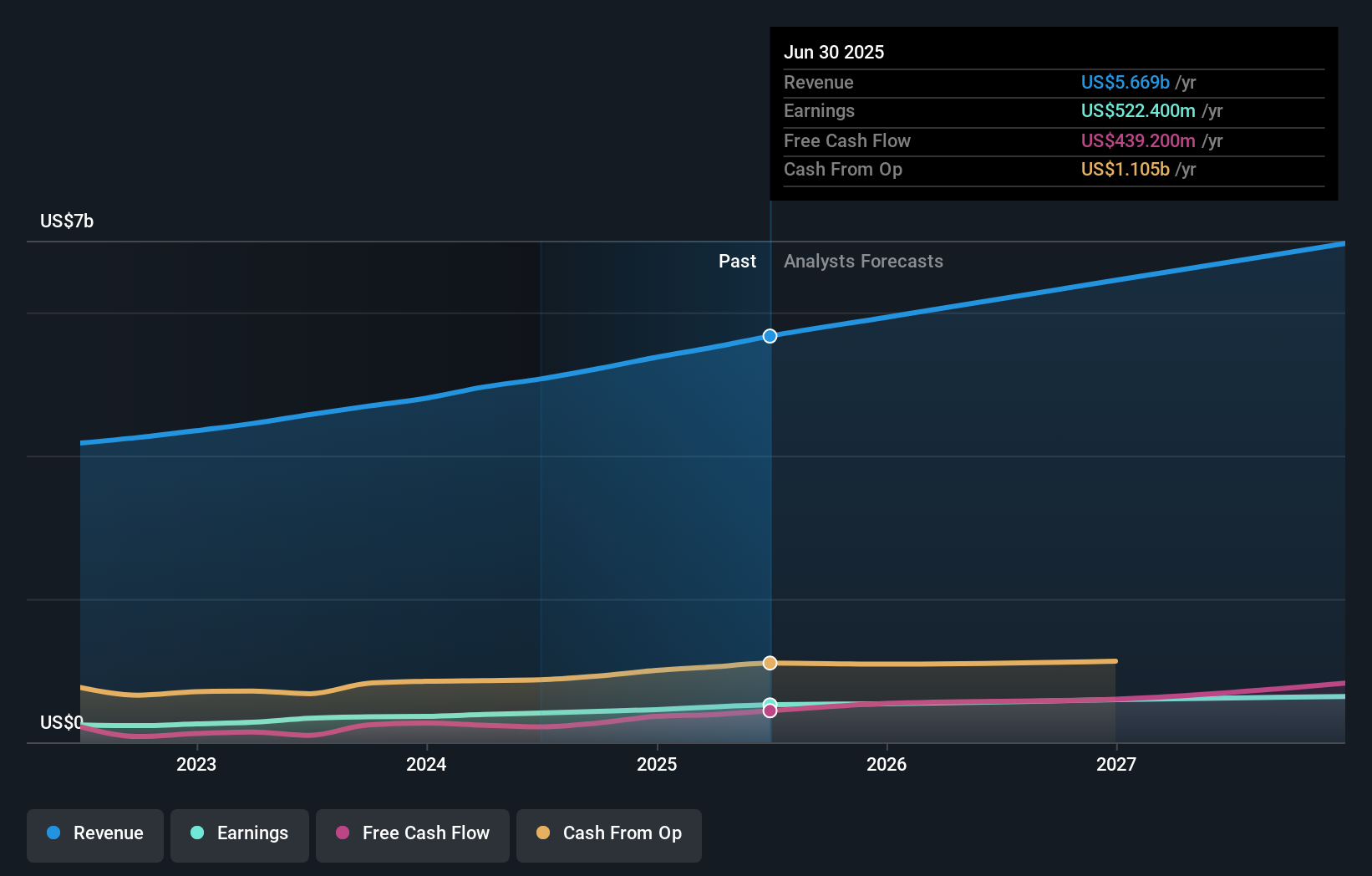

Among recent updates, Encompass Health’s second-quarter earnings report stands out, showing sales of US$1,457.7 million and net income of US$142.1 million, both improved from the previous year. This performance allowed management to raise full-year guidance, reinforcing the company’s view that strong demand and network expansion can offset ongoing industry headwinds.

But despite growth, investors should remain alert to new headlines around patient safety and compliance, as...

Read the full narrative on Encompass Health (it's free!)

Encompass Health's outlook anticipates $7.2 billion in revenue and $711.6 million in earnings by 2028. This scenario assumes 8.1% annual revenue growth and a $190 million increase in earnings from the current $521.6 million.

Uncover how Encompass Health's forecasts yield a $135.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community has shared a fair value estimate for Encompass Health, coming in at US$135. While some see the company’s network expansion as a catalyst for growth, regulatory risk remains an active point of discussion that could influence your own outlook.

Explore another fair value estimate on Encompass Health - why the stock might be worth as much as 15% more than the current price!

Build Your Own Encompass Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encompass Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encompass Health's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com