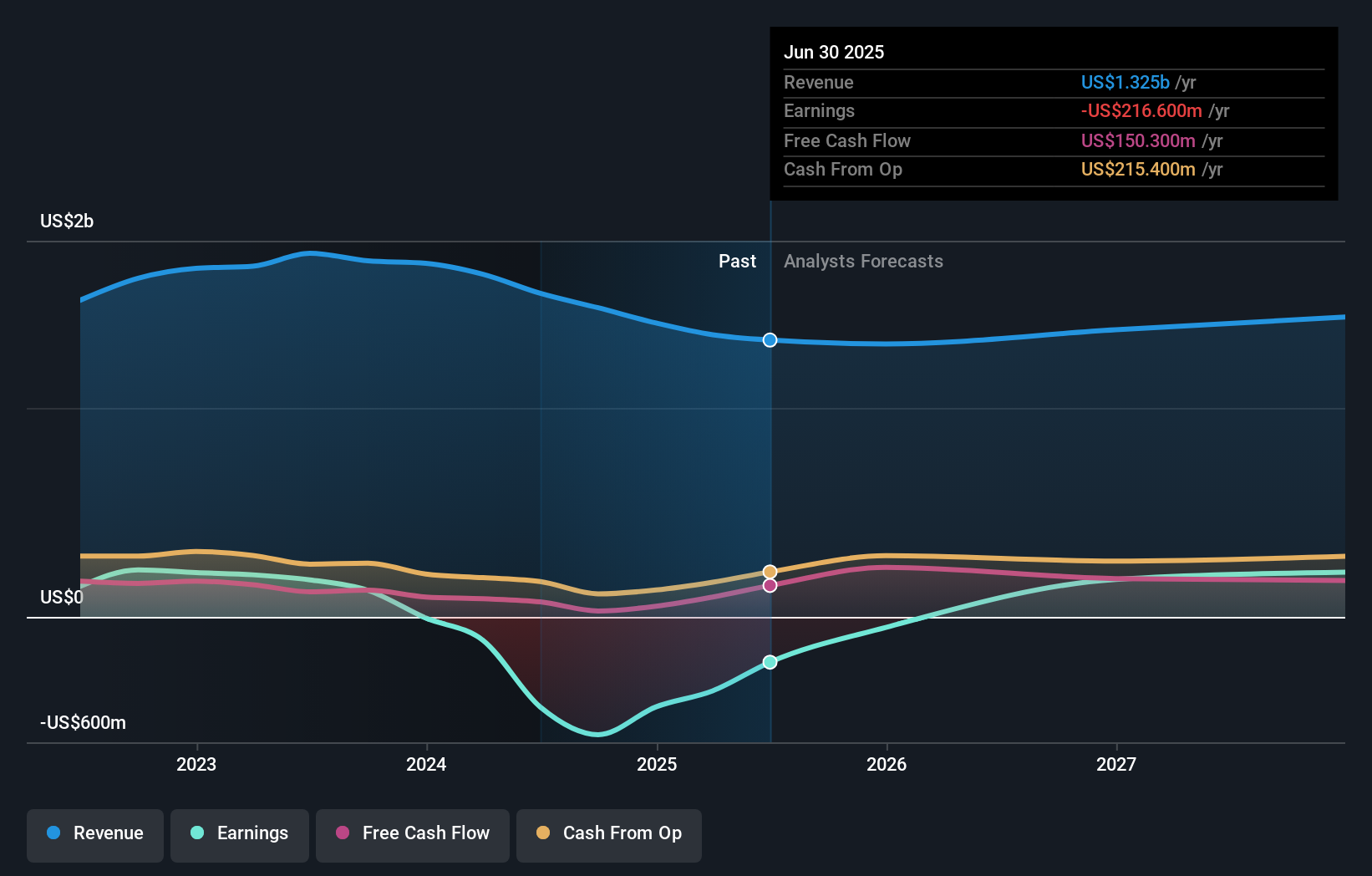

- Ingevity Corporation recently reported its second quarter and first half 2025 financial results, noting sales of US$365.1 million and a net loss of US$146.5 million for the quarter ended June 30, with losses narrowing compared to the prior year.

- Despite year-over-year declines in sales, the company increased its full-year EBITDA and free cash flow guidance, and maintained its revenue outlook, reflecting confidence in ongoing operational improvements and the impact of its planned divestitures.

- We'll assess how Ingevity's raised profitability guidance and continued portfolio review shape its investment narrative moving forward.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ingevity Investment Narrative Recap

To be a shareholder in Ingevity today means believing that management’s ongoing portfolio review and planned divestitures can spark a turnaround in earnings quality and free cash flow, despite persistent headwinds in global industrial and APT markets. The recent financial update, with raised EBITDA and free cash flow guidance despite narrower losses, reinforces management’s near-term optimism but does not materially change the biggest short-term risk: continued weakness and tariff uncertainties in the APT segment. Near-term catalysts remain tied to the successful execution of planned asset sales and improvements in Performance Materials profitability.

Among the latest announcements, the advancement of the sale process for the Industrial Specialties business and CTO refinery stands out as directly relevant. Execution on these divestitures is central to Ingevity’s strategy of focusing on higher-growth, higher-margin areas, and remains pivotal to whether the company’s raised profitability targets are sustainable or fleeting.

By contrast, investors should also be aware that ongoing tariff pressures and cyclical exposure in APT mean any stumble in ...

Read the full narrative on Ingevity (it's free!)

Ingevity's outlook anticipates $1.5 billion in revenue and $378.5 million in earnings by 2028. This scenario implies a 3.1% annual revenue growth rate and a $595.1 million increase in earnings from the current level of -$216.6 million.

Uncover how Ingevity's forecasts yield a $60.50 fair value, a 18% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community produced a single fair value estimate of US$60.50 for Ingevity, highlighting a lack of divergence in opinion. Performance hinges on whether portfolio changes deliver margin stability in the face of prolonged demand risks, so consider multiple viewpoints as you assess Ingevity’s future.

Explore another fair value estimate on Ingevity - why the stock might be worth just $60.50!

Build Your Own Ingevity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingevity research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ingevity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingevity's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com