- Mueller Industries recently announced that its Board of Directors declared a regular quarterly cash dividend of US$0.25 per share, payable on September 19, 2025, to shareholders of record as of September 5, 2025.

- While the company reported strong profits, a significant portion stemmed from an unusual US$60 million one-time gain, raising questions about the sustainability of its core earnings.

- We'll explore how reliance on significant one-time gains affects Mueller Industries' investment narrative in light of the recent dividend announcement.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Mueller Industries' Investment Narrative?

For shareholders in Mueller Industries, confidence in the company's long-term fundamentals is crucial, especially as the recent dividend announcement arrives just after an earnings report bolstered by a US$60 million one-time gain. While the continuation of the US$0.25 per share quarterly dividend signals stability, it's important to acknowledge that much of the latest profit growth was not driven by core operations. Previously, catalysts like strong revenue expansion, solid profit margins, and consistent dividend hikes gave investors reason for optimism, but this new emphasis on nonrecurring income could temper expectations for sustainable short-term growth. At the same time, the risk of overestimating recurring earnings is now more pronounced, particularly since the underlying business may not repeat such gains. For most investors, the dividend news is unlikely to shift major catalysts or risk factors meaningfully, unless future quarters reveal a pattern of similar one-offs.

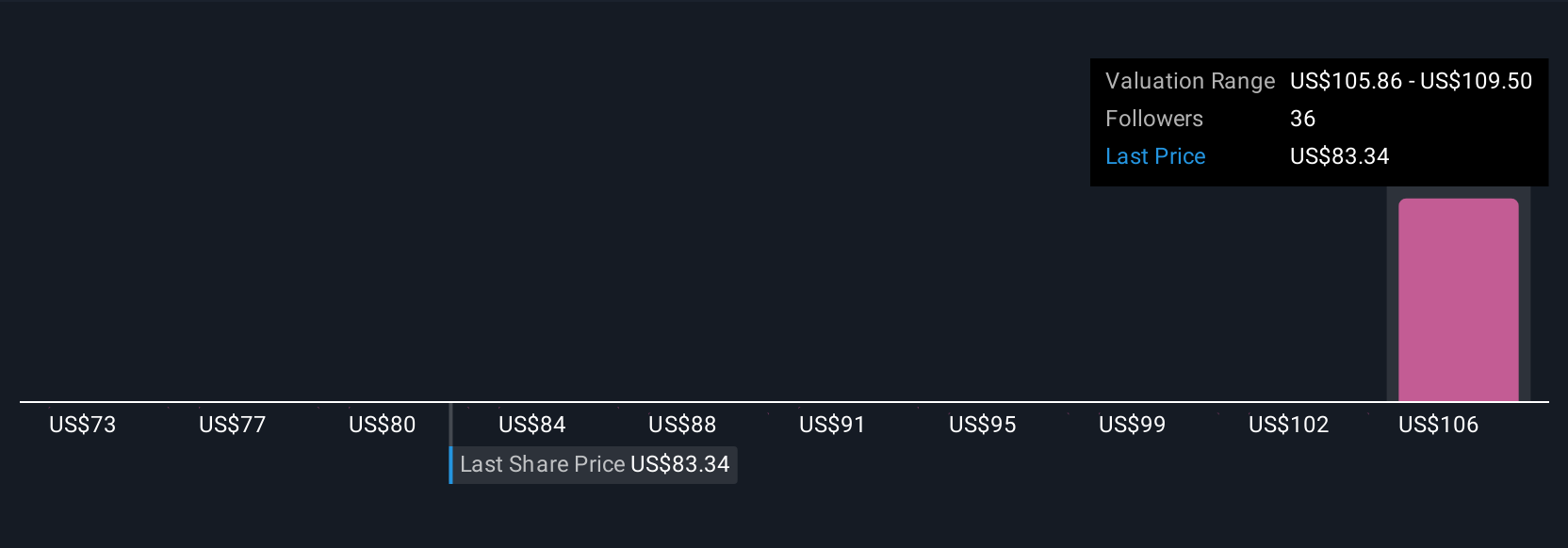

But beneath the regular dividend lies a risk investors need to keep in focus. Mueller Industries' shares have been on the rise but are still potentially undervalued by 11%. Find out what it's worth.Exploring Other Perspectives

Explore 7 other fair value estimates on Mueller Industries - why the stock might be worth 18% less than the current price!

Build Your Own Mueller Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mueller Industries research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Mueller Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mueller Industries' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com