- Piper Sandler Companies recently reported second-quarter 2025 earnings, posting year-over-year growth in revenue to US$398.58 million and net income to US$42.18 million, alongside a quarterly dividend hike to US$0.70 per share and completion of a share repurchase tranche.

- This performance, combined with upward analyst earnings revisions and a Zacks Rank #1 (Strong Buy), has drawn increased attention from both investors and options markets.

- We'll explore how Piper Sandler's strong earnings growth and dividend increase shape its current investment narrative for shareholders.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Piper Sandler Companies' Investment Narrative?

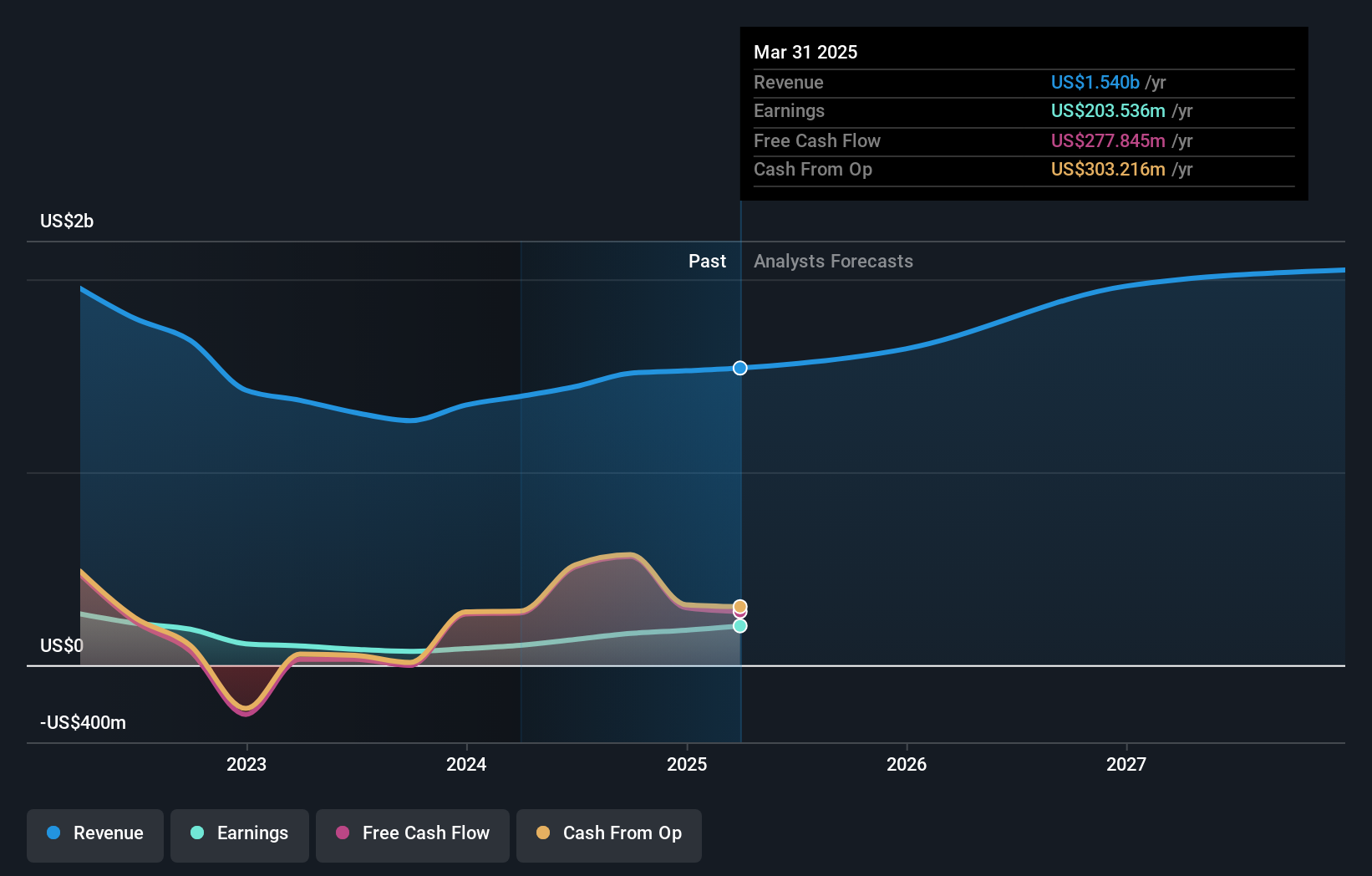

Shareholders in Piper Sandler Companies today need to believe in the sustained ability of the firm to generate both organic growth and shareholder returns, supported by disciplined capital allocation and a capable management team. The recent quarterly results highlight continued improvements in revenue and profit, a further dividend boost, and a completed share buyback, sending a positive near-term signal. This momentum, along with upward analyst revisions and heightened options market activity, shifts the immediate catalyst story from mere earnings delivery to how effectively Piper Sandler can maintain client and revenue growth as market conditions evolve. Key risks such as high insider selling and a premium valuation versus peers remain relevant, though the company’s near-term fundamentals appear improved in light of this latest update. The recent news may temper some earlier concerns, but valuation and sustainability questions still loom for investors to weigh.

On the other hand, Piper Sandler's premium valuation versus peers is an important concern. Piper Sandler Companies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Piper Sandler Companies - why the stock might be a potential multi-bagger!

Build Your Own Piper Sandler Companies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Piper Sandler Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Piper Sandler Companies' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com