- PC Connection, Inc. recently reported second quarter 2025 results, highlighting sales of US$759.69 million and a quarterly dividend of US$0.15 per share, while also completing a significant share buyback tranche.

- Alongside rising year-over-year sales, the company filed a US$28.90 million shelf registration related to its Employee Stock Ownership Plan, signaling ongoing efforts to engage and reward employees.

- Next, we'll explore how the combination of stable earnings and the completed share repurchase program could influence PC Connection's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

PC Connection Investment Narrative Recap

To own shares in PC Connection, an investor typically needs confidence in the company’s ability to consistently grow by capturing IT spending tied to technology refresh cycles and the shift towards advanced solutions and services. The latest results, with modest year-over-year sales growth but relatively flat profitability, do not significantly shift the short-term catalyst, which remains centered on the pace of customer demand for new infrastructure projects, nor do they materially reduce the ongoing risk of compressed margins in a competitive hardware market.

Among the most relevant recent announcements, the completion of a significant share buyback program stands out. Concluding the repurchase of 1,575,440 shares for US$90.61 million, this move reflects PC Connection’s continued use of available capital to manage its equity base. It also aligns with the company’s emphasis on shareholder returns, but does not directly address concerns around margin pressures or changes in the business model as hardware commoditization persists.

However, investors should be mindful that while share buybacks and steady dividends may provide near-term support, cash flow volatility and working capital risks can ...

Read the full narrative on PC Connection (it's free!)

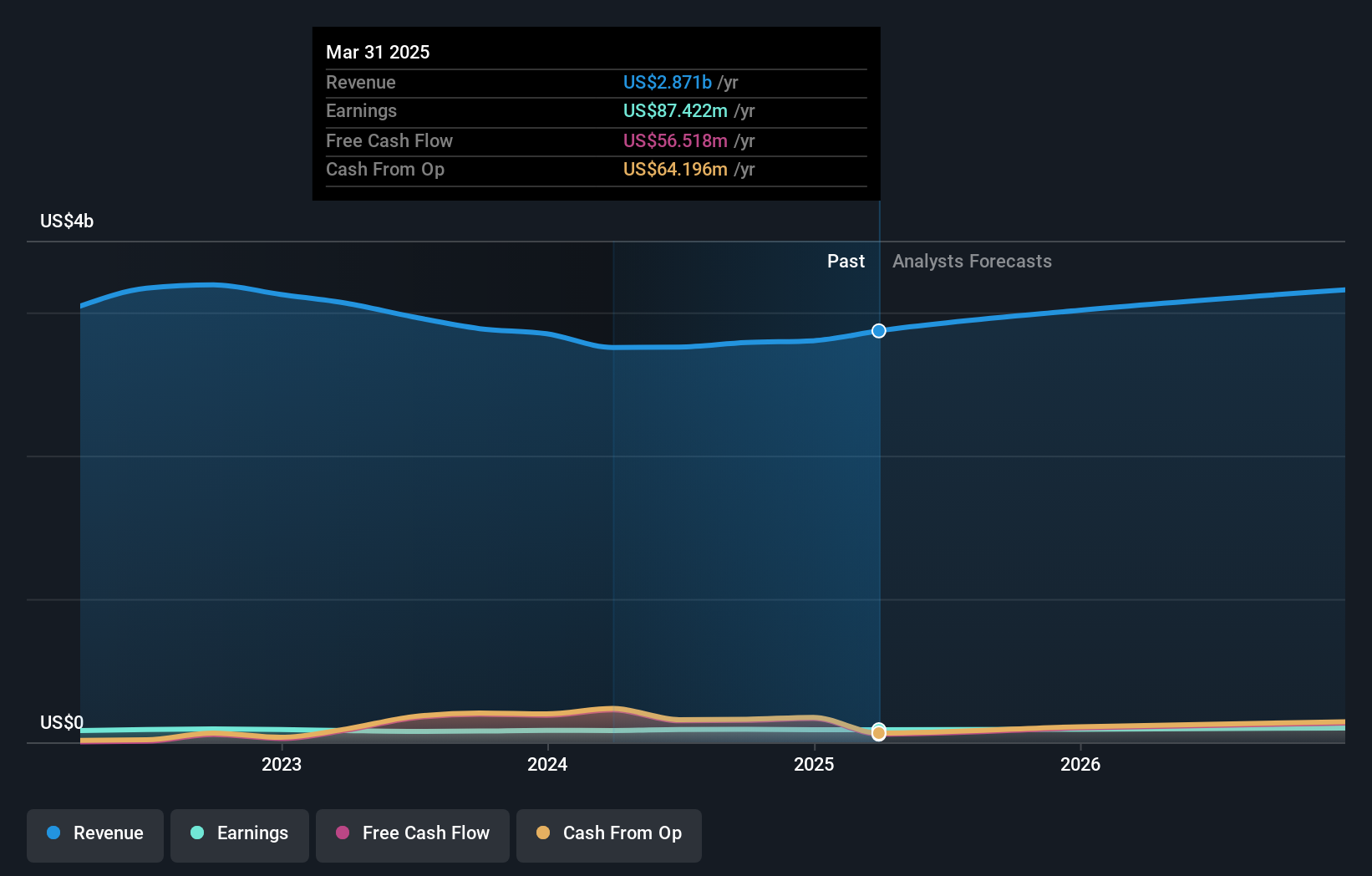

PC Connection's narrative projects $3.4 billion revenue and $116.0 million earnings by 2028. This requires 5.4% yearly revenue growth and a $30.0 million earnings increase from $86.0 million.

Uncover how PC Connection's forecasts yield a $76.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for PC Connection span from US$65.56 to US$99.52, capturing broad opinion on its potential. While many see opportunity, persistent hardware margin pressure could affect long-term returns so it pays to review multiple viewpoints.

Explore 3 other fair value estimates on PC Connection - why the stock might be worth just $65.56!

Build Your Own PC Connection Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PC Connection research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PC Connection research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PC Connection's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com