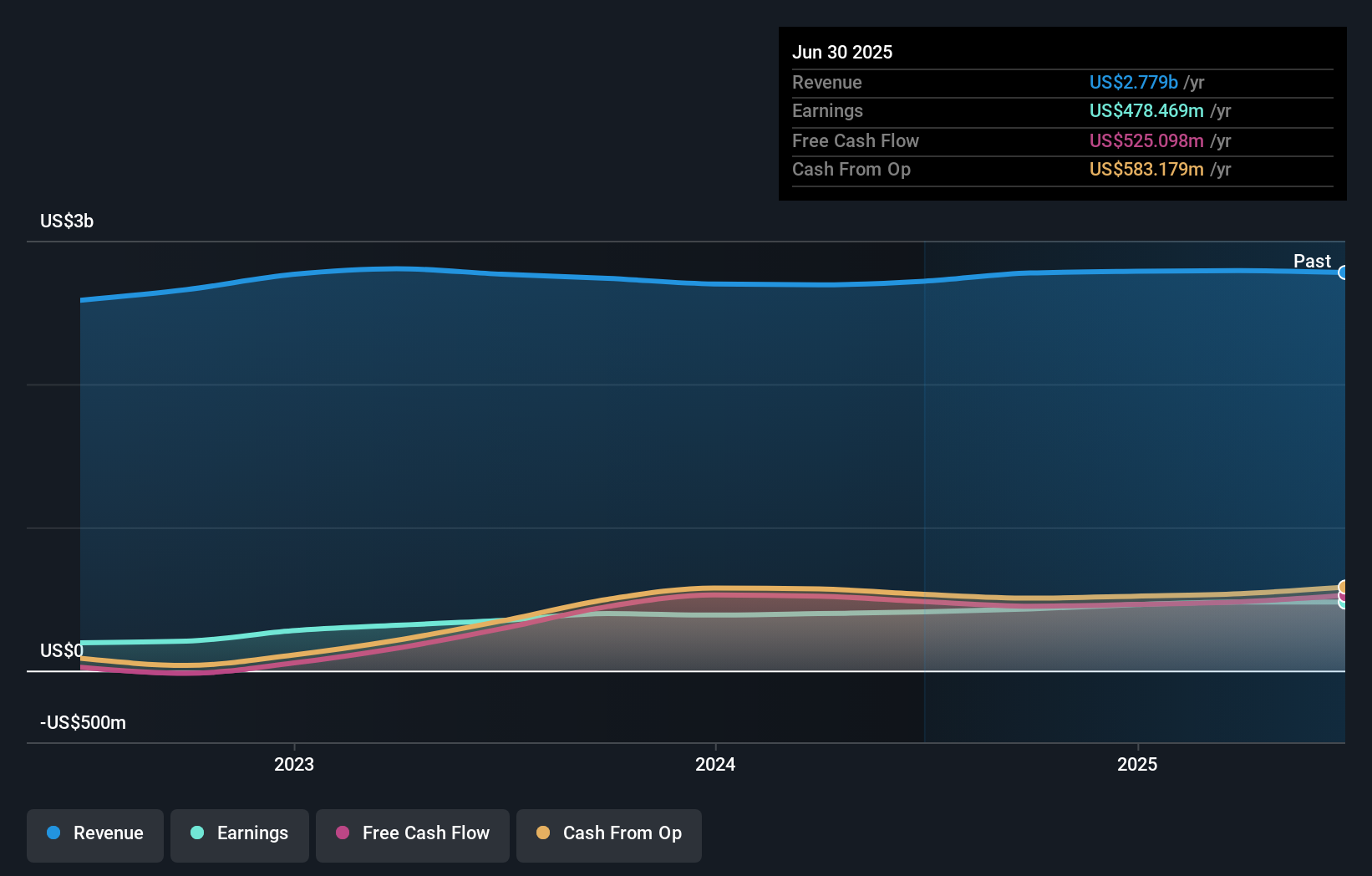

- NewMarket Corporation has reported its second-quarter 2025 earnings with net income holding steady at US$111.24 million and announced a US$2.75 quarterly dividend payable on October 1, 2025, along with the completion of a share repurchase tranche totaling 133,658 shares for US$71.79 million.

- These actions emphasize the company's focus on consistent capital returns and earnings stability, despite a slight year-over-year decrease in sales revenue.

- We'll explore how NewMarket's recent dividend declaration underscores its approach to shareholder returns and shapes its investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is NewMarket's Investment Narrative?

Owning shares in NewMarket means believing in the company’s disciplined approach to capital returns and its ability to protect earnings, even as sales waver. The latest dividend affirmation at US$2.75 per share signals management’s confidence in stable operations, while the completed buyback adds another layer of shareholder value. These recent actions should reinforce the near-term investment thesis: that prudent capital allocation and steady profits remain at the center of NewMarket’s story. However, a slight sales dip is a reminder that product demand fluctuations and broader chemicals sector volatility are never far off. Recent results won’t dramatically alter the short-term catalysts or major risks for shareholders, but continued sales softness could weigh on sentiment if it persists. For now, management’s consistency offsets operational unpredictability, but not completely.

But there’s a risk that continued weak sales could unsettle the company’s current momentum. NewMarket's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on NewMarket - why the stock might be worth just $739.86!

Build Your Own NewMarket Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewMarket research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NewMarket research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewMarket's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com