- CVR Partners, LP recently announced a strong second quarter with higher sales and net income, an increased cash distribution of $3.89 per common unit, and the filing of a $49.25 million shelf registration related to an ESOP offering.

- This combination of financial milestones and corporate actions highlights the company's focus on both rewarding unitholders and supporting future equity initiatives.

- We’ll explore how the significant dividend hike may shape CVR Partners' investment narrative amid these latest corporate developments.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is CVR Partners' Investment Narrative?

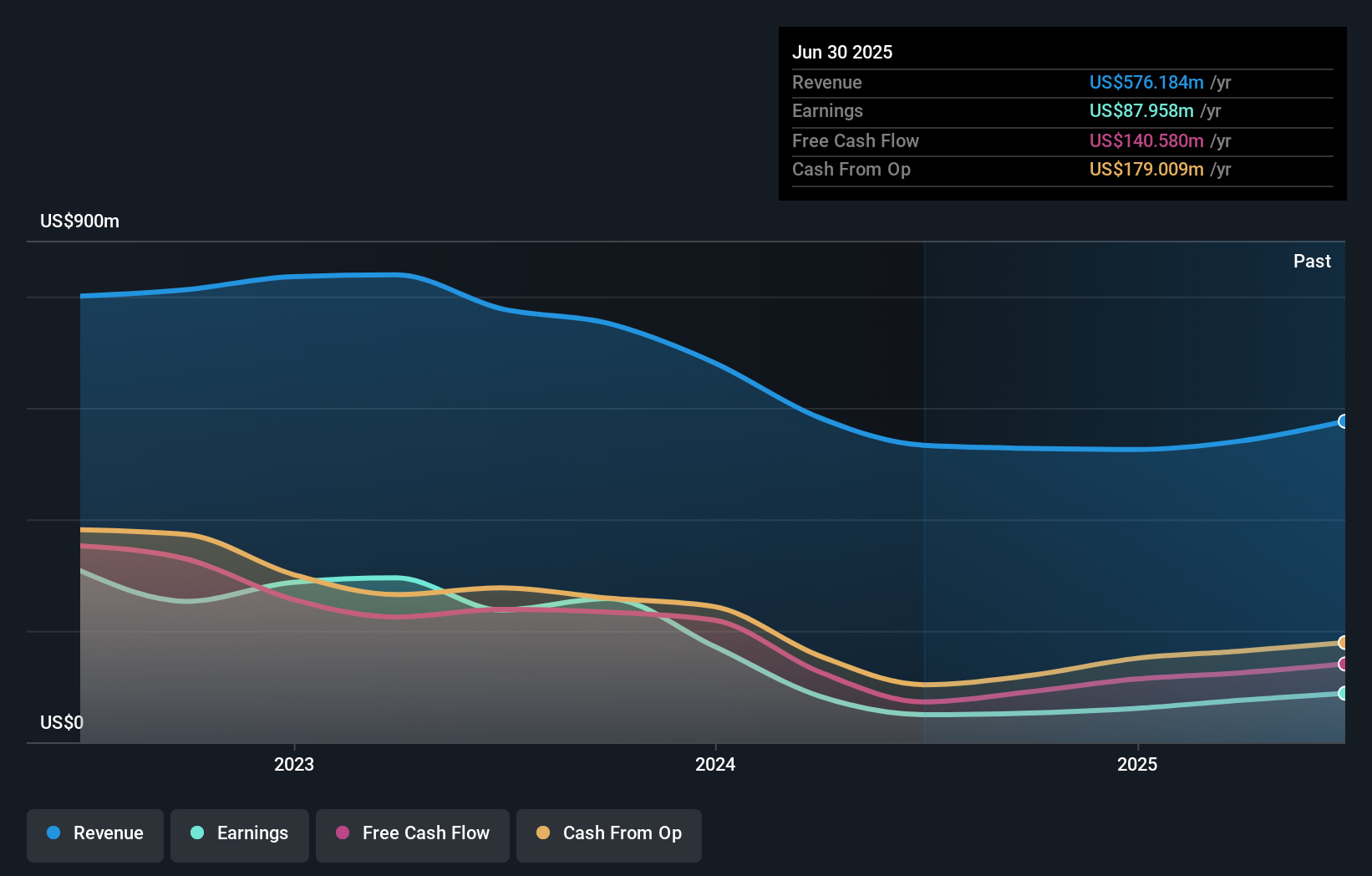

To believe in CVR Partners as a shareholder today is to focus on its strong financial upswing, rising net income, and a generous cash distribution, all evident in its latest results. While a new ESOP-related shelf registration emphasizes long-term capital flexibility, the real short-term catalyst remains earnings momentum and dividend growth, as seen with the jump to a $3.89 per unit payout. That said, the production dip in ammonia and UAN this quarter hints at underlying operational constraints, which could weigh on consistency if it persists. The latest news reinforces the company’s commitment to shareholder returns but puts an even brighter spotlight on how sustainable these distributions are, given coverage concerns. The overall risk profile shifts modestly, now hinging on both market demand and the ability to maintain high dividend levels despite production headwinds.

But even with higher dividends, dividend coverage remains an important risk for investors to watch. Despite retreating, CVR Partners' shares might still be trading 29% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on CVR Partners - why the stock might be worth as much as 42% more than the current price!

Build Your Own CVR Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CVR Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CVR Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CVR Partners' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com