- On July 31, 2025, Laureate Education, Inc. raised its full-year 2025 revenue outlook by about US$55 million due to more favorable foreign currency rates and continued its share repurchase program, offsetting mixed earnings where second-quarter net income declined year-on-year despite higher sales.

- This combination of heightened revenue guidance and active buybacks offers a sign of management's positive outlook in the face of recent profitability challenges.

- We'll examine how Laureate's upgraded revenue guidance, particularly driven by currency gains, may impact its future investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Laureate Education Investment Narrative Recap

To be a Laureate Education shareholder today, you need to believe in the company's ability to drive sustained enrollment and revenue growth in Latin America, while effectively expanding its online programs and navigating currency fluctuations. The recent revenue guidance increase, driven by favorable foreign exchange rates, provides some short-term relief but does not materially resolve the biggest near-term catalyst, successfully attracting students for new campus openings and digital offerings, or the primary risk, which remains exposure to shifting macroeconomic and policy environments, particularly in Mexico and Peru.

Among recent announcements, the continuation of Laureate’s share repurchase program stands out as especially relevant, signaling management’s confidence amid earnings volatility. By completing US$72.42 million in buybacks to date, Laureate aligns with a string of capital return initiatives that may help support the stock while core business drivers are tested by evolving market conditions.

Yet, in contrast, investors should be aware that revenue concentration in two key markets leaves Laureate exposed if macro conditions in Mexico or Peru shift...

Read the full narrative on Laureate Education (it's free!)

Laureate Education's outlook projects $2.0 billion in revenue and $343.9 million in earnings by 2028. This requires 8.4% annual revenue growth and a $89.7 million increase in earnings from the current $254.2 million.

Uncover how Laureate Education's forecasts yield a $28.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

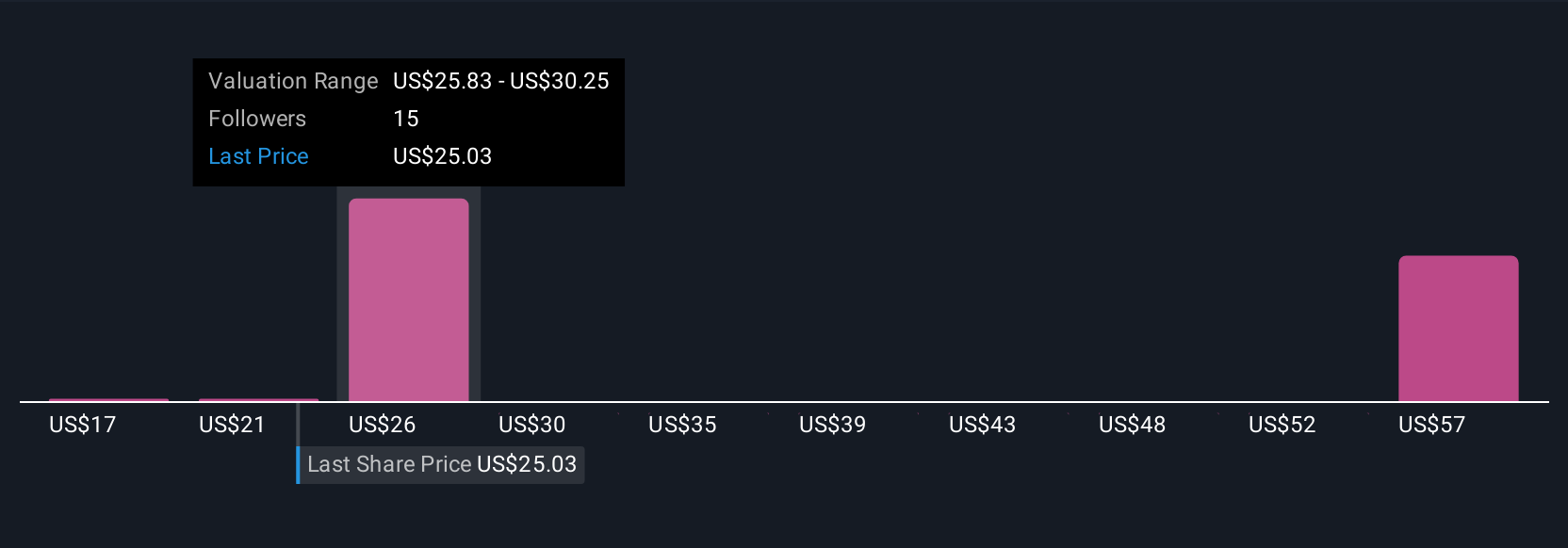

Four individual fair value estimates from the Simply Wall St Community range from US$17 to US$61.30 per share, reflecting broad disagreement on future growth. This diversity of views is striking, especially as many continue to watch Laureate’s heavy reliance on Latin American revenues and the risks related to shifting political and economic environments.

Explore 4 other fair value estimates on Laureate Education - why the stock might be worth over 2x more than the current price!

Build Your Own Laureate Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laureate Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Laureate Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laureate Education's overall financial health at a glance.

No Opportunity In Laureate Education?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com