Meta Platforms Inc. (NASDAQ:META) has reportedly enlisted the services of PIMCO and Blue Owl Capital to finance its $29 billion data center expansion project in rural Louisiana.

Check out the current price of META stock here.

What Happened: The U.S. bond giant PIMCO and alternative asset manager Blue Owl will be responsible for raising the funds, Reuters reported, citing sources. PIMCO will manage around $26 billion in debt, likely in the form of bonds, while Blue Owl will contribute $3 billion in equity.

The deal was first reported by Bloomberg News, which also revealed that Meta had been working with Morgan Stanley (NYSE:MS) to raise funds. Other contenders for leading the deal included Apollo Global Management (NYSE:APO) and KKR (NYSE:KKR).

See Also: Jim Cramer Calls Out Intel’s $18.8 Billion Foundry Loss Despite Subsidies: ‘We Sell Your Stock’

Meta, PIMCO and Blue Owl did not immediately respond to Benzinga's request for comment.

Why It Matters: The California-based tech giants's decision to partner with PIMCO and Blue Owl for its data center expansion project is a strategic move to secure the necessary funding for its ambitious AI infrastructure push. This development follows Meta’s decision to sell $2 billion in data center assets to share the burden of its increasing AI infrastructure costs.

Earlier in July, Meta CEO Mark Zuckerberg announced that the company would be investing hundreds of billions of dollars to build several massive AI data centers for its superintelligence unit. This move is part of Meta’s ongoing efforts to remain at the forefront of AI technology, amidst a global buildout of data center infrastructure to meet the immense computing power needed for AI ambitions by tech giants.

Price in Action: According to Benzinga Pro data. Meta closed at $769.30, up 0.98% on Friday, with a slight after-hours gain to $769.61. It has a market cap of $1.93 trillion, an average volume of 12.88 million shares and a price-to-earnings ratio of 27.90.

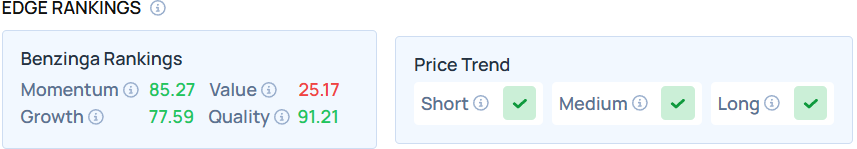

With a high Momentum in the 85th percentile and a strong Growth score of 77.59, Benzinga’s Edge Stock Rankings indicates Meta stock has a positive price trend across all time frames. Find out how the stock competes with other tech giants.

Read Next:

Photo Courtesy: Poetra.RH on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.