- Leidos Holdings recently reported strong second quarter results with increased sales, improved profitability, and a raised full-year 2025 revenue guidance, alongside the announcement of a new partnership with Second Front Systems to streamline secure software deployment for government customers.

- This collaborative move emphasizes Leidos' continued alignment with federal sector digital transformation initiatives and highlights its focus on operational efficiencies and secure technology integration for government agencies.

- We'll now explore how the partnership with Second Front Systems could influence Leidos' investment narrative and future government contract opportunities.

AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Leidos Holdings Investment Narrative Recap

To be a Leidos shareholder, you need to believe in the persistent demand for federal digital transformation, the company’s ability to secure long-term government contracts, and the view that secure, AI-driven solutions are critical for future growth. The new partnership with Second Front Systems may bolster Leidos’ core catalyst, winning digital modernization projects in defense and intelligence, but it does not significantly alter the principal risk, which remains overreliance on U.S. government funding and the unpredictability that comes with it.

Among recent announcements, the $128 million FBI contract for agile software development is especially relevant as it showcases Leidos’ position at the intersection of security technology and government modernization. This contract aligns closely with the evolving federal needs that the Second Front Systems partnership targets, underpinning the narrative that continued success in securing and delivering such projects remains the company’s main catalyst.

However, investors should be aware that even as federal digital investment expands, sudden shifts in budget allocation or a change in congressional priorities could...

Read the full narrative on Leidos Holdings (it's free!)

Leidos Holdings' outlook projects $18.6 billion in revenue and $1.5 billion in earnings by 2028. This scenario assumes a 3.0% annual revenue growth rate and a $0.1 billion increase in earnings from the current $1.4 billion.

Uncover how Leidos Holdings' forecasts yield a $177.38 fair value, in line with its current price.

Exploring Other Perspectives

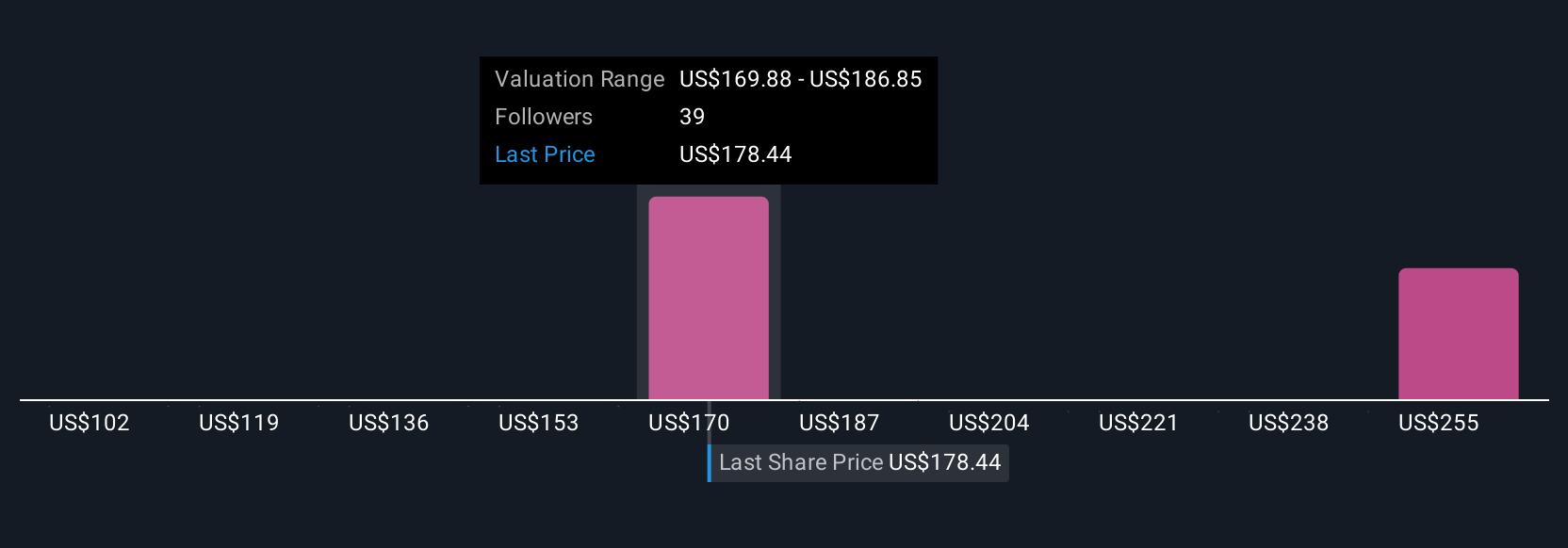

Eight fair value estimates from the Simply Wall St Community range from US$102 to US$272, highlighting contrasting opinions on Leidos’ valuation. While many see growth from digital modernization as key, others caution about the volatility tied to large government programs, explore these viewpoints for a broader context.

Explore 8 other fair value estimates on Leidos Holdings - why the stock might be worth 42% less than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leidos Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Leidos Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leidos Holdings' overall financial health at a glance.

No Opportunity In Leidos Holdings?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com