- United States Lime & Minerals, Inc. announced that its Board of Directors declared a regular quarterly cash dividend of US$0.06 per share, payable on September 12, 2025, to shareholders of record as of August 22, 2025, and reported strong second-quarter results, with sales rising to US$91.52 million and net income reaching US$30.83 million compared to the prior year.

- The robust increases in both sales and net income highlight the company's ongoing operational performance and underpin continued confidence in shareholder returns through dividend payouts.

- With this backdrop of significant earnings growth, we'll explore how improved profitability strengthens United States Lime & Minerals' investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is United States Lime & Minerals' Investment Narrative?

To be a shareholder in United States Lime & Minerals, the big picture belief centers on the company’s ability to maintain robust profitability and a track record of consistent, albeit modest, dividend payments. The newly reported Q2 results, with sales and net income both showing solid annual growth, affirm operational momentum and provide a near-term confidence boost to those watching for execution against industry competitors. This freshness in financials could sustain positive sentiment as a short-term catalyst, especially given the recent uptick in share price. However, the most significant risks are still present: a relatively high price-to-earnings ratio compared to peers may leave the stock sensitive to any slowdown in earnings growth, and future profit expansion is only expected to be moderate compared to broader market trends. While recent news reinforces positive aspects of the story, it does not fundamentally change the balance of risk and catalysts facing the business. In contrast, the premium valuation could become a drag if growth stalls.

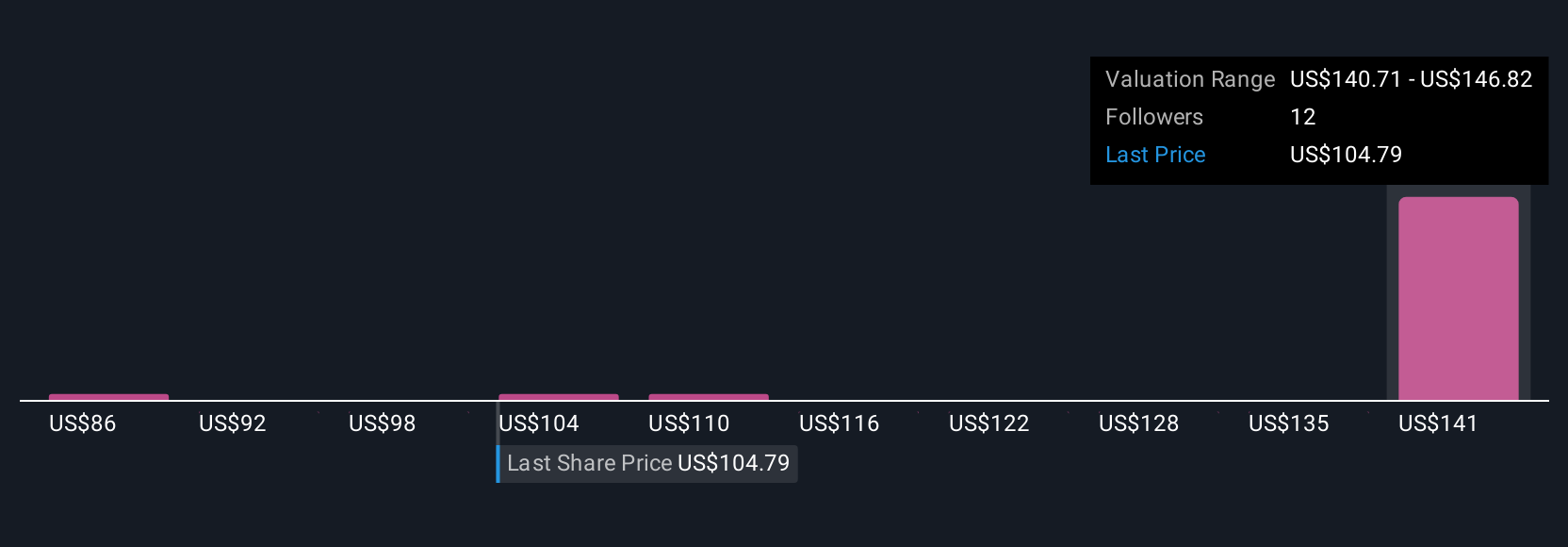

United States Lime & Minerals' shares have been on the rise but are still potentially undervalued by 17%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on United States Lime & Minerals - why the stock might be worth as much as 20% more than the current price!

Build Your Own United States Lime & Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United States Lime & Minerals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free United States Lime & Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United States Lime & Minerals' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com