- Earlier this month, Ally Financial announced the issuance of two fixed-rate senior unsecured notes: a 5.750% bond due August 2035 and a 4.700% bond due August 2028, both callable and issued at par with modest discounts per security.

- This move reflects Ally’s ongoing efforts to secure long-term funding and demonstrates investor confidence in the company's creditworthiness following strong second quarter results.

- We will explore how Ally’s recent fixed-income offering and impressive quarterly earnings impact its outlook for digital banking and auto finance expansion.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ally Financial Investment Narrative Recap

To be an Ally Financial shareholder, you need to believe in the company’s digital banking model and its ability to drive customer growth through technology, while managing the risks inherent in heavy auto lending exposure. The recent senior unsecured notes issuance adds stability to Ally’s balance sheet, though it does not directly impact the key short-term catalyst, namely, the expansion of digital and auto finance offerings; nor does it substantially alter the most pressing risk, the company’s reliance on traditional auto lending amid industry shifts.

Of recent announcements, Ally’s Q2 2025 earnings report is most relevant: revenue and earnings beat expectations, with net income rising to US$352 million and basic EPS reaching US$1.05, up significantly year over year. This strong financial result supports Ally’s underlying growth catalysts but also places the spotlight back on its ability to diversify revenues beyond auto finance, which remains a critical area as the market evolves.

However, with competition in auto lending intensifying and new fintech entrants squeezing margins, it’s essential for investors to be aware of how shifts in the industry could...

Read the full narrative on Ally Financial (it's free!)

Ally Financial's narrative projects $9.6 billion in revenue and $1.8 billion in earnings by 2028. This requires 12.0% yearly revenue growth and an increase of approximately $1.5 billion in earnings from the current $324.0 million.

Uncover how Ally Financial's forecasts yield a $46.00 fair value, a 23% upside to its current price.

Exploring Other Perspectives

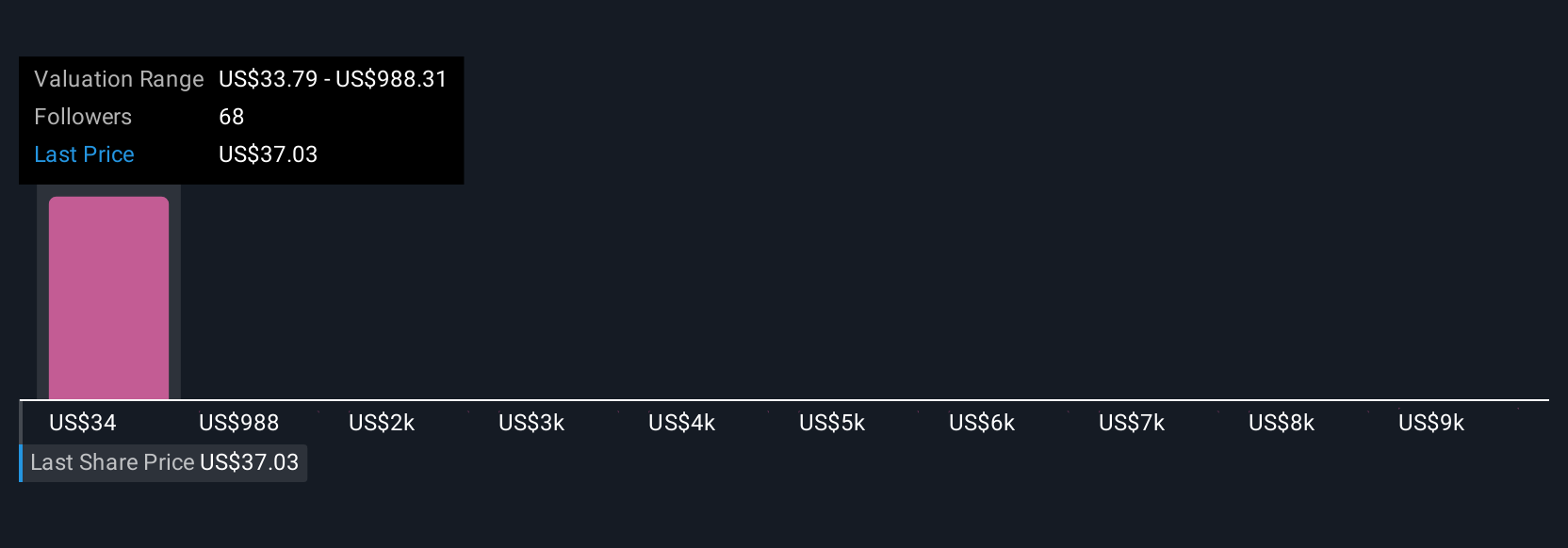

Ten Simply Wall St Community members estimate Ally’s fair value to range from US$33.79 to an outlier US$9,578.94. While these opinions differ greatly, keep in mind that evolving competition in auto finance may continue to pressure yields and earnings, shaping future opportunities and risks for the company.

Explore 10 other fair value estimates on Ally Financial - why the stock might be worth 10% less than the current price!

Build Your Own Ally Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ally Financial research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ally Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ally Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com